Sallie Mae 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

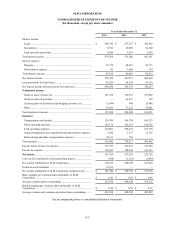

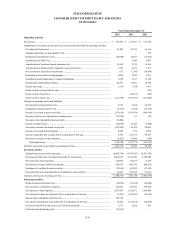

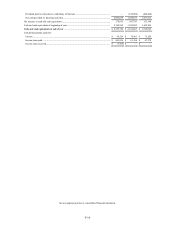

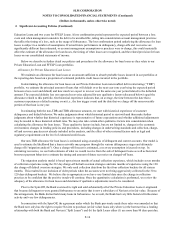

SLM CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Years Ended December 31,

2014

2013

2012

Operating activities

Net income .........................................................................................................

$

193,785

$

257,593

$

215,726

Adjustments to reconcile net income to net cash (used in) provided by operating activities:

Provisions for loan losses ....................................................................................

85,529

69,339

66,116

Valuation allowance on loans held for sale ...............................................................

—

—

275

Deferred tax (benefit) provision.............................................................................

(40,888

)

14,567

(11,015

)

Amortization of FDIC fees ...................................................................................

—

1,046

3,897

Amortization of brokered deposit placement fee ........................................................

10,164

9,754

8,416

Amortization of deferred loan origination costs and fees, net ........................................

1,995

2,199

5,337

Net accretion of discount on investments .................................................................

633

(7,187

)

(10,058

)

Depreciation of premises and equipment..................................................................

6,099

5,059

6,837

Amortization and impairment of acquired intangibles .................................................

3,290

3,317

13,125

Stock-based compensation expense ........................................................................

24,971

15,681

19,102

Interest rate swap ...............................................................................................

1,214

(324

)

5,411

Gains on sales of loans held for sale .......................................................................

—

—

(167

)

Gains on sale of securities ....................................................................................

—

(63,813

)

(129

)

Gains on sale of loans, net ...................................................................................

(121,359

)

(196,593

)

(235,202

)

Changes in operating assets and liabilities:

Net decrease in loans held for sale .........................................................................

6,519

3,628

61,275

Origination of loans held for sale ...........................................................................

(6,519

)

(3,628

)

(61,275

)

Increase in accrued interest receivable.....................................................................

(331,014

)

(281,856

)

(168,146

)

(Increase) decrease in other interest-earning assets .....................................................

(72,928

)

97

158

Decrease in tax indemnification receivable ...............................................................

38,820

—

—

Increase in other assets ........................................................................................

(24,959

)

(2,357

)

(7,008

)

(Decrease) increase in income tax payable ...............................................................

(221,222

)

56,784

88,803

Increase in accrued interest payable ........................................................................

2,985

239

2,095

Increase in payable due to entity that is a subsidiary of Navient .....................................

8,764

147,379

96,591

(Decrease) increase in other liabilities .....................................................................

(2,652

)

39,096

(614

)

Total adjustments ..........................................................................................

(630,558

)

(187,573

)

(116,176

)

Total net cash (used in) provided by operating activities .................................................

(436,773

)

70,020

99,550

Investing activities

Student loans acquired and originated .....................................................................

(4,094,790

)

(4,387,093

)

(4,251,595

)

Net proceeds from sales of student loans held for investment ........................................

2,001,625

2,546,940

2,789,822

Proceeds from claim payments ..............................................................................

127,869

82,615

4,219

Net decrease in loans held for investment ................................................................

638,321

490,791

460,216

Purchases of available-for-sale securities .................................................................

(72,049

)

(62,097

)

(33,053

)

Proceeds from sales and maturities of available-for-sale securities..................................

10,653

597,728

27,017

Total net cash used in investing activities ...................................................................

(1,388,371

)

(731,116

)

(1,003,374

)

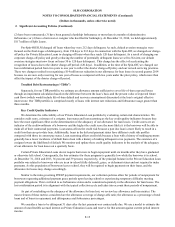

Financing activities

Brokered deposit placement fee .............................................................................

(15,098

)

(12,114

)

(16,484

)

Net increase in certificates of deposit ......................................................................

340,225

535,456

395,304

Net increase in other deposits ...............................................................................

1,207,487

1,126,673

1,109,886

Net decrease in deposits with entity that is a subsidiary of Navient .................................

(5,633

)

(126,923

)

(12,166

)

Special cash contribution from Navient ...................................................................

472,718

—

—

Net capital contributions from entity that is a subsidiary of Navient ................................

12,022

(164,471

)

(20,419

)

Excess tax benefit from the exercise of stock-based awards ..........................................

3,271

6,258

891

Preferred stock dividends paid ..............................................................................

(12,933

)

—

—

F-9