Sallie Mae 2014 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

20. Income Taxes (Continued)

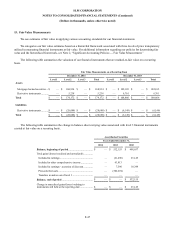

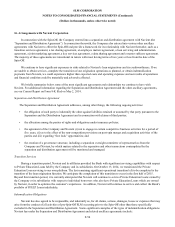

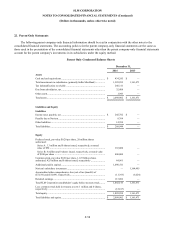

The tax effect of temporary differences that give rise to deferred tax assets and liabilities include the following:

December 31,

2014

2013

Deferred tax assets:

Loan reserves ..................................................................

$

33,570

$

26,853

Stock-based compensation plans .......................................

16,342

28,211

Deferred revenue .............................................................

418

607

Operating loss and credit carryovers ..................................

14,324

1,273

Unrealized losses .............................................................

7,185

1,849

Accrued expenses not currently deductible .........................

10,606

2,853

Unrecorded tax benefits ....................................................

19,798

2,331

Other ..............................................................................

8,918

334

Total deferred tax assets....................................................

111,161

64,311

Deferred tax liabilities:

Gains on repurchased debt ................................................

251,671

—

Fixed assets .....................................................................

5,849

3,181

Acquired intangible assets ................................................

6,151

616

Student loan premiums and discounts, net ..........................

3,050

(87

)

Other ..............................................................................

2,656

3

Total deferred tax liabilities ...............................................

269,377

3,713

Net deferred tax (liabilities) assets .....................................

$

(158,216

)

$

60,598

Included in operating loss carryovers is a valuation allowance of $69.9 million as of December 31, 2014, against a portion

of our state net operating loss carryovers that management believes is more likely than not will expire prior to being realized.

As of December 31, 2014, we have apportioned state net operating loss carryforwards of $22 million which begin to expire in

2029.

Accounting for Uncertainty in Income Taxes

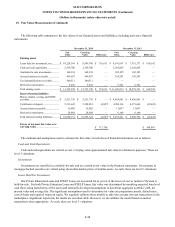

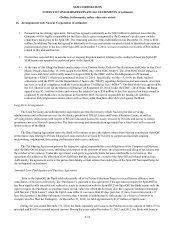

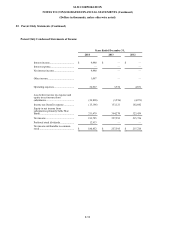

The following table summarizes changes in unrecognized tax benefits:

December 31,

2014

2013

2012

Unrecognized tax benefits at beginning of year .............................

$

7,343.5

$

3,951.1

$

2,467.3

Increases resulting from tax positions taken during a prior period .......

45,184.2

573.9

503.1

Increases resulting from tax positions taken during the current

period ..........................................................................................

7,712.5

2,818.5

980.7

Decreases related to settlements with taxing authorities .....................

(235.7

)

—

—

Reductions related to the lapse of statute of limitations .....................

(599.6

)

—

—

Unrecognized tax benefits at end of year ......................................

$

59,404.9

$

7,343.5

$

3,951.1

F-55