Sallie Mae 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

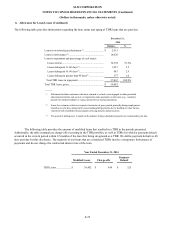

2.

Significant Accounting Policies (Continued)

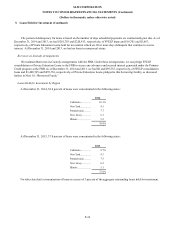

Recently Issued Accounting Pronouncements

On May 28, 2014, the Financial Accounting Standards Board (“FASB”) issued ASU No. 2014-09, “Revenue from

Contracts with Customers,” which requires an entity to recognize the amount of revenue to which it expects to be entitled for

the transfer of promised goods or services to customers. The ASU will replace most existing revenue recognition guidance

when it becomes effective. The new standard is effective on January 1, 2017. Early application is not permitted. The standard

permits the use of either the retrospective or cumulative effect transition method. We have determined that this new guidance

will have an immaterial impact on the financial results of the Company.

3. Cash and Cash Equivalents

As of December 31, 2014, cash and cash equivalents include cash due from the FRB of $2,344,901 and cash due from

depository institutions of $14,879. As of December 31, 2013, cash and cash equivalents include cash due from the FRB of

$2,181,463, and cash due from depository institutions of $1,402. As of December 31, 2014 and 2013, we had no outstanding

cash equivalents.

In 2010, the FRB introduced the Term Deposit Facility to facilitate the conduct of monetary policy by providing a tool

that may be used to manage the aggregate quantity of reserve balances held by depository institutions. Under this program the

FRB accepts deposits for a stated maturity at a rate of interest determined via auction. The funds are removed from the

accounts of participating institutions for the life of the term deposit. We participated in these auctions in 2014 and 2013,

resulting in interest income of $1,248 and $813, respectively. As of December 31, 2014 and 2013, no funds were on deposit

with the FRB under this program.

We are required to maintain average reserve balances with the FRB based on a percentage of deposits. The average

amounts of those reserves for the years ended December 31, 2014 and 2013 were $324 and $1,548, respectively.

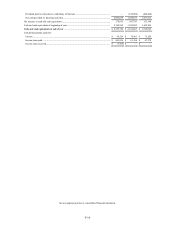

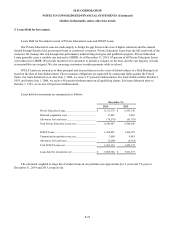

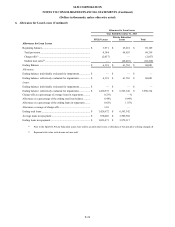

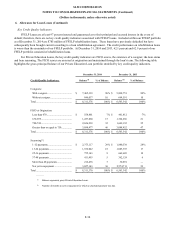

4. Investments

The amortized cost and fair value of securities available for sale are as follows:

As of December 31, 2014

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fa ir Va lue

Available for sale:

Mortgage-backed securities ..........

$

167,740

$

2,686

$

(1,492

)

$

168,934

As of December 31, 2013

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fa ir Va lue

Available for sale:

Mortgage-backed securities ..........

$

106,977

$

706

$

(5,578

)

$

102,105

F-20