Sallie Mae 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

6.

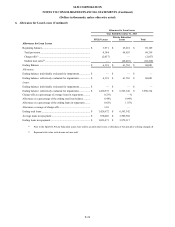

Allowance for Loan Losses (Continued)

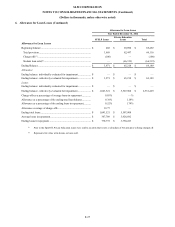

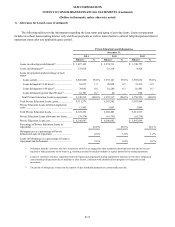

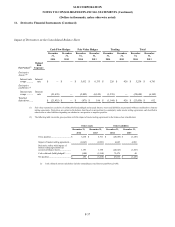

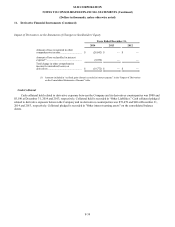

Key Credit Quality Indicators

FFELP Loans are at least 97 percent insured and guaranteed as to their principal and accrued interest in the event of

default; therefore, there are no key credit quality indicators associated with FFELP Loans. Included within our FFELP portfolio

as of December 31, 2014 are $785 million of FFELP rehabilitation loans. These loans have previously defaulted but have

subsequently been brought current according to a loan rehabilitation agreement. The credit performance on rehabilitation loans

is worse than the remainder of our FFELP portfolio. At December 31, 2014 and 2013, 62.1 percent and 62.9 percent of our

FFELP portfolio consisted of rehabilitation loans.

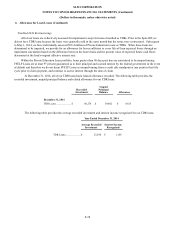

For Private Education Loans, the key credit quality indicators are FICO scores, the existence of a cosigner, the loan status

and loan seasoning. The FICO scores are assessed at origination and maintained through the loan's term. The following table

highlights the gross principal balance of our Private Education Loan portfolio stratified by key credit quality indicators.

December 31, 2014

December 31, 2013

Credit Quality Indicators:

Balance

(1)

% of Balance

Balance

(1)

% of Balance

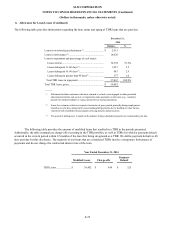

Cosigners:

With cosigner ...................................

$

7,465,339

90

%

$

5,898,751

90

%

Without cosigner ..............................

846,037

10

664,591

10

Total ..................................................

$

8,311,376

100

%

$

6,563,342

100

%

FICO at Origination:

Less than 670 ...................................

$

558,801

7

%

$

461,412

7

%

670-699 ...........................................

1,227,860

15

1,364,286

21

700-749 ...........................................

2,626,238

32

1,649,192

25

Greater than or equal to 750...............

3,898,477

46

3,088,452

47

Total ..................................................

$

8,311,376

100

%

$

6,563,342

100

%

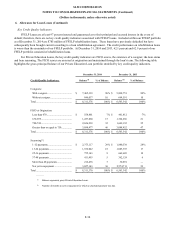

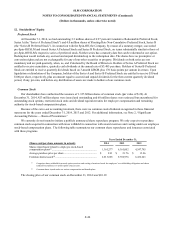

Seasoning

(2)

:

1-12 payments..................................

$

2,373,117

29

%

$

1,840,538

28

%

13-24 payments ................................

1,532,042

18

1,085,393

17

25-36 payments ................................

755,143

9

669,685

10

37-48 payments ................................

411,493

5

362,124

6

More than 48 payments .....................

212,438

3

30,891

—

Not yet in repayment ........................

3,027,143

36

2,574,711

39

Total ..................................................

$

8,311,376

100

%

$

6,563,342

100

%

___________

(1) Balance represents gross Private Education Loans.

(2) Number of months in active repayment for which a scheduled payment was due.

F-30