Sallie Mae 2014 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

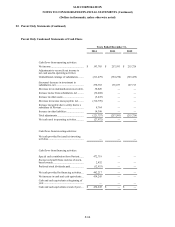

16.

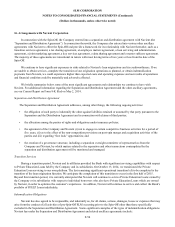

Arrangements with Navient Corporation (Continued)

the Purchasers in the amount of $2,415,846 and $2,640,245, respectively, in principal and $67,018 and $77,685, respectively, in

accrued interest income.

The gain resulting from loans sold was $35,848, $196,593 and $235,202 in the years ended December 31, 2014, 2013 and

2012, respectively. Total write-downs to fair value for loans sold with a fair value lower than par totaled $53,484, $68,410 and

$28,694 in the years ended December 31, 2014, 2013 and 2012, respectively. Navient is the servicer for all of these loans.

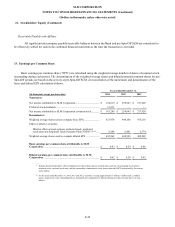

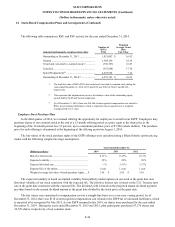

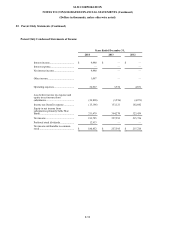

17. Regulatory Capital

The Bank is subject to various regulatory capital requirements administered by federal banking authorities. Failure to

meet minimum capital requirements can initiate certain mandatory and possibly additional discretionary actions by regulators

that, if undertaken, could have a direct material adverse effect on our financial condition. Under the regulatory framework for

prompt corrective action, we must meet specific capital guidelines that involve quantitative measures of our assets, and certain

off-balance sheet items as calculated under regulatory accounting practices. The Bank’s capital amounts and classification are

also subject to qualitative judgments by the regulators about components, risk-weightings and other factors.

“Well capitalized” regulatory requirements are the quantitative measures established by regulation to ensure capital

adequacy. The Bank is required to maintain minimum amounts and ratios (set forth in the table below) of Total and Tier I

Capital to risk-weighted assets and of Tier I Capital to average assets, as defined by the regulation. The following amounts and

ratios are based upon the Bank's assets.

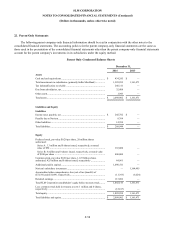

Actual

Well Capitalized Regulatory

Requirements

Amount

Ratio

Amount

Ratio

As of December 31, 2014:

Tier I Capital (to Average Assets) ............................

$

1,413,988

11.5

%

$

614,709

>

5.0

%

Tier I Capital (to Risk Weighted Assets) ...................

$

1,413,988

15.0

%

$

565,148

>

6.0

%

Total Capital (to Risk Weighted Assets)....................

$

1,497,830

15.9

%

$

941,913

>

10.0

%

As of December 31, 2013:

Tier I Capital (to Average Assets) ............................

$

1,221,416

11.7

%

$

521,973

>

5.0

%

Tier I Capital (to Risk Weighted Assets) ...................

$

1,221,416

16.4

%

$

446,860

>

6.0

%

Total Capital (to Risk Weighted Assets)....................

$

1,289,497

17.3

%

$

745,374

>

10.0

%

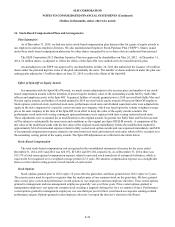

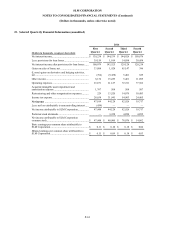

Bank Dividends

The Bank is chartered under the laws of the State of Utah and its deposits are insured by the FDIC. The Bank’s ability to

pay dividends is subject to the laws of Utah and the regulations of the FDIC. Generally, under Utah’s industrial bank laws and

regulations as well as FDIC regulations, the Bank may pay dividends from its net profits without regulatory approval if,

following the payment of the dividend, the Bank’s capital and surplus would not be impaired. The Bank paid no dividends for

the year ended December 31, 2014. Total dividends paid by the Bank were $120,000 and $420,000 in the years ended

December 2013 and 2012, respectively. For the foreseeable future, we expect the Bank to only pay dividends to the Company

as may be necessary to provide for regularly scheduled dividends payable on the Company’s Series A and Series B Preferred

Stock.

F-52