Sallie Mae 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

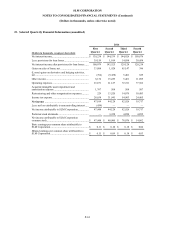

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

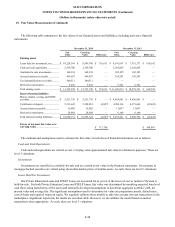

22. Parent Only Statements

The following parent company-only financial information should be read in conjunction with the other notes to the

consolidated financial statements. The accounting policies for the parent company-only financial statements are the same as

those used in the presentation of the consolidated financial statements other than the parent company-only financial statements

account for the parent company's investments in its subsidiaries under the equity method.

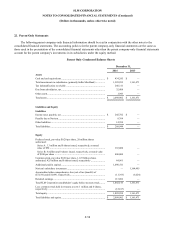

Parent Only Condensed Balance Sheets

December 31,

2014

2013

Assets

Cash and cash equivalents .............................................................

$

434,245

$

—

Total investments in subsidiaries (primarily Sallie Mae Bank) .............

1,389,995

1,161,471

Tax indemnification receivable ......................................................

240,311

—

Due from subsidiaries, net .............................................................

32,408

—

Other assets ................................................................................

1,943

—

Total assets .................................................................................

$

2,098,902

$

1,161,471

Liabilities and Equity

Liabilities

Income taxes payable, net .............................................................

$

245,782

$

—

Payable due to Navient .................................................................

8,764

—

Other liabilities ...........................................................................

14,398

—

Total liabilities ............................................................................

$

268,944

—

Equity

Preferred stock, par value $0.20 per share, 20 million shares

authorized:

Series A: 3.3 million and 0 shares issued, respectively, at stated

value of $50 .............................................................................

165,000

—

Series B: 4 million and 0 shares issued, respectively, at stated value

of $100 per share ......................................................................

400,000

—

Common stock, par value $0.20 per share, 1.125 billion shares

authorized: 425 million and 0 shares issued, respectively ....................

84,961

—

Additional paid-in capital ..............................................................

1,090,511

—

Navient's subsidiary investment .....................................................

—

1,164,495

Accumulated other comprehensive loss (net of tax (benefit) of

($7,186) and ($1,849), respectively .................................................

(11,393

)

(3,024

)

Retained earnings ........................................................................

113,066

—

Total SLM Corporation stockholders' equity before treasury stock ........

1,842,145

1,161,471

Less: common stock held in treasury at cost: 1 million and 0 shares,

respectively ................................................................................

(12,187

)

—

Total equity ................................................................................

1,829,958

1,161,471

Total liabilities and equity .............................................................

$

2,098,902

$

1,161,471

F-58