Sallie Mae 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

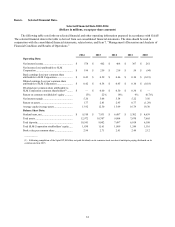

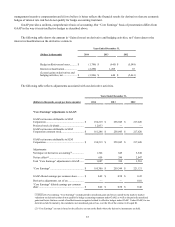

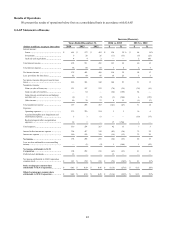

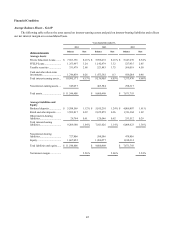

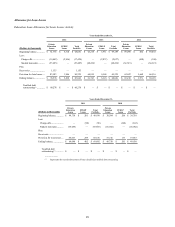

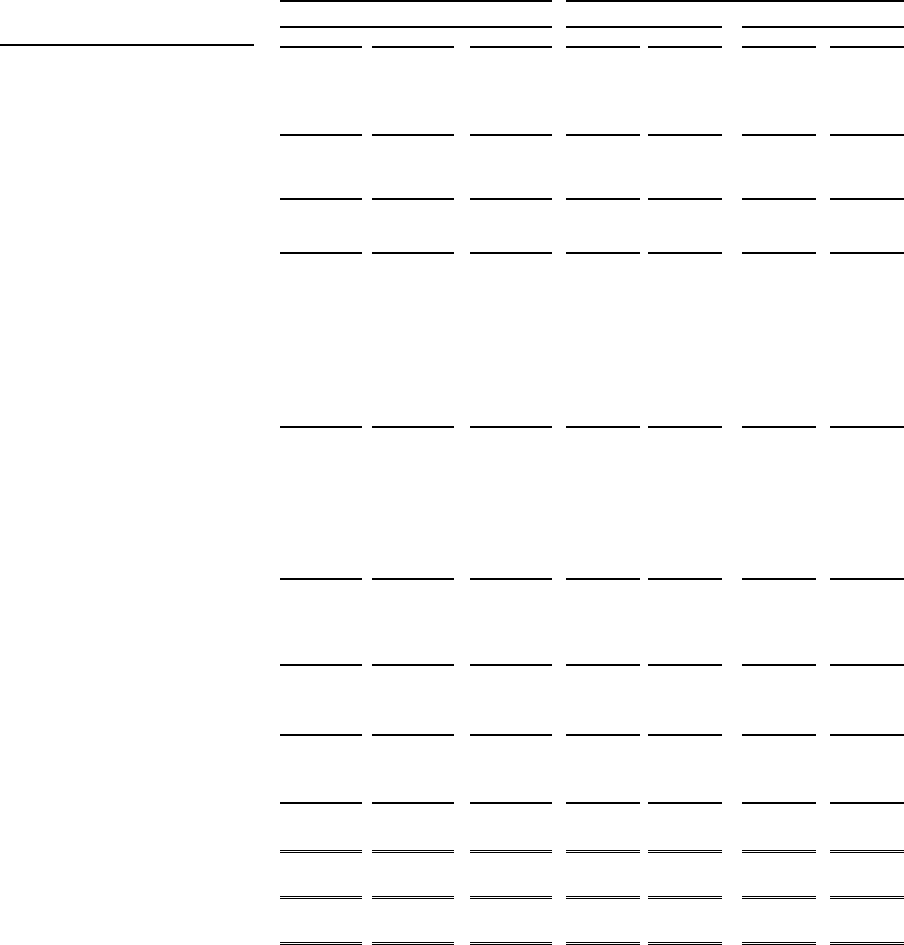

Results of Operations

We present the results of operations below first on a consolidated basis in accordance with GAAP.

GAAP Statements of Income

Increase (Decrease)

Years Ended December 31,

2014 vs. 2013

2013 vs. 2012

(Dollars in millions, except per share data)

2014

2013

2012

$

%

$

%

Interest income:

Loans ...........................................

$

661

$

527

$

463

$

134

25

%

$

64

14

%

Investments ....................................

9

20

26

(11

)

(55

)

(6

)

(23

)

Cash and cash equivalents .....................

4

4

2

—

—

2

100

Total interest income .............................

674

551

491

123

22

60

12

Total interest expense ............................

96

89

83

7

8

6

7

Net interest income ..............................

578

462

408

116

25

54

13

Less: provisions for loan losses .................

85

69

66

16

23

3

5

Net interest income after provisions for loan

losses ..............................................

493

393

342

100

25

51

15

Noninterest income:

Gains on sales of loans, net ...................

121

197

235

(76

)

(39

)

(38

)

(16

)

Gains on sales of securities ....................

—

64

—

(64

)

(100

)

64

—

Gains (losses) on derivatives and hedging

activities, net ...................................

(4

)

1

(5

)

(5

)

(500

)

6

(120

)

Other income ...................................

40

36

37

4

11

(1

)

(3

)

Total noninterest income ........................

157

298

267

(141

)

(47

)

31

12

Expenses:

Operating expenses ............................

275

270

254

5

2

16

6

Acquired intangible asset impairment and

amortization expense ..........................

3

3

13

—

—

(10

)

(77

)

Restructuring and other reorganization

expenses ........................................

38

1

—

37

3,700

1

—

Total expenses ....................................

316

274

267

42

15

7

3

Income before income tax expense .............

334

417

342

(83

)

(20

)

75

22

Income tax expense ..............................

140

159

126

(19

)

(12

)

33

26

Net income .......................................

194

258

216

(64

)

(25

)

42

19

Less: net loss attributable to noncontrolling

interest ............................................

—

(1

)

(2

)

1

(100

)

1

(50

)

Net income attributable to SLM

Corporation .....................................

194

259

218

(65

)

(25

)

41

19

Preferred stock dividends ........................

13

—

—

13

—

—

—

Net income attributable to SLM Corporation

common stock ....................................

$

181

$

259

$

218

$

(78

)

(30

)%

$

41

19

%

Basic earnings per common share

attributable to SLM Corporation .............

$

0.43

$

0.59

$

0.46

$

(0.16

)

(27

)%

$

0.13

28

%

Diluted earnings per common share

attributable to SLM Corporation .............

$

0.42

$

0.58

$

0.45

$

(0.16

)

(28

)%

$

0.13

29

%

42