Sallie Mae 2014 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

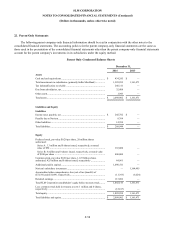

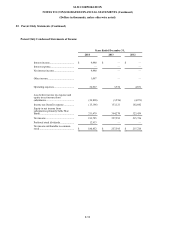

23. Selected Quarterly Financial Information (unaudited)

2014

First

Second

Third

Fourth

(Dollars in thousands, except per share data)

Quarter

Quarter

Quarter

Quarter

Net interest income...................................................

$

139,238

$

144,539

$

144,026

$

150,676

Less: provisions for loan losses ..................................

39,159

1,014

14,898

30,458

Net interest income after provisions for loan losses ......

100,079

143,525

129,128

120,218

Gains on sales of loans, net .......................................

33,888

1,928

85,147

396

(Losses) gains on derivative and hedging activities,

net ..........................................................................

(764

)

(9,458

)

5,401

825

Other income ...........................................................

8,136

15,229

5,461

11,095

Operating expenses ..................................................

63,671

61,127

72,721

77,362

Acquired intangible asset impairment and

amortization expense ................................................

1,767

508

508

507

Restructuring and other reorganization expenses..........

229

13,520

14,079

10,483

Income tax expense ..................................................

28,658

31,941

54,903

24,465

Net income .............................................................

47,014

44,128

82,926

19,717

Less: net loss attributable to noncontrolling interest .....

(434

)

—

—

—

Net income attributable to SLM Corporation ...............

47,448

44,128

82,926

19,717

Preferred stock dividends ..........................................

—

3,228

4,850

4,855

Net income attributable to SLM Corporation

common stock..........................................................

$

47,448

$

40,900

$

78,076

$

14,862

Basic earnings per common share attributable to

SLM Corporation .....................................................

$

0.11

$

0.10

$

0.18

$

0.04

Diluted earnings per common share attributable to

SLM Corporation .....................................................

$

0.11

$

0.09

$

0.18

$

0.03

F-61