Rogers 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

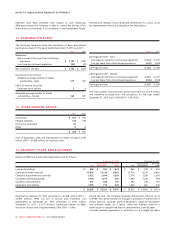

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

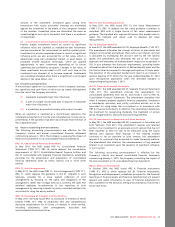

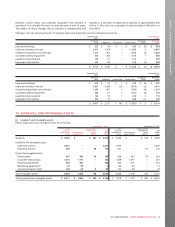

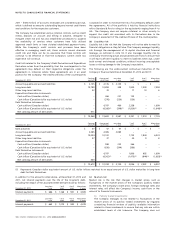

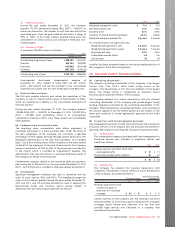

17. LONG-TERM DEBT:

Due

date Principal

amount Interest

rate December 31,

2012 December 31,

2011

Bank credit facility Floating $–$ 250

Senior Notes(1) 2013 $ U.S. 350 6.25% 348 356

Senior Notes(2) 2014 U.S. 750 6.375% 746 763

Senior Notes(1) 2014 U.S. 350 5.50% 348 356

Senior Notes(2) 2015 U.S. 550 7.50% 547 559

Senior Notes(1) 2015 U.S. 280 6.75% 279 285

Senior Notes 2016 1,000 5.80% 1,000 1,000

Senior Notes 2017 500 3.00% 500 –

Senior Notes 2018 U.S. 1,400 6.80% 1,393 1,424

Senior Notes 2019 500 5.38% 500 500

Senior Notes 2020 900 4.70% 900 900

Senior Notes 2021 1,450 5.34% 1,450 1,450

Senior Notes 2022 600 4.00% 600 –

Senior Debentures(1) 2032 U.S. 200 8.75% 199 203

Senior Notes 2038 U.S. 350 7.50% 348 356

Senior Notes 2039 500 6.68% 500 500

Senior Notes 2040 800 6.11% 800 800

Senior Notes 2041 400 6.56% 400 400

10,858 10,102

Fair value decrement arising from purchase accounting (1) (4)

Deferred transaction costs and discounts (68) (64)

Less current portion (348) –

$ 10,441 $ 10,034

(1) Denotes Senior Notes and debentures originally issued by Rogers Cable Inc. which are now unsecured obligations of RCI and for which

Rogers Communications Partnership (“RCP”) is an unsecured guarantor.

(2) Denotes Senior Notes originally issued by Rogers Wireless Inc. which are now unsecured obligations of RCI and for which RCP is an

unsecured co-obligor.

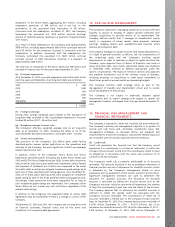

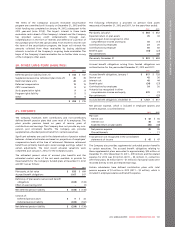

(a) Bank credit facility:

In July 2012, the Company entered into a new five-year $2.0 billion

bank credit facility maturing in July 2017 with a consortium of

financial institutions. This new bank credit facility replaces the

Company’s prior $2.4 billion bank credit facility that was set to expire

in July 2013.

The bank credit facility is available on a fully revolving basis until

maturity on July 20, 2017 and there are no scheduled reductions prior

to maturity. The interest rate charged on the bank credit facility

ranges from nil to 1.25% per annum over the bank prime rate or base

rate or 1.00% to 2.25% over the bankers’ acceptance rate or London

Inter-Bank Offered Rate. The Company’s bank credit facility is

unsecured and ranks pari passu with the Company’s senior public

debt and Debt Derivatives.

(b) Senior Notes:

Interest is paid semi-annually on all of the Company’s Senior Notes

and Senior Debentures.

Each of the Company’s Senior Notes and Senior Debentures are

redeemable, in whole or in part, at the Company’s option, at any

time, subject to a certain prepayment premium.

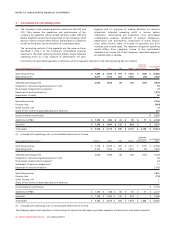

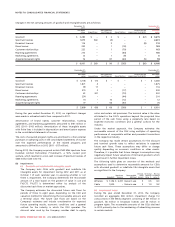

(c) Issuance of Senior Notes:

2012 Issuances:

In June 2012, the Company issued $500 million of 3.00% Senior Notes

that mature on June 6, 2017 and $600 million of 4.00% Senior Notes

that mature on June 6, 2022. The net proceeds from the offering

were approximately $1,091 million after the deduction of the original

issue discount and debt issuance costs. Debt issuance costs of $9

million related to these notes are included as deferred transaction

costs in the carrying value of the long-term debt, and are being

amortized using the effective interest method.

2011 Issuances:

In March 2011, the Company issued $1,450 million of 5.34% Senior

Notes that mature on March 22, 2021 and $400 million of 6.56%

Senior Notes that mature on March 22, 2041. The net proceeds from

the offering were approximately $1,840 million after the deduction of

the original issue discount and debt issuance costs. Debt issuance costs

of $10 million related to these debt issuances are included as deferred

transaction costs in the carrying value of the long-term debt, and are

being amortized using the effective interest method.

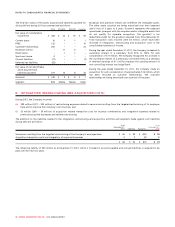

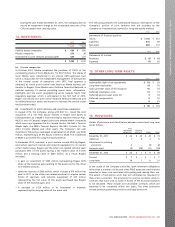

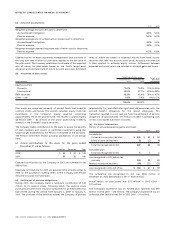

(d) Redemption of Senior Notes:

2011 Redemptions:

In March 2011, the Company redeemed the outstanding principal

amount of its U.S. $350 million ($342 million) 7.875% Senior Notes

due 2012 at the prescribed redemption price of 107.882% of the

principal amount effective on that date. The Company incurred a loss

on the repayment of the Senior Notes aggregating $42 million,

including redemption premiums of $27 million, a net loss on the

termination of the associated Debt Derivatives of $14 million and a

write-off of deferred transaction costs of $1 million. Concurrent with

this redemption, on March 21, 2011, the Company terminated the

associated U.S. $350 million notional principal amount of Debt

Derivatives, resulting in a payment of approximately $219 million.

In March 2011, the Company redeemed the outstanding principal

amount of its U.S. $470 million ($460 million) 7.25% Senior Notes due

2012 at the prescribed redemption price of 110.735% of the principal

amount effective on that date. The Company incurred a loss on the

102 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT