Sallie Mae 2014 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

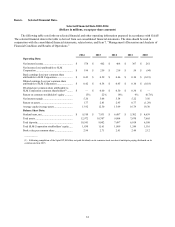

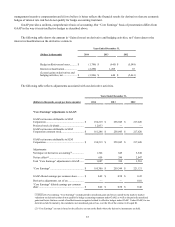

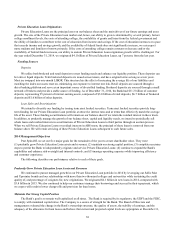

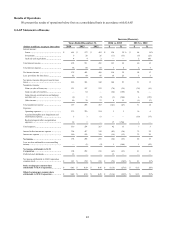

Item 6. Selected Financial Data.

Selected Financial Data 2010-2014

(Dollars in millions, except per share amounts)

The following table sets forth our selected financial and other operating information prepared in accordance with GAAP.

The selected financial data in the table is derived from our consolidated financial statements. The data should be read in

conjunction with the consolidated financial statements, related notes, and Item 7. “Management’s Discussion and Analysis of

Financial Condition and Results of Operations.”

2014

2013

2012

2011

2010

Operating Data:

Net interest income .........................................

$

578

$

462

$

408

$

367

$

261

Net income (loss) attributable to SLM

Corporation ...................................................

$

194

$

259

$

218

$

54

$

(94

)

Basic earnings (loss) per common share

attributable to SLM Corporation ......................

$

0.43

$

0.59

$

0.46

$

0.10

$

(0.19

)

Diluted earnings (loss) per common share

attributable to SLM Corporation ......................

$

0.42

$

0.58

$

0.45

$

0.10

$

(0.18

)

Dividends per common share attributable to

SLM Corporation common shareholders

(1)

........

$

—

$

0.60

$

0.50

$

0.30

$

—

Return on common stockholders’ equity ...........

15

%

22

%

18

%

4

%

(0.7

)%

Net interest margin .........................................

5.26

5.06

5.54

5.22

3.56

Return on assets .............................................

1.77

2.83

2.95

0.77

(1.29

)

Average equity/average assets ..........................

13.92

12.50

15.49

16.79

18.30

Balance Sheet Data:

Student loans, net ...........................................

$

9,510

$

7,931

$

6,487

$

5,302

$

4,659

Total assets ....................................................

12,972

10,707

9,084

7,670

7,665

Total deposits .................................................

10,541

9,002

7,497

6,018

6,108

Total SLM Corporation stockholders’ equity .....

1,830

1,161

1,089

1,244

1,116

Book value per common share .........................

2.99

2.71

2.41

2.44

2.12

_________

(1) Following completion of the Spin-Off, SLM has not paid dividends on its common stock nor does it anticipate paying dividends on its

common stock in 2015.

33