Sallie Mae 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, unless otherwise noted)

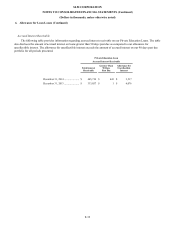

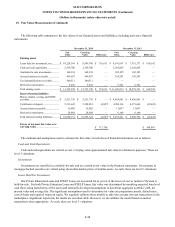

11.

Derivative Financial Instruments (Continued)

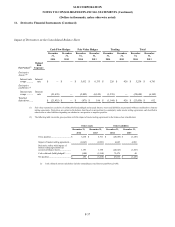

Cash Flow

Fa ir Va lue

Trading

Total

December

31,

December

31,

December

31,

December

31,

December

31,

December

31,

December

31,

December

31,

2014

2013

2014

2013

2014

2013

2014

2013

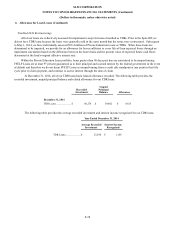

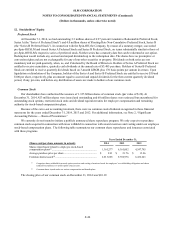

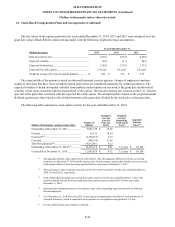

Notional Values

Interest rate

swaps ...............

$

1,106,920

$

—

$

3,044,492

$

2,089,624

$

973,539

$

575,131

$

5,124,951

$

2,664,755

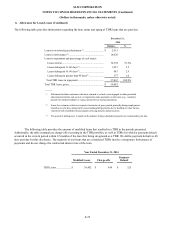

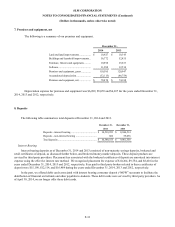

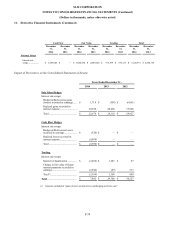

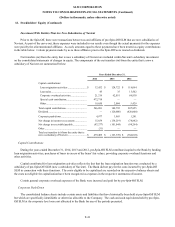

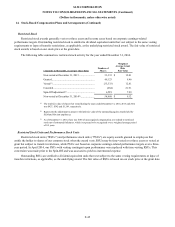

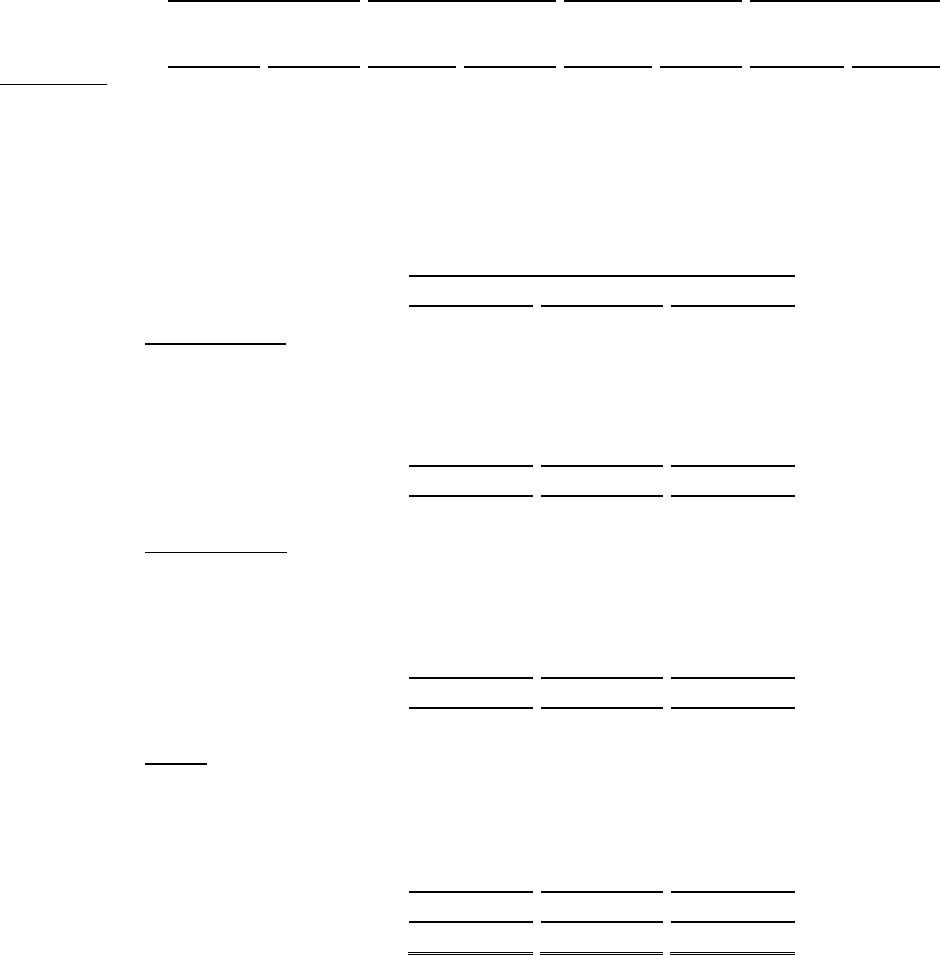

Impact of Derivatives on the Consolidated Statements of Income

Years Ended December 31,

2014

2013

2012

Fair Value Hedges

Interest rate swaps:

Hedge ineffectiveness gains

(losses) recorded in earnings .....

$

1,718

$

(558

)

$

(6,061

)

Realized gains recorded in

interest expense .......................

20,958

28,668

35,988

Total ......................................

$

22,676

$

28,110

$

29,927

Cash Flow Hedges

Interest rate swaps:

Hedge ineffectiveness losses

recorded in earnings ................

$

(520

)

$

—

$

—

Realized losses recorded in

interest expense .......................

(9,070

)

—

—

Total ......................................

$

(9,590

)

$

—

$

—

Trading

Interest rate swaps:

Interest reclassification ............

$

(2,250

)

$

1,285

$

87

Change in fair value of future

interest payments recorded in

earnings..................................

(2,944

)

(87

)

513

Total

(1)

....................................

(5,194

)

1,198

600

Total ........................................

$

7,892

$

29,308

$

30,527

(1) Amounts included in "gains (losses) on derivatives and hedging activities, net."

F-38