Sallie Mae 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

2.

Significant Accounting Policies (Continued)

recorded at fair value with any difference reflecting ineffectiveness which is recorded immediately in the consolidated

statements of income. Cash flow hedges are designed to hedge our exposure to variability in cash flows related to variable rate

deposits. The assessment of the hedge’s effectiveness is performed at inception and on an ongoing basis, generally using

regression testing. For hedges of a pool of liabilities, tests are performed to demonstrate the similarity of individual instruments

of the pool. When it is determined that a derivative is not currently an effective hedge, ineffectiveness is recognized for the full

change in fair value of the derivative with no offsetting amount from the hedged item since the last time it was effective. If it is

also determined the hedge will not be effective in the future, we discontinue the hedge accounting prospectively and begin

amortization of any basis adjustments that exist related to the hedged item.

Stock-Based Compensation

We recognize stock-based compensation cost in our consolidated statements of income using the fair value method.

Under this method we determine the fair value of the stock-based compensation at the time of the grant and recognize the

resulting compensation expense over the vesting period of the stock-based grant.

Income Taxes

We account for income taxes under the asset and liability approach, which requires the recognition of deferred tax

liabilities and assets for the expected future tax consequences of temporary differences between the carrying amounts and tax

basis of our assets and liabilities. To the extent tax laws change, deferred tax assets and liabilities are adjusted in the period that

the tax change is enacted.

“Income tax expense/(benefit)” includes (i) deferred tax expense/(benefit), which represents the net change in the

deferred tax asset or liability balance during the year when applicable, and (ii) current tax expense/(benefit), which represents

the amount of tax currently payable to or receivable from a tax authority plus amounts accrued for unrecognized tax benefits.

Income tax expense/(benefit) excludes the tax effects related to adjustments recorded in equity.

An uncertain tax position is recognized only if it is more likely than not to be sustained upon examination based on the

technical merits of the position. The amount of tax benefit recognized in the financial statements is the largest amount of benefit

that is more than fifty percent likely of being sustained upon ultimate settlement of the uncertain tax position. We recognize

interest related to unrecognized tax benefits in income tax expense/(benefit), and penalties, if any, in operating expenses.

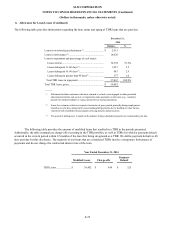

In connection with the Spin-Off, we have become the taxpayer legally responsible for $283 million of deferred taxes

payable (installment payments due quarterly through 2018) in connection with gains recognized by pre-Spin-Off SLM on debt

repurchases in prior years. As part of the tax sharing agreement between us and Navient, Navient has agreed to fully pay us for

these deferred taxes due. An indemnification receivable of $291 million was recorded, which represents the fair value of the

future payments under the agreement based on a discounted cash flow model. We will accrue interest income on the

indemnification receivable using the interest method.

We also recorded a liability related to uncertain tax positions of $27 million for which we are indemnified by Navient. If

there is an adjustment to the indemnified uncertain tax liability, an offsetting adjustment to the indemnification receivable will

be recorded as pre-tax adjustment to the income statement.

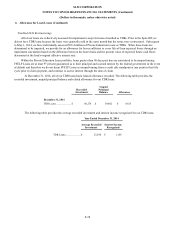

As of the date of the Spin-Off on April 30, 2014, we recorded a liability of $310 million ($283 million related to deferred

taxes and $27 million related to uncertain tax positions) and an indemnification receivable of $291 million ($310 million less

the $19 million discount). As of December 31, 2014, the liability balance is $268 million ($252 million related to deferred taxes

and $16 million related to uncertain tax positions) and the indemnification receivable balance is $240 million ($224 million

related to deferred taxes and $16 million related to uncertain tax positions).

Reclassifications

Certain reclassifications have been made to the balances as of and for the years ended December 31, 2013 and 2012, to be

consistent with classifications adopted for 2014, which had no effect on net income, total assets or total liabilities.

F-19