Sallie Mae 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

8.

Deposits (Continued)

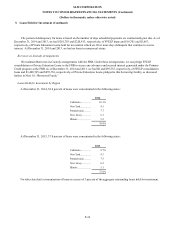

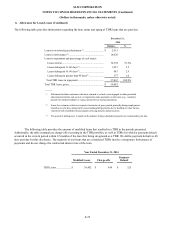

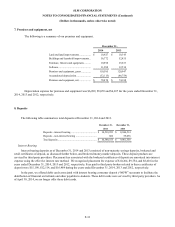

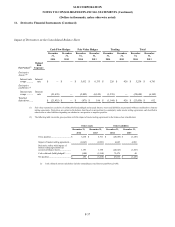

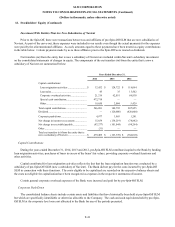

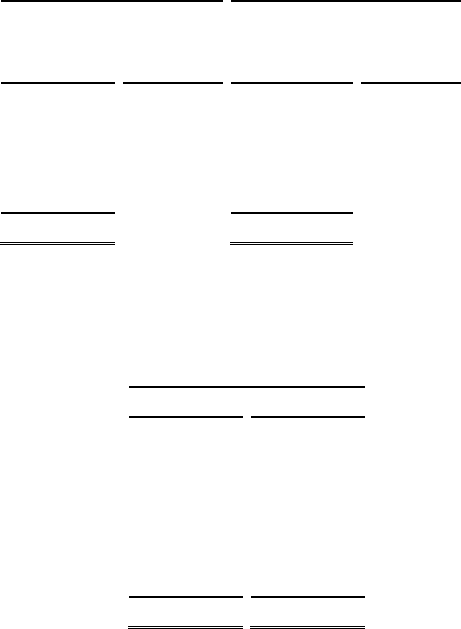

Interest bearing deposits at December 31, 2014 and 2013 are summarized as follows:

December 31, 2014

December 31, 2013

Amount

Ye a r -End

Weighted

Average

Stated Rate

Amount

Ye a r -End

Weighted

Average

Stated Rate

Money market .........................................

$

4,527,448

1.15

%

$

3,212,889

0.65

%

Savings...................................................

703,687

0.81

%

743,742

0.81

%

NOW .....................................................

—

—

%

18,214

0.12

%

Certificates of deposit ..............................

5,308,818

1.00

%

4,971,669

1.39

%

Deposits - interest bearing ......................

$

10,539,953

$

8,946,514

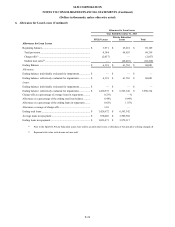

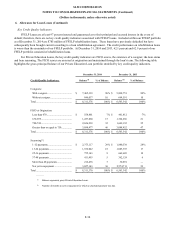

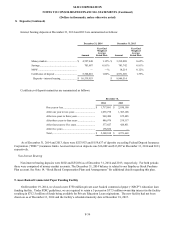

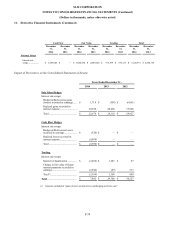

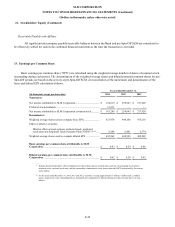

Certificates of deposit maturities are summarized as follows:

December 31,

2014

2013

One year or less ............................................

$

1,717,891

$

2,030,190

After one year to two years ............................

1,038,778

1,303,106

After two years to three years .........................

948,490

675,405

After three years to four years ........................

846,976

538,117

After four years to five years ..........................

577,827

424,851

After five years .............................................

178,856

—

Total ............................................................

$

5,308,818

$

4,971,669

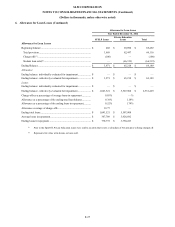

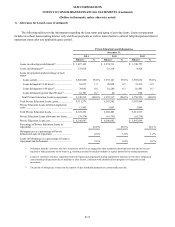

As of December 31, 2014 and 2013, there were $253,953 and $159,637 of deposits exceeding Federal Deposit Insurance

Corporation (“FDIC”) insurance limits. Accrued interest on deposits was $16,082 and $13,097 at December 31, 2014 and 2013,

respectively.

Non Interest Bearing

Non interest bearing deposits were $602 and $55,036 as of December 31, 2014 and 2013, respectively. For both periods

these were comprised of money market accounts. The December 31, 2014 balance is related to our Employee Stock Purchase

Plan account. See Note 14, “Stock Based Compensation Plans and Arrangements” for additional details regarding this plan.

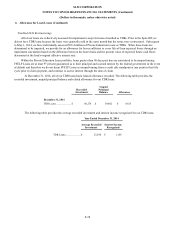

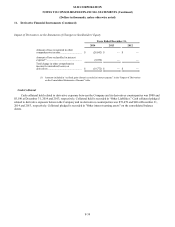

9. Asset-Backed Commercial Paper Funding Facility

On December 19, 2014, we closed a new $750 million private asset backed commercial paper (“ABCP”) education loan

funding facility. Under FDIC guidelines, we are required to retain a 5 percent or $37.5 million ownership interest in the facility

resulting in $712.5 million of funds being available for Private Education Loan originations. The new facility had not been

drawn on as of December 31, 2014 and the facility’s scheduled maturity date is December 18, 2015.

F-34