Sallie Mae 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

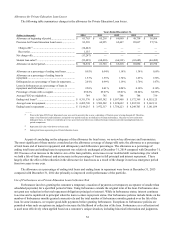

Liquidity and Capital Resources

Funding and Liquidity Risk Management

Our four primary liquidity needs include our ongoing ability to fund our businesses throughout market cycles (including

during periods of financial stress), our ongoing ability to fund originations of Private Education Loans, servicing our bank

deposits, and payment of required dividends on our preferred stock. To achieve these objectives we analyze and monitor our

liquidity needs, maintain excess liquidity and access diverse funding sources, such as deposits at the Bank, issuance of secured

debt primarily through asset-backed securitizations and other financing facilities and through whole loan sales. It is our policy

to manage operations so liquidity needs are fully satisfied through normal operations to avoid unplanned asset sales under

emergency conditions. Our liquidity management is governed by policies approved by our Board of Directors. Oversight of

these policies is performed in the Asset and Liability Committee (“ALCO”), a management-level committee.

These policies take into account the volatility of cash flow forecasts, expected maturities, anticipated loan demand and a

variety of other factors to establish minimum liquidity guidelines.

Key risks associated with our liquidity relate to our ability to access the capital markets and the markets for bank deposits

at reasonable rates. This ability may be affected by our performance and the macroeconomic environment and the impact they

have on the availability of funding sources in the marketplace.

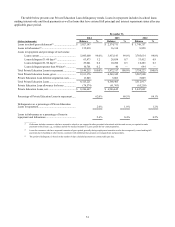

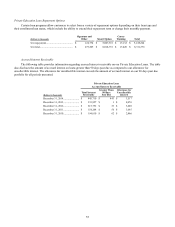

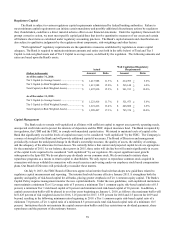

Sources of Liquidity and Available Capacity

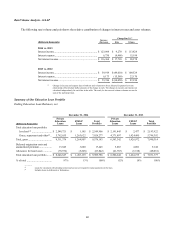

Ending Balances

(Dollars in thousands)

December 31, 2014

December 31, 2013

Sources of primary liquidity:

Unrestricted cash and liquid investments:

Holding Company and other non-bank subsidiaries ........

$

7,677

$

1,052

Sallie Mae Bank(1).......................................................

2,352,103

2,181,813

Available-for-sale investments .....................................

168,934

102,105

Total unrestricted cash and liquid investments ..................

$

2,528,714

$

2,284,970

_______

(1) This amount will be used primarily to originate Private Education Loans at the Bank.

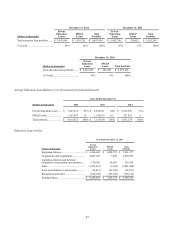

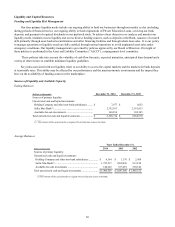

Average Balances

Years Ended December 31,

(Dollars in thousands)

2014

2013

2012

Sources of primary liquidity:

Unrestricted cash and liquid investments:

Holding Company and other non-bank subsidiaries .............

$

4,364

$

1,176

$

2,458

Sallie Mae Bank

(1)

............................................................

1,755,517

1,509,026

913,350

Available-for-sale investments ..........................................

140,622

537,458

569,344

Total unrestricted cash and liquid investments .......................

$

1,900,503

$

2,047,660

$

1,485,152

________

(1) This amount will be used primarily to originate Private Education Loans at the Bank.

56