Rogers 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

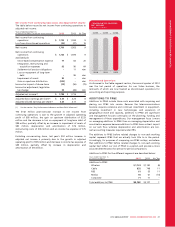

Covenant Compliance

We are currently in compliance with all of the covenants under our

debt instruments. At December 31, 2012, there were no financial

leverage covenants in effect other than those pursuant to our bank

credit facility (see Note 17(h) to the 2012 Audited Consolidated

Financial Statements). Based on our most restrictive leverage

covenants, we would have had the capacity to issue up to

approximately $10.9 billion of additional long-term debt at

December 31, 2012.

Shelf Prospectuses

Rogers has two outstanding shelf prospectuses with securities

regulators to qualify debt securities of RCI, one for the sale of up to

$4 billion of debt securities in Canada and the other for the sale of up

to US$4 billion in the U.S. and Ontario. Each of the shelf prospectuses

expires in January 2014.

Credit Ratings

The following information relating to our credit ratings is provided as

it relates to our financing costs and liquidity. Specifically, credit

ratings may affect our ability to obtain short-term and long-term

financing and the terms of such financing. A reduction in the credit

ratings on our debt by the rating agencies, particularly a downgrade

below investment grade ratings, could adversely affect our cost of

financing and our access to sources of liquidity and capital.

In May 2012, Standard & Poor’s Ratings Services affirmed the

corporate credit rating for RCI to be BBB and the rating for RCI’s

senior unsecured debt to be BBB, each with a stable outlook, and

assigned its BBB rating to each of the 2017 Notes and the 2022 Notes.

In May 2012, Fitch Ratings affirmed the issuer default rating for RCI to

be BBB and the rating for RCI’s senior unsecured debt to be BBB, each

with a stable outlook, and assigned its BBB rating to each of the 2017

Notes and the 2022 Notes.

In May 2012, Moody’s Investor Service affirmed the corporate credit

rating for RCI to be Baa1 and the rating for RCI’s senior unsecured

debt to be Baa1, each with a stable outlook, and assigned its Baa1

rating to each of the 2017 Notes and the 2022 Notes.

Credit ratings are intended to provide investors with an independent

measure of credit quality of an issue of securities. Ratings for debt

instruments range along a scale from AAA, in the case of Standard &

Poor’s and Fitch, or Aaa, in the case of Moody’s, which represents the

highest quality of securities rated, to D, in the case of Standard &

Poor’s, C, in the case of Moody’s, and Substantial Risk, in the case of

Fitch, which represents the lowest quality of securities rated. The

credit ratings assigned by the rating agencies are not

recommendations to purchase, hold or sell the rated securities, nor do

such ratings provide comment as to market price or suitability for a

particular investor. There is no assurance that any rating will remain

in effect for any given period of time, or that any rating will not be

revised or withdrawn entirely by a rating agency in the future if in its

judgment circumstances so warrant. The ratings on RCI’s senior debt

of BBB from Standard & Poor’s and Fitch and of Baa1 from Moody’s

all represent investment grade ratings.

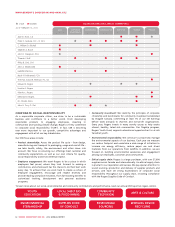

Employee Benefit Plan Funding

Our pension plans had a deficiency on a solvency basis at

December 31, 2012 of approximately $334 million, and are expected

to have a deficiency on a solvency basis at December 31, 2013.

Consequently, in addition to our regular contributions, we are

making certain minimum monthly special payments to eliminate the

solvency deficiency. In 2012, the special payments, including

contributions associated with benefits paid from the plans, totalled

approximately $10 million. In 2013, our total estimated funding

requirements are expected to be $96 million, and will be subject to

annual adjustments thereafter based on various market factors and

staffing assumptions.

As further discussed in the section “Critical Accounting Estimates”,

changes in factors such as the discount rate, the rate of compensation

increase and the expected return on plan assets can impact the

accrued benefit obligation, pension expense and the deficiency of

plan assets over accrued obligations in the future.

Pension Plans Purchase of Annuities

From time to time the Company has made additional lump-sum

contributions to our pension plans and, in turn, the pension plans

have purchased annuities from insurance companies to fund the

pension benefit obligations for certain retired employees in the

pension plans. The purchase of the annuities relieves us of primary

responsibility for, and eliminates significant risk associated with, the

accrued benefit obligation for the retired employees.

In 2012, we did not make any additional lump-sum contributions to

our pension plans and the pension plans did not purchase additional

annuities.

In 2011, we made a lump-sum contribution of $18 million to our

pension plans, following which the pension plans purchased $68

million of annuities from insurance companies for employees in the

pension plans who had retired between January 1, 2009 and

January 1, 2011. The non-cash settlement loss arising from this

settlement of pension obligations was $11 million.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 53