Rogers 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

DIVIDENDS ON RCI EQUITY SECURITIES

In February 2013, Rogers’ Board of Directors approved an annualized

dividend rate of $1.74 per Class A Voting and Class B Non-Voting

share, effective immediately, to be paid in quarterly amounts of

$0.435. Such quarterly dividends are only payable as and when

declared by our Board and there is no entitlement to any dividend

prior thereto. This follows the increase to our annualized dividend

rate from $1.42 to $1.58 per Class A Voting and Class B Non-Voting

shares in February 2012.

In 2012, we declared and paid dividends on each of our outstanding

Class A Voting and Class B Non-Voting shares. We paid an aggregate

amount of $803 million in cash dividends, an increase of $45 million

from 2011.

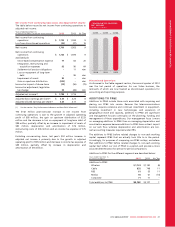

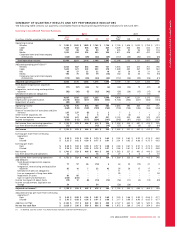

We have declared and paid dividends on each of our outstanding Class A Voting and Class B Non-Voting shares during the past two years, as

follows:

Declaration date Record date Payment date Dividend

per share Dividends paid

(in millions)

February 15, 2011 March 18, 2011 April 1, 2011 $ 0.355 $ 195

April 27, 2011 June 15, 2011 July 4, 2011 $ 0.355 $ 194

August 17, 2011 September 15, 2011 October 3, 2011 $ 0.355 $ 190

October 26, 2011 December 15, 2011 January 4, 2012 $ 0.355 $ 187

February 21, 2012 March 19, 2012 April 2, 2012 $ 0.395 $ 207

April 25, 2012 June 15, 2012 July 3, 2012 $ 0.395 $ 205

August 15, 2012 September 14, 2012 October 3, 2012 $ 0.395 $ 204

October 24, 2012 December 14, 2012 January 2, 2013 $ 0.395 $ 204

We currently expect that the dividend record and payment dates for

the 2013 declaration of dividends, subject to the declaration by our

Board each quarter at their sole discretion, would be as follows:

Record date Payment date

March 15, 2013 April 2, 2013

June 14, 2013 July 3, 2013

September 13, 2013 October 2, 2013

December 13, 2013 January 2, 2014

INTEREST RATE AND FOREIGN EXCHANGE

MANAGEMENT

Foreign Currency Forward Contracts

In July 2011, we entered into an aggregate US$720 million of foreign

currency forward contracts to hedge the foreign exchange risk on

certain forecast expenditures (“Expenditure Derivatives”, and

together with Debt Derivatives, “Derivatives”). The Expenditure

Derivatives fix the exchange rate on an aggregate US$20 million per

month of our forecast expenditures at an average exchange rate of

Cdn$0.9643/US$1 from August 2011 through July 2014. As at

December 31, 2012, US$380 million of these Expenditure Derivatives

remain outstanding, all of which qualify for and have been

designated as hedges for accounting purposes.

Economic Hedge Analysis

For the purposes of our discussion on the hedged portion of long-

term debt, we have used non-GAAP measures given that we include

all Debt Derivatives hedging our U.S. dollar-denominated debt,

whether or not they qualify as hedges for accounting purposes. Debt

Derivatives are used for risk-management purposes only. The

Canadian dollar equivalent of our U.S. dollar-denominated long-term

debt illustrated in the table below reflects the contracted foreign

exchange rate for all of our Debt Derivatives, regardless of

qualifications for accounting purposes as a hedge.

At December 31, 2012, 100% of our U.S. dollar-denominated debt

was hedged on an economic basis, while 91.7% of our U.S. dollar-

denominated debt was hedged on an accounting basis. The Debt

Derivatives hedging our US$350 million Senior Notes due 2038 do not

qualify as hedges for accounting purposes.

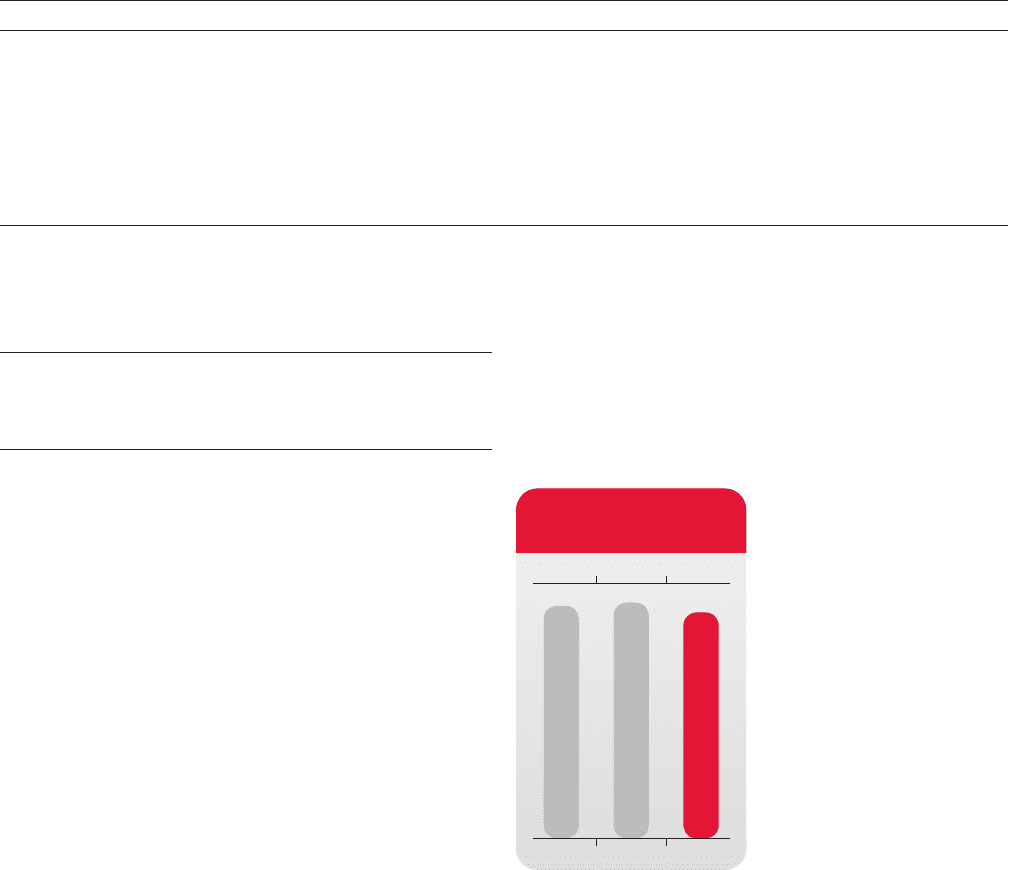

RATIO OF ADJUSTED OPERATING

PROFIT TO INTEREST

7.0x 7.1x 6.8x

2010 2011 2012

54 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT