Sallie Mae 2014 Annual Report Download - page 40

Download and view the complete annual report

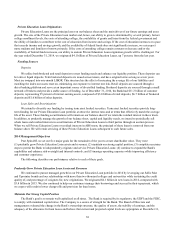

Please find page 40 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Private Education Loan Originations

Private Education Loans are the principal asset on our balance sheet and the main driver of our future earnings and asset

growth. The size of the Private Education Loan market and, hence, our ability to grow is determined by several primary factors:

college enrollment levels, the costs of attending college, the availability of grants and loans from the federal government and

the ability of families to contribute to the cost of education from income and savings. If the cost of education increases at a pace

that exceeds income and savings growth, and the availability of federal funds does not significantly increase, we can expect

more students and families to borrow privately. If the costs of attending college remain constant or decrease and/or the

availability of federal funds increases, our ability to sustain Private Education Loan origination growth will be challenged. For

the year ended December 31, 2014, we originated $4.1 billion of Private Education Loans, up 7 percent, from the last year.

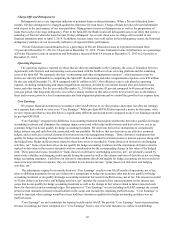

Funding Sources

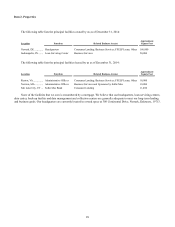

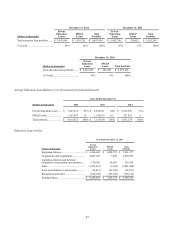

Deposits

We utilize both brokered and retail deposits to meet funding needs and enhance our liquidity position. These deposits can

be term or liquid deposits. Term brokered deposits are issued across tenors, and have original terms as long as seven years.

Most are swapped into one-month LIBOR. This structure has the effect of increasing the average life of our liabilities and

matching the index our assets reset on, minimizing our exposure to interest rate risk. Retail deposits are sourced through a

direct banking platform and serve as an important source of diversified funding. Brokered deposits are sourced through a small

network of brokers and provide a stable source of funding. As of December 31, 2014, the Bank had $11.3 billion of customer

deposits, representing 95 percent of interest earning assets, composed of $3.0 billion of retail deposits, $6.7 billion of brokered

deposits and $1.6 billion of other deposits.

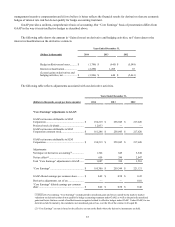

Loan Sales and Securitizations

We intend to diversify our funding by issuing term asset backed securities. Term asset backed securities provide long-

term funding for our Private Education Loan portfolio at attractive interest rates and at terms that effectively match the average

life of the asset. These funding securitizations will remain on our balance sheet if we retain the residual interest in these trusts.

In addition, to prudently manage the growth of our balance sheet, capital and liquidity needs, we intend to periodically sell

whole loans and residual interests in securitizations of Private Education Loans to third parties through an auction process.

When we sell Private Education Loans or residual interests in ABS trusts, the principal of these loans is removed from our

balance sheet. We will retain servicing of these Private Education Loans subsequent to such future sales.

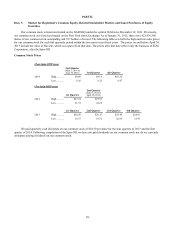

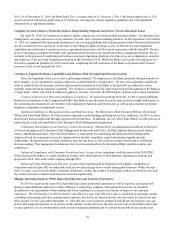

2014 Management Objectives

Post Spin-Off, we set out five major goals for the remainder of the year to create shareholder value. They were:

(1) prudently grow Private Education Loan assets and revenues; (2) maintain our strong capital position; (3) complete necessary

steps to permit the Bank to independently originate and service Private Education Loans; (4) continue to expand the Bank's

capabilities and enhance risk oversight and internal controls; and (5) manage operating expenses while improving efficiency

and customer experience.

The following describes our performance relative to each of these goals.

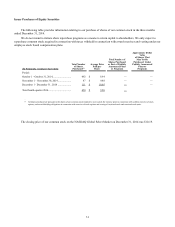

Prudently Grow Private Education Loan Assets and Revenues

We continued to pursue managed growth in our Private Education Loan portfolio in 2014 by leveraging our Sallie Mae

and Upromise brands and our relationships with more than two thousand colleges and universities while sustaining the credit

quality of, and percentage of cosigners for, new originations. We originated $4.1 billion in new loans in 2014, compared with

$3.8 billion in 2013. We also continued to help our customers manage their borrowings and succeed in their repayment, which

we expect will result in lower charge-offs and provision for loan losses.

Maintain Our Strong Capital Position

The Bank’ s goal is to remain well-capitalized at all times. The Bank is required by its regulators, the UDFI and the FDIC,

to comply with mandated capital ratios. The Company is a source of strength for the Bank. The Board of Directors and

management evaluated the change in the Bank’s ownership structure, the quality of assets, the stability of earnings, and the

adequacy of the allowance for loan losses and believe that current and projected capital levels are appropriate at December 31,

38