Sallie Mae 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

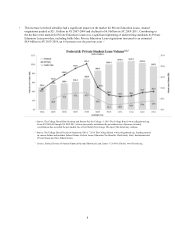

Key Drivers of Private Education Loan Market Growth

The size of the Private Education Loan market is based on three primary factors: college enrollment levels, the costs of

attending college and the availability of funds from the federal government to pay for a college education. The amounts that

students and their families can contribute toward a college education and the availability of scholarships and institutional grants

are also important. If the cost of education continues to increase at a pace exceeding the sum of family income, savings, federal

subsidies, and scholarships, more students and families can be expected to borrow privately. If enrollment levels or college

costs decline or the availability of federal education loans, grants or subsidies and scholarships significantly increases, Private

Education Loan originations could decrease. Our competitors1 in the Private Education Loan market include large banks such

as Wells Fargo Bank NA, Discover Bank, RBS Citizens, and PNC Bank NA, as well as a number of smaller specialty finance

companies.

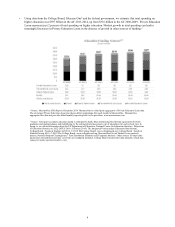

Our primary lending focus is on public and private not-for-profit four-year degree granting institutions. We do limited

business with two-year and for-profit schools. Due to the low cost of two-year programs, federal grant and loan programs are

typically sufficient for the financing needs of these students. The for-profit industry has been the subject of increased scrutiny

and regulation over the last several years. Since 2007, we have significantly reduced the number of for-profit institutions we do

business with. The institutions we continue to do business with are focused on career training and are subject to regular

performance review. We expect students attending for-profit schools to be able to support the same repayment performance as

students attending public and private not-for-profit four-year degree granting institutions.

• Undergraduate and graduate enrollments at public and private not-for-profit four-year institutions increased by

approximately 11 percent from Academic Years (“AYs”) 2003-2004 to 2007-2008. Post-secondary enrollment

increased considerably during the recession of 2007-2009, especially in areas most affected by high unemployment.

Enrollment has been stable post-recession. According to ED’s projections released in February 2014, the high school

graduate population is projected to remain relatively flat from 2013 to 2022.2 Based on these projections and recent

trends, we expect modest enrollment growth in the next several years.

________

1 Source: MeasureOne CBA Report, December 2014. www.measureone.com.

2 Source: U.S. Department of Education, National Center for Education

Statistics, Projections of Education Statistics to 2022 (NCES, February

2014), Enrollment in Postsecondary Institutions (NCES, December

2013) and Enrollment in Postsecondary Institutions (NCES, October

2014).

6