Sallie Mae 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

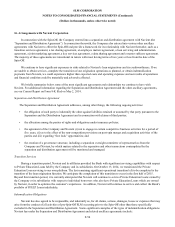

21. Concentrations of Risk

Our business is primarily focused in providing and/or servicing to help students and their families save, plan and pay for

college. We primarily originate, service and/or collect loans made to students and their families to finance the cost of their

education. We provide funding, delivery and servicing support for education loans in the United States through our Private

Education Loan programs. Because of this concentration in one industry, we are exposed to credit, legislative, operational,

regulatory, and liquidity risks associated with the student loan industry.

Concentration Risk in the Revenues Associated with Private Education Loans

We compete in the Private Education Loan market with banks and other consumer lending institutions, some with strong

consumer brand name recognition and greater financial resources. We compete based on our products, origination capability

and customer service. To the extent our competitors compete aggressively or more effectively, we could lose market share to

them or subject our existing loans to refinancing risk. Our product offerings may not prove to be profitable and may result in

higher than expected losses.

We are a leading provider of saving- and paying-for-college products and programs. This concentration gives us a

competitive advantage in the marketplace. This concentration also creates risks in our business, particularly in light of our

concentrations as a Private Education Loan lender. If population demographics result in a decrease in college-age individuals, if

demand for higher education decreases, if the cost of attendance of higher education decreases, if public resistance to higher

education costs increases, or if the demand for higher education loans decreases, our consumer lending business could be

negatively affected. In addition, the federal government, through the DSLP, poses significant competition to our private credit

loan products. If loan limits under the DSLP increase, DSLP loans could be more widely available to students and their families

and DSLP loans could increase, resulting in further decreases in the size of the Private Education Loan market and demand for

our Private Education Loan products.

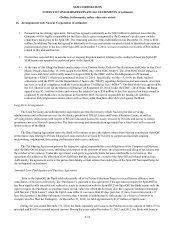

Concentration Risk in the Revenues Associated with FFELP Loans

On July 1, 2010, the HCERA legislation eliminated FFELP Loan originations, a major source of our net income. All

federal loans to students are now made through the DSLP. The terms and conditions of existing FFELP Loans were not affected

by this legislation. Despite the end of FFELP, Congress, ED and the Administration still exercise significant authority over the

servicing and administration of existing FFELP Loans. Because of the ongoing uncertainty around efforts to reduce the federal

budget deficit, the timing, method and manner of implementation of various education lending initiatives has become less

predictable. The interest income we earn on our FFELP Loans portfolio, which totaled $43,831 in 2014, will decline over time

as the portfolio amortizes

F-57