Sallie Mae 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

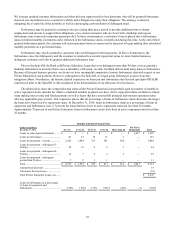

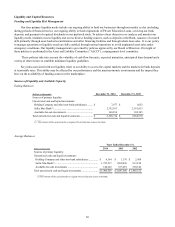

As of December 31, 2014, the Bank had a Tier 1 leverage ratio of 11.5 percent, a Tier 1 risk-based capital ratio of 15.0

percent and total risk-based capital ratio of 15.9 percent, exceeding the current guidelines by a significant factor. Our ratios

would also exceed the future guidelines if we calculated them today based on the new definitions of capital and risk-weighted

assets.

Dividends

The Bank is chartered under the laws of the State of Utah and its deposits are insured by the FDIC. The Bank’s ability

to pay dividends is subject to the laws of Utah and the regulations of the FDIC. Generally, under Utah’s industrial bank laws

and regulations as well as FDIC regulations, the Bank may pay dividends to the Company from its net profits without

regulatory approval if, following the payment of the dividend, the Bank’s capital and surplus would not be impaired. The Bank

paid no dividends for the year ended December 31, 2014. For the years ended December 31, 2013 and 2012, the Bank paid

dividends of $120 million and $420 million, respectively, to an entity that is now a subsidiary of Navient. For the foreseeable

future, we expect the Bank to only pay dividends to the Company as may be necessary to provide for regularly scheduled

dividends payable on the Company’s Series A and Series B Preferred Stock.

Borrowed Funds

The Bank maintains discretionary uncommitted Federal Funds lines of credit with various correspondent banks, which

totaled $100 million at December 31, 2014. The interest rate charged to the Bank on these lines of credit is priced at the Fed

Funds rate plus a spread at the time of borrowing, and is payable daily. The Bank did not utilize these lines of credit in the years

ended December 31, 2014 and 2013.

The Bank established an account at the FRB to meet eligibility requirements for access to the Primary Credit borrowing

facility at the FRB’s Discount Window (“Window”). The Primary Credit borrowing facility is a lending program available to

depository institutions that are in generally sound financial condition. All borrowings at the Window must be fully

collateralized. We can pledge asset-backed and mortgage-backed securities, as well as FFELP Loans and Private Education

Loans, to the FRB as collateral for borrowings at the Window. Generally, collateral value is assigned based on the estimated

fair value of the pledged assets. At December 31, 2014 and 2013, the lendable value of our collateral at the FRB totaled $1.4

billion and $900 million, respectively. The interest rate charged to us is the discount rate set by the FRB. We did not utilize this

facility in the years ended December 31, 2014 and 2013.

On December 19, 2014, we closed a new $750 million private asset backed commercial paper (“ABCP”) education loan

funding facility. Under FDIC guidelines, we are required to retain a 5 percent or $37.5 million ownership interest in the facility

resulting in $712.5 million of funds being available for Private Education Loan originations. The new facility had not been

drawn on as of December 31, 2014 and the facility’s scheduled maturity date is December 18, 2015.

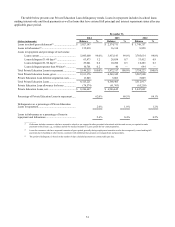

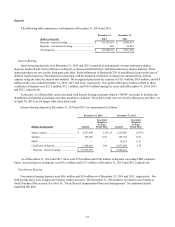

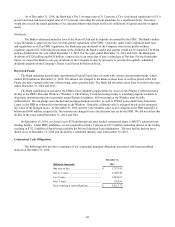

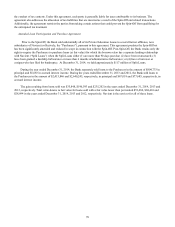

Contractual Cash Obligations

The following table provides a summary of our contractual principal obligations associated with long-term Bank

deposits at December 31, 2014.

December 31,

(Dollars in thousands)

2014

One year or less ............................................

$

1,717,541

One to 3 years ..............................................

1,992,349

3 to 5 years...................................................

1,422,631

Over 5 years .................................................

178,856

Total contractual cash obligations ...................

$

5,311,377

60