Sallie Mae 2014 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

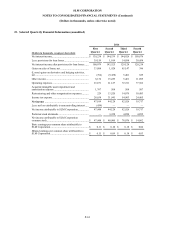

20. Income Taxes

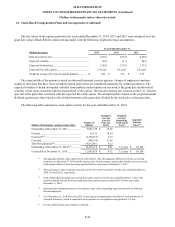

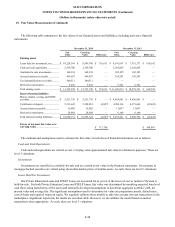

Reconciliations of the statutory U.S. federal income tax rates to our effective tax rate for continuing operations follow:

Years Ended December 31,

2014

2013

2012

Statutory rate ............................................

35.0

%

35.0

%

35.0

%

State tax, net of federal benefit ...................

2.9

2.6

—

Effect of state rate change on net deferred

tax liabilities, net of federal benefit .............

4.4

—

(0.1

)

State, release valuation allowance on net

operating losses ........................................

(4.0

)

—

—

Unrecognized tax benefits, U.S. federal

and state, net of federal benefit ...................

4.8

—

—

Other, net .................................................

(1.2

)

0.6

2.0

Effective tax rate .......................................

41.9

%

38.2

%

36.9

%

The effective tax rate varies from the statutory U.S. federal rate of 35 percent primarily due to the impact of unrecognized

tax benefits, net of federal benefit, for the year ended December 31, 2014. The effective tax rate varies from the statutory U.S.

federal rate of 35 percent primarily due to the impact of state taxes, net of federal benefit, for the years ended December 31

2013, and 2012. The increase in the impact of state rate change is due to an increase in the net state deferred liabilities as a

result of an increase in the overall blended state tax rate and by the impact of state law changes recorded in 2014. In addition, in

2014 the Company recorded a partial valuation allowance release related to state net operating losses.

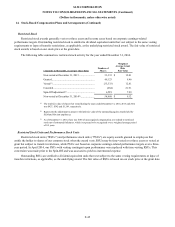

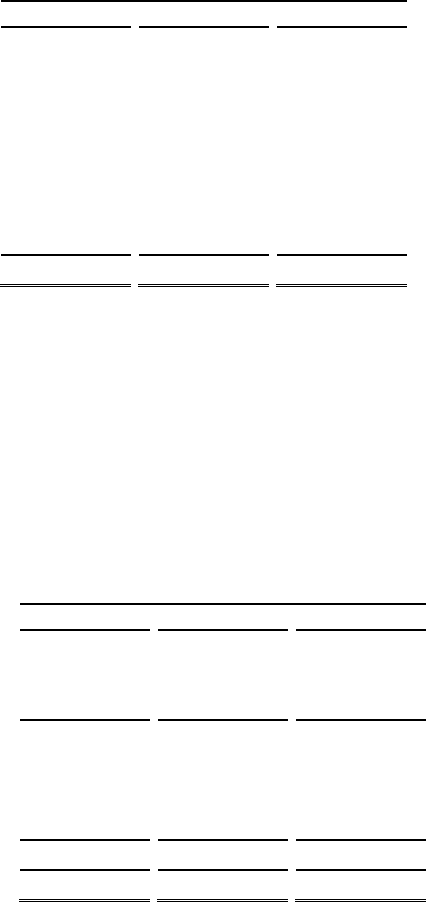

Income tax expense consists of:

December 31,

2014

2013

2012

Current provision:

Federal ..........................................................

$

137,573

$

130,854

$

126,484

State .............................................................

43,282

13,513

10,674

Total current provision ......................................

180,855

144,367

137,158

Deferred (benefit)/provision:

Federal ..........................................................

(40,370

)

13,240

(9,747

)

State .............................................................

(518

)

1,327

(1,268

)

Total deferred (benefit)/provision .......................

(40,888

)

14,567

(11,015

)

Provision for income tax expense .......................

$

139,967

$

158,934

$

126,143

F-54