Rogers 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

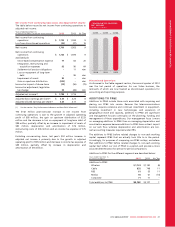

Net Income from Continuing Operations and Adjusted Net Income

The table below reconciles net income from continuing operations to

adjusted net income:

Years ended December 31,

(In millions of dollars, except per share amounts) 2012 2011 % Chg

Net income from continuing

operations $ 1,732 $ 1,590 9

Loss from discontinued operations (32) (27) 19

Net income 1,700 1,563 9

Net income from continuing

operations $ 1,732 $ 1,590 9

Add (deduct):

Stock-based compensation expense 77 64 20

Integration, restructuring and

acquisition expenses 92 56 64

Settlement of pension obligations –11 n/m

Loss on repayment of long-term

debt –99 n/m

Impairment of assets 80 – n/m

Gain on spectrum distribution (233) – n/m

Income tax impact of above items (14) (56) (75)

Income tax adjustment, legislative

tax change 54 (28) n/m

Adjusted net income(1) $ 1,788 $ 1,736 3

Adjusted basic earnings per share(1) $ 3.45 $ 3.20 8

Adjusted diluted earnings per share(1) 3.43 3.17 8

(1) See the section “Key Performance Indicators and Non-GAAP Measures”.

The $142 million year-over-year increase in net income from

continuing operations is due to the growth in adjusted operating

profit of $95 million, the gain on spectrum distribution of $233

million and the decrease in loss on repayment of long-term debt of

$99 million, partially offset by an increase in impairment of assets of

$80 million, depreciation and amortization of $76 million,

restructuring costs of $36 million and an income tax expense of $75

million.

Excluding non-recurring items, last year’s $52 million increase in

adjusted net income is primarily due to the growth in adjusted

operating profit of $95 million and decrease in income tax expense of

$49 million, partially offset by increase in depreciation and

amortization of $76 million.

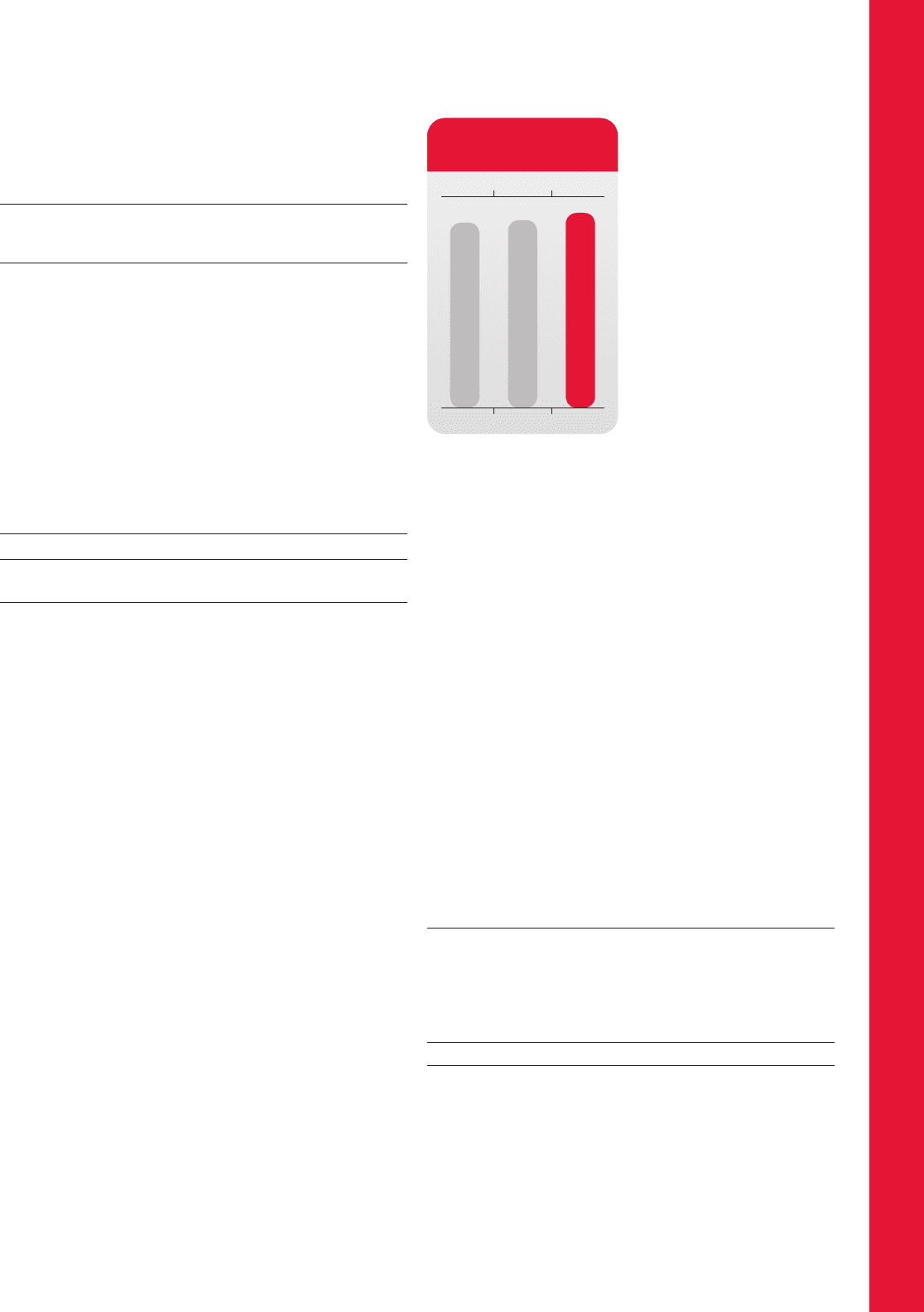

(In millions of dollars)

CONSOLIDATED ADJUSTED

NET INCOME

$1,704 $1,736 $1,788

2010 2011 2012

Discontinued Operations

As discussed in the Cable segment section, the second quarter of 2012

was the last period of operations for our Video business, the

remnants of which are now treated as discontinued operations for

accounting and reporting purposes.

ADDITIONS TO PP&E

Additions to PP&E include those costs associated with acquiring and

placing our PP&E into service. Because the telecommunications

business requires extensive and continual investment in equipment,

including investment in new technologies and expansion of

geographical reach and capacity, additions to PP&E are significant

and management focuses continually on the planning, funding and

management of these expenditures. Our management focus is more

on managing additions to PP&E than on managing depreciation and

amortization expense because additions to PP&E have a direct impact

on our cash flow, whereas depreciation and amortization are non-

cash accounting measures required under IFRS.

The additions to PP&E before related changes to non-cash working

capital represent PP&E that we actually took title to in the period.

Accordingly, for purposes of comparing our PP&E outlays, we believe

that additions to PP&E before related changes to non-cash working

capital best reflect our cost of PP&E in a period, and provide a more

accurate determination for period-to-period comparisons.

Additions to PP&E for the different segments are described below:

Years ended December 31,

(In millions of dollars) 2012 2011 % Chg

Additions to PP&E

Wireless $ 1,123 $1,192 (6)

Cable 832 748 11

RBS 61 55 11

Media 55 61 (10)

Corporate 71 71 –

Total additions to PP&E $2,142 $2,127 1

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 47