Sallie Mae 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

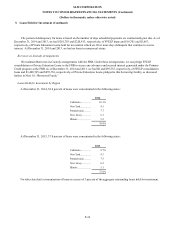

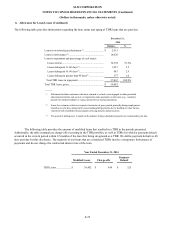

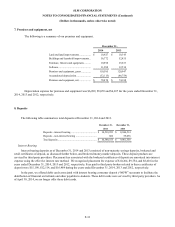

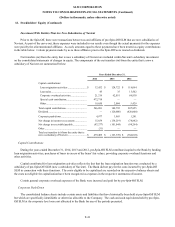

7. Premises and equipment, net

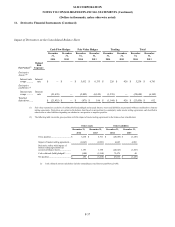

The following is a summary of our premises and equipment.

December 31,

2014

2013

Land and land improvements ................

$

10,927

$

10,345

Buildings and leasehold improvements ..

56,772

52,435

Furniture, fixtures and equipment ..........

10,898

25,633

Software .............................................

31,988

32,534

Premises and equipment, gross .............

110,585

120,947

Accumulated depreciation ....................

(32,115

)

(46,759

)

Premises and equipment, net .................

$

78,470

$

74,188

Depreciation expense for premises and equipment was $6,099, $5,059 and $6,837 for the years ended December 31,

2014, 2013 and 2012, respectively.

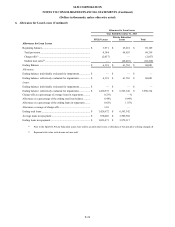

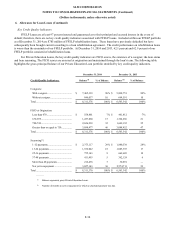

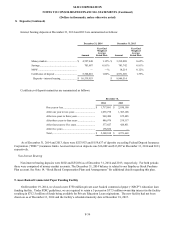

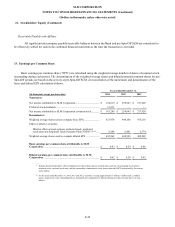

8. Deposits

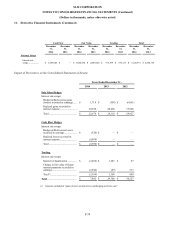

The following table summarizes total deposits at December 31, 2014 and 2013.

December 31,

December 31,

2014

2013

Deposits - interest bearing ....................................

$

10,539,953

$

8,946,514

Deposits - non-interest bearing .............................

602

55,036

Total deposits ......................................................

$

10,540,555

$

9,001,550

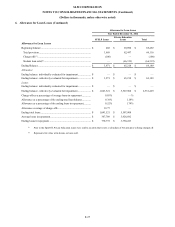

Interest Bearing

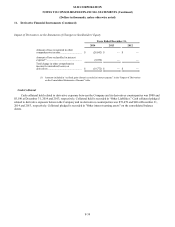

Interest bearing deposits as of December 31, 2014 and 2013 consisted of non-maturity savings deposits, brokered and

retail certificates of deposit, as discussed further below, and brokered money market deposits. These deposit products are

serviced by third party providers. Placement fees associated with the brokered certificates of deposit are amortized into interest

expense using the effective interest rate method. We recognized placement fee expense of $10,264, $9,754, and $8,416 in the

years ended December 31, 2014, 2013 and 2012, respectively. Fees paid to third party brokers related to these certificates of

deposit were $15,198, $12,114, and $16,484 during the years ended December 31, 2014, 2013 and 2012, respectively.

In the past, we offered debit cards associated with interest bearing consumer deposit (“NOW”) accounts to facilitate the

distribution of financial aid refunds and other payables to students. These debit cards were serviced by third party providers. As

of April 30, 2014, we no longer offer these debit cards.

F-33