Rogers 2012 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

• Increased the annualized dividend rate by 11% from $1.42 to $1.58

per Class A Voting and Class B Non-Voting share in February 2012,

paying out $803 million in dividends during 2012. Also, purchased for

cancellation 9.6 million Class B Non-Voting shares for $350 million,

returning $1,153 million to shareholders during the year.

• Issued $1.1 billion of debt securities consisting of $500 million of

3.0% Senior Notes due 2017 and $600 million of 4.0% Senior Notes

due 2022. The net proceeds from the offering were used to repay

amounts outstanding under Rogers’ bank credit facility and for

general corporate purposes, including funding Rogers’ investment

in MLSE.

• Entered into an accounts receivable securitization program on

December 31, 2012, further supplementing our liquidity and

sources of secured funding by up to $900 million and the initial

funding was received on January 14, 2013, subsequent to the 2012

year-end.

• Entered into a new, five-year $2.0 billion syndicated bank credit

facility that will mature in July 2017. It replaces Rogers’ prior bank

credit facility that was scheduled to expire in July 2013. At

December 31, 2012, there were no advances outstanding under the

bank credit facility which, together with our cash and cash

equivalents and the committed funding available under the

accounts receivable securitization program, provided for

$3.1 billion of available liquidity.

• In February 2013, Rogers’ Board of Directors approved an increase

of 10% in the annualized dividend rate from $1.58 to $1.74 per

Class A Voting and Class B Non-Voting share, effective immediately,

to be paid in quarterly amounts of $0.435. In addition, the Board

has approved a renewed share buyback program for the

repurchase of up to $500 million of RCI shares on the open market

over the following twelve months.

• On January 14, 2013, we announced a multipart strategic

transaction with Shaw Communications (“Shaw”) to acquire Shaw’s

cable system in Hamilton, Ontario and secure an option to

purchase Shaw’s Advanced Wireless Service (“AWS”) spectrum

holdings in 2014. We will also sell to Shaw our one-third interest in

specialty channel TVtropolis and enter into negotiations for the

provision of certain services in Western Canada. Rogers’ net cash

investment is expected to total approximately $700 million if all

aspects of the transactions are approved.

• On February 14, 2013, we announced that the Company’s President

and Chief Executive Officer, Nadir Mohamed, has decided to retire

in January 2014. Mr. Mohamed has agreed to work with the Board

of Directors to ensure a seamless and orderly transition and to

continue to lead the company in 2013. The Board of Directors will

appoint a search committee and select a search firm to begin an

international search.

Wireless Cable RBS Media

(In millions of dollars)

REVENUE BY SEGMENT

3,190 3,309 3,358

6,973 7,138 7,280

452 405 351

1,461 1,611 1,620

2010 2011 2012

Wireless Cable & RBS Media

(In millions of dollars)

ADJUSTED OPERATING

PROFIT BY SEGMENT

1,459 1,635 1,694

3,173 3,036 3,063

131 180 190

2010 2011 2012

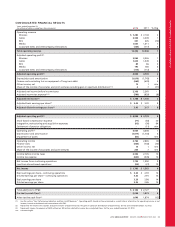

(In millions of dollars)

CONSOLIDATED

TOTAL ASSETS

$17,033 $18,362 $19,618

2010 2011 2012

(In millions of dollars)

ADDITIONS TO

CONSOLIDATED PP&E

$1,821 $2,127 $2,142

2010 2011 2012

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 25