Rogers 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

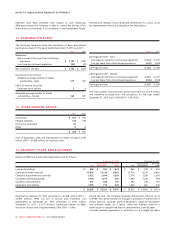

(ii) Intangible assets:

Intangible assets acquired in a business combination are

recorded at their fair values. Intangible assets with finite useful

lives are amortized over their estimated useful lives and are

tested for impairment, as described in note 2(u). Useful lives,

residual values and amortization methods for intangible assets

with finite useful lives are reviewed at least annually.

Intangible assets having an indefinite life, which consist of

spectrum and broadcast licences, are not amortized but are

tested for impairment on an annual basis, as described in note

2(u). Spectrum licences and broadcast licences are indefinite life

intangible assets because there is no foreseeable limit to the

period over which these assets are expected to generate net cash

inflows for the Company. The determination of these assets’

indefinite life is based on judgment that includes an analysis of

all relevant factors, including the expected usage of the asset,

the typical life cycle of the asset and anticipated changes in the

market demand for the products and services that the asset

helps generate.

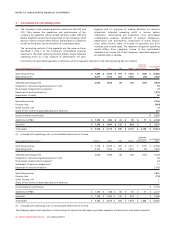

Intangible assets with finite useful lives are amortized on a

straight-line basis over their estimated useful lives as follows:

Brand names 7 to 20 years

Customer relationships 3 to 5 years

Roaming agreements 12 years

Marketing agreements 3 years

(u) Impairment:

(i) Financial assets:

A financial asset is considered impaired if objective evidence

indicates that one or more events have had a negative effect on

the estimated future cash flow of that asset that can be

estimated reliably. Individually significant financial assets are

tested for impairment on an individual basis. The remaining

financial assets are assessed collectively based on the nature of

the asset.

An impairment loss on loans and receivables is measured as the

difference between the assets carrying amount and the present

value of the future cash flows expected to be derived from the

asset. The carrying value is reduced through the use of an

allowance for doubtful accounts, with the loss recognized in net

income.

An impairment loss on available-for-sale financial assets is

recognized by reclassifying the losses accumulated in the fair

value reserve in equity to the consolidated statements of

income. The cumulative loss that is reclassified from equity to

the consolidated statements of income is the difference between

the acquisition cost less any impairment loss previously

recognized and the current fair value.

An impairment loss in respect of an equity-accounted investment

is measured by comparing the recoverable amount of the

investment with its carrying amount in accordance with note

2(u)(iv).

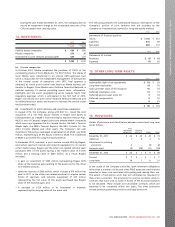

(ii) Goodwill and indefinite-life intangible assets:

The carrying values of identifiable intangible assets with

indefinite lives and goodwill are tested annually for impairment

or more frequently if there are indicators of impairment. A cash

generating unit (“CGU”) is the smallest identifiable group of

assets that generates cash inflows that are largely independent

of the cash inflows from other assets or groups of assets.

Goodwill and indefinite life intangible assets are allocated to

CGUs for the purpose of impairment testing based on the level

at which management monitors goodwill, which is not higher

than an operating segment. The allocation involves significant

estimates and considerable management judgment, and is made

to those CGUs that are expected to benefit from the synergies of

the business combination.

(iii) Non-financial assets with finite useful lives:

The carrying values of CGUs with other non-financial assets with

finite useful lives, such as PP&E and intangible assets with finite

useful lives, are assessed for impairment whenever events or

changes in circumstances indicate that their carrying amounts

may not be recoverable. If any such indication exists, the

recoverable amount of the asset must be determined. Such

assets are impaired if their recoverable amount is lower than

their carrying amount. If it is not possible to estimate the

recoverable amount of an individual asset, the recoverable

amount of the CGU to which the asset belongs is tested for

impairment.

(iv) Recognition of impairment charge:

The recoverable amount is the higher of an asset’s or CGU’s fair

value less costs to sell (“FVLCTS”) or its value in use. The

determination of the recoverable amount requires the use of

significant management estimates such as the estimated future

cash flows, terminal growth rate and discount rate applied. If

the recoverable amount of an asset or CGU is estimated to be

less than its carrying amount, the carrying amount of the asset

or CGU is reduced to its recoverable amount. The resulting

impairment loss is recognized in the consolidated statements of

income. An impairment loss is reversed if there has been a

change in the estimates used to determine the recoverable

amount. When an impairment loss is subsequently reversed, the

carrying amount of the asset or CGU is increased to the revised

estimate of its recoverable amount so that the increased carrying

amount does not exceed the carrying amount that would have

been recorded had no impairment losses been recognized for

the asset or CGU in prior years. Impairment losses recognized for

goodwill are not reversed.

In assessing value in use, the estimated future cash flows are

discounted to their present value using a pre-tax rate that

reflects current market assessments of the time value of money

and the risks specific to that asset. The cash flows used reflect

management assumptions and are supported by external sources

of information.

In assessing FVLCTS, the fair value is based on the best

information available to reflect the amount that could be

obtained from the disposal of the asset in an arm’s length

transaction between knowledgeable and willing parties, net of

estimates of the costs of disposal.

(v) Investments:

(i) Investments in associates and joint ventures:

The Company’s interests in investments in associates and joint

ventures are accounted for using the equity method of

accounting. Associates are those entities in which the Company

has significant influence, but not control, over the financial and

operating policies. Significant influence is presumed to exist

when the Company holds between 20% and 50% of the voting

power of another entity. Joint ventures are those entities over

whose activities the Company has joint control, established by

contractual agreement and requiring unanimous consent for

strategic financial and operating decisions.

The investments in associates and joint ventures are initially

recognized at cost. The carrying amount is increased or

decreased to recognize, in net income, the Company’s share of

the income or loss of the investee after the date of acquisition.

Distributions received from an investee reduce the carrying

92 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT