Sallie Mae 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

15.

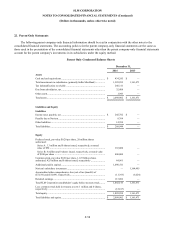

Fair Value Measurements (Continued)

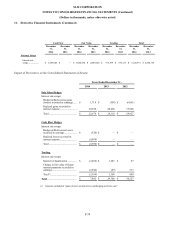

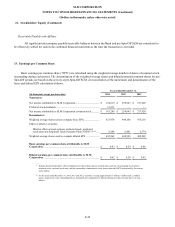

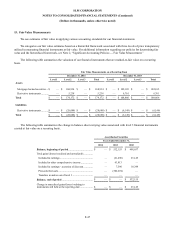

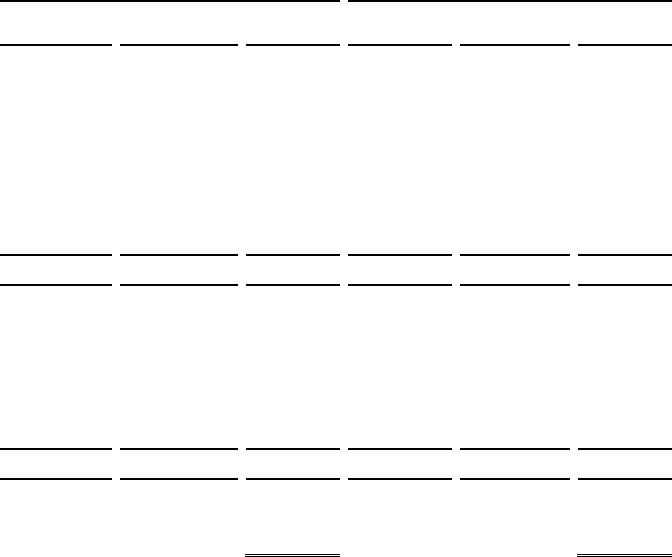

The following table summarizes the fair values of our financial assets and liabilities, including derivative financial

instruments.

December 31, 2014

December 31, 2013

Fair

Valu e

Carrying

Valu e

Difference

Fair

Valu e

Carrying

Valu e

Difference

Earning assets

Loans held for investment, net ..........

$

10,228,399

$

9,509,786

$

718,613

$

8,541,919

$

7,931,377

$

610,542

Cash and cash equivalents ................

2,359,780

2,359,780

—

2,182,865

2,182,865

—

Available for sale investments ...........

168,934

168,934

—

102,105

102,105

—

Accrued interest receivable ...............

469,697

469,697

—

356,283

356,283

—

Tax indemnification receivable .........

240,311

240,311

—

—

—

—

Derivative instruments .....................

5,238

5,238

—

6,761

6,761

—

Total earning assets ..........................

$

13,472,359

$

12,753,746

$

718,613

$

11,189,933

$

10,579,391

$

610,542

Interest-bearing liabilities

Money-market, savings and NOW

accounts .........................................

$

5,231,736

$

5,231,736

$

—

$

4,029,881

$

4,029,881

$

—

Certificates of deposit ......................

5,313,645

5,308,818

(4,827

)

4,984,114

4,971,669

(12,445

)

Accrued interest payable ..................

16,082

16,082

—

13,097

13,097

—

Derivative instruments .....................

28,688

28,688

—

6,149

6,149

—

Total interest-bearing liabilities .........

$

10,590,151

$

10,585,324

(4,827

)

$

9,033,241

$

9,020,796

$

(12,445

)

Excess of net asset fair value over

carrying value

................................

$

713,786

$

598,097

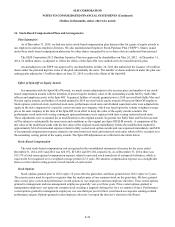

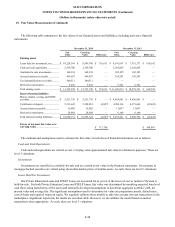

The methods and assumptions used to estimate the fair value of each class of financial instruments are as follows:

Cash and Cash Equivalents

Cash and cash equivalents are carried at cost. Carrying value approximated fair value for disclosure purposes. These are

level 1 valuations.

Investments

Investments are classified as available-for-sale and are carried at fair value in the financial statements. Investments in

mortgage-backed securities are valued using observable market prices of similar assets. As such, these are level 2 valuations.

Loans Held For Investment

Our Private Education Loans and FFELP Loans are accounted for at cost or at the lower of cost or market if the loan is

held-for-sale. For both Private Education Loans and FFELP Loans, fair value was determined by modeling expected loan level

cash flows using stated terms of the assets and internally developed assumptions to determine aggregate portfolio yield, net

present value and average life. The significant assumptions used to determine fair value are prepayment speeds, default rates,

cost of funds and required return on equity. We regularly calibrate these models to take into account relevant transactions in the

marketplace. Significant inputs into the model are not observable. However, we do calibrate the model based on market

transactions when appropriate. As such, these are level 3 valuations.

F-48