Sallie Mae 2014 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

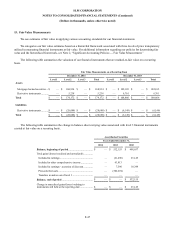

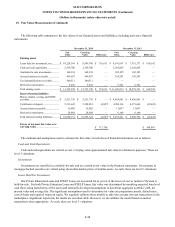

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

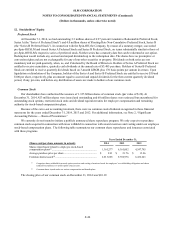

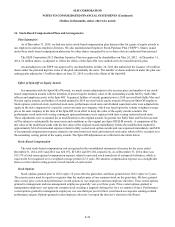

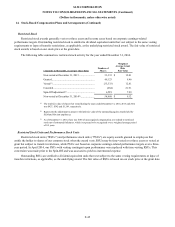

14. Stock-Based Compensation Plans and Arrangements

Plan Summaries

As of December 31, 2014, we had one active stock-based compensation plan that provides for grants of equity awards to

our employees and non-employee directors. We also maintained an Employee Stock Purchase Plan (“ESPP”). Shares issued

under these stock-based compensation plans may be either shares reacquired by us or shares that are authorized but unissued.

The SLM Corporation 2012 Omnibus Incentive Plan was approved by shareholders on May 24, 2012. At December 31,

2014, 32 million shares, as adjusted to reflect the effects of the Spin-Off, were authorized to be issued from this plan.

An amendment to our ESPP was approved by our shareholders on May 24, 2012 that authorized the issuance of 6 million

shares under the plan and kept the terms of the plan substantially the same. The number of shares authorized under the plan was

subsequently adjusted to 15 million shares on June 25, 2014, to reflect the effects of the Spin-Off.

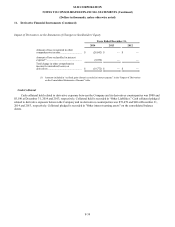

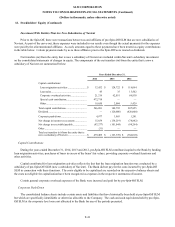

Effect of Spin-Off on Equity Awards

In connection with the Spin-Off of Navient, we made certain adjustments to the exercise price and number of our stock-

based compensation awards with the intention of preserving the intrinsic value of the outstanding awards held by Sallie Mae

officers and employees prior to the Spin-Off. In general, holders of awards granted prior to 2014 received both Sallie Mae and

Navient equity awards, and holders of awards granted in 2014 received solely equity awards of their post-Spin-Off employer.

Stock options, restricted stock, restricted stock units, performance stock units and dividend equivalent units were adjusted into

equity in the new companies by a specific conversion ratio per company, which was based upon the volume weighted average

prices for each company at the time of the Spin-Off, in an effort to keep the value of the equity awards constant. Our

performance stock units with vesting contingent upon performance were replaced with time-vesting restricted stock units.

These adjustments were accounted for as modifications to the original awards. In general, the Sallie Mae and Navient awards

will be subject to substantially the same terms and conditions as the original pre-Spin-Off SLM awards. A comparison of the

fair value of the modified awards with the fair value of the original awards immediately before the modification resulted in

approximately $64 of incremental expense related to fully-vested stock option awards and was expensed immediately and $630

of incremental compensation expense related to unvested restricted stock and restricted stock units which will be recorded over

the remaining vesting period of the equity awards. The Spin-Off Adjustments are reflected in the tables below.

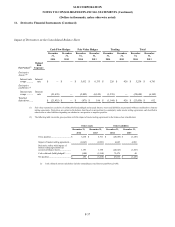

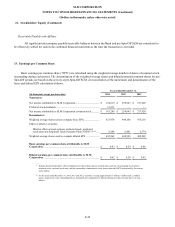

Stock-Based Compensation

The total stock-based compensation cost recognized in the consolidated statements of income for the years ended

December 31, 2014, 2013 and 2012 was $24,971, $15,681 and $19,102, respectively. As of December 31, 2014, there was

$15,174 of total unrecognized compensation expense related to unvested stock awards net of estimated forfeitures, which is

expected to be recognized over a weighted average period of 2.2 years. We amortize compensation expense on a straight-line

basis over the related vesting periods of each tranche of each award.

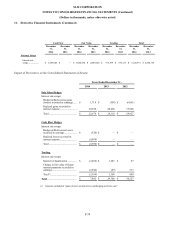

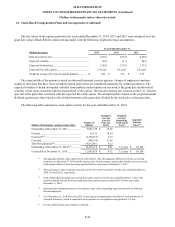

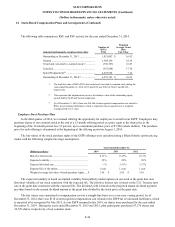

Stock Options

Stock options granted prior to 2012 expire 10 years after the grant date, and those granted since 2012 expire in 5 years.

The exercise price must be equal to or greater than the market price of our common stock on the grant date. We have granted

time-vested, price-vested and performance-vested options to our employees and non-employee directors. Time-vested options

granted to management and non-management employees generally vest over three years. Price-vested options granted to

management employees vest upon our common stock reaching a targeted closing price for a set number of days. Performance-

vested options granted to management employees vest one-third per year for three years based on corporate earnings-related

performance targets. Options granted to non-employee directors vest upon the director’s election to the Board.

F-43