Rogers 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

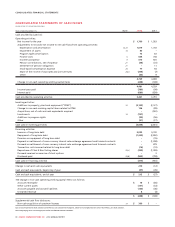

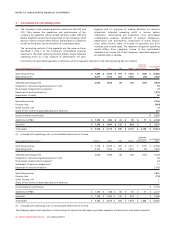

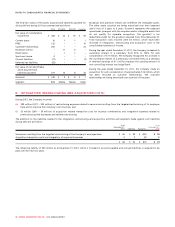

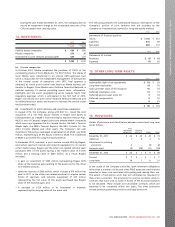

(b) Revenue by product is as follows:

2012 2011

Wireless:

Postpaid $ 6,402 $ 6,275

Prepaid 317 326

Network revenue 6,719 6,601

Equipment sales 561 537

Total Wireless 7,280 7,138

Cable:

Cable television 1,868 1,878

Internet 998 926

Home phone 477 478

Service revenue 3,343 3,282

Equipment sales 15 27

Total Cable 3,358 3,309

RBS:

Next generation 162 128

Legacy 183 271

Service revenue 345 399

Equipment sales 66

Total RBS 351 405

Media:

Advertising 784 816

Subscription 264 241

Retail 276 272

Other 296 282

Total Media 1,620 1,611

Corporate items and intercompany

eliminations (123) (117)

$ 12,486 $ 12,346

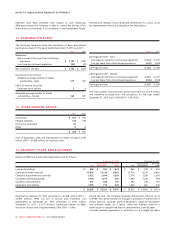

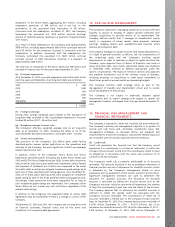

4. OPERATING COSTS:

2012 2011

Cost of equipment sales and direct channel

subsidies $ 1,605 $ 1,454

Merchandise for resale 173 171

Other external purchases 4,138 4,304

Employee salaries and benefits 1,813 1,742

Settlement of pension obligations (note 21) –11

$ 7,729 $ 7,682

5. FINANCE COSTS:

2012 2011

Interest on long-term debt $ 691 $ 668

Loss on repayment of long-term debt

(note 17) –99

Foreign exchange loss (gain) (9) 6

Change in fair value of derivative

instruments 1(14)

Capitalized interest (28) (29)

Other 98

$ 664 $ 738

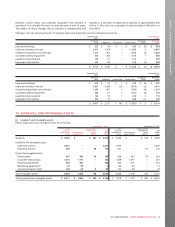

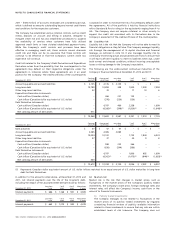

6. DISCONTINUED OPERATIONS:

During the second quarter of 2012, the Company discontinued its

Video segment. Accordingly, the Video segment results of operations

have been reported as discontinued operations. As of June 2012,

Rogers’ stores no longer offered video and game rentals or sales at

any of its retail locations. Certain of these stores continue to serve

customers’ wireless and cable needs. The results of the discontinued

operations are as follows:

2012 2011

Operating revenue $18$82

Operating costs (30) (105)

(12) (23)

Integration, restructuring and acquisition costs (30) (14)

Loss before income taxes (42) (37)

Income tax recovery 10 10

Loss from discontinued operations for the year $ (32) $ (27)

The Video segment did not have any significant assets or liabilities as

at December 31, 2012. Cash flows from operating activities for the

discontinued Video segment for the year ended December 31, 2012

were $2 million (2011 – $1 million). The Video segment did not have

any cash flows from investing or financing activities for the years

ended December 31, 2012 and 2011.

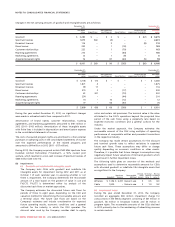

7. BUSINESS COMBINATIONS AND

DIVESTITURES:

There were no individually material business combinations or

divestitures during 2012.

During 2011, the Company made the following acquisitions:

• On January 4, 2011, the Company closed an agreement to purchase

a 100% interest in Atria Networks LP (“Atria”) for cash

consideration of $426 million. Atria, based in Kitchener, Ontario,

owns and operates one of the largest fibre-optic networks in

Ontario, delivering premier business Internet and data services. The

acquisition will augment RBS’s small business and medium-sized

business offerings by enhancing its ability to deliver on-net data

centric services within and adjacent to Cable’s footprint.

• On January 31, 2011, the Company closed an agreement to acquire

all of the assets of Edmonton, Alberta radio station BOUNCE

(CHBN-FM) for cash consideration of $22 million. The acquisition of

this radio station was made to increase the Company’s presence in

the Edmonton market.

• On January 31, 2011, the Company closed an agreement to acquire

all of the assets of London, Ontario radio station, BOB-FM (CHST-

FM), for cash consideration of $16 million. The acquisition of this

radio station was made to enter into the London, Ontario market.

• On February 28, 2011, the Company closed an agreement to

acquire all of the assets of Compton Cable T.V. Ltd. (“Compton”)

for cash consideration of $40 million. Compton provides cable

television, Internet and telephony services in Port Perry, Ontario

and the surrounding area. The acquisition was made to enter into

the Port Perry, Ontario market and is adjacent to the existing Cable

footprint.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 95