Rogers 2012 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

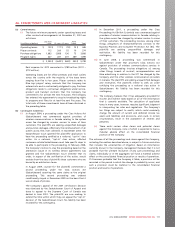

At December 31, 2011, 91.7% of the Company’s U.S. dollar-

denominated long-term debt instruments were hedged against

fluctuations in foreign exchange rates for accounting purposes. At

December 31, 2011, details of the Derivatives net liability position are

as follows:

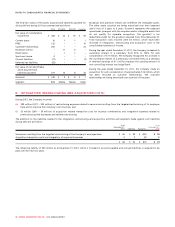

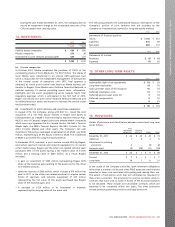

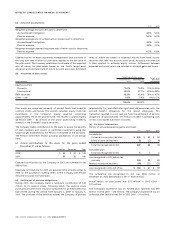

December 31, 2011 U.S. $

notional Exchange

rate Cdn. $

notional Fair

value

Debt Derivatives accounted

for as cash flow hedges:

As assets $ 1,975 1.0252 $ 2,025 $ 39

As liabilities 1,905 1.2668 2,413 (540)

Debt Derivatives not

accounted for as hedges:

As assets 350 1.0258 359 2

Net mark-to-market liability

Debt Derivatives (499)

Expenditure Derivatives

accounted for as cash flow

hedges:

As assets 620 0.9643 598 39

Net mark-to-market liability $ (460)

(e) Fair values:

The carrying value of accounts receivable, bank advances and

accounts payable and accrued liabilities approximate their fair values

because of the short-term nature of these financial instruments.

The fair value of the Company’s publicly traded investments is

determined by quoted market values for each of the investments. The

fair value of the Company’s private investments are determined by

management using well established market, asset based or projected

income valuation techniques that are applied appropriately to each

investment depending on its future operating and profitability

prospects.

The carrying value of the bank credit facility approximates its fair

value because the interest rates approximate current market rates.

The fair values of each of the Company’s public debt instruments are

based on the year-end trading values. The fair values of the

Company’s Derivatives are determined using an estimated credit-

adjusted mark-to-market valuation. In the case of Derivatives in an

asset position, the credit spread for the financial institution

counterparty is added to the risk-free discount rate to determine the

estimated credit-adjusted value for each derivative. In the case of

Derivatives in a liability position, the Company’s credit spread is

added to the risk-free discount rate for each derivative.

The change in fair value of Derivatives not designated as hedges for

accounting purposes are recorded immediately in the consolidated

statements of income.

Fair value estimates are made at a specific point in time based on

relevant market information and information about the financial

instruments. The estimates are subjective in nature and involve

uncertainties and matters of judgment.

The Company provides disclosure of the three-level hierarchy that

reflects the significance of the inputs used in making the fair value

measurements. Fair value of financial assets and financial liabilities

included in Level 1 are determined by reference to quoted prices in

active markets for identical assets and liabilities. Financial assets and

financial liabilities in Level 2 include valuations using inputs based on

observable market data, either directly or indirectly, other than the

quoted prices. Level 3 valuations are based on inputs that are not

based on observable market data. There were no material financial

instruments categorized in Level 3 (valuation technique using non-

observable market inputs) as at December 31, 2012 and 2011.

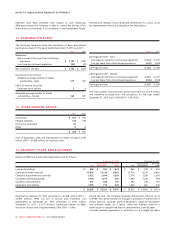

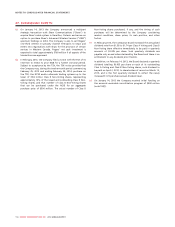

Financial instruments carried at fair value by valuation method are as

follows:

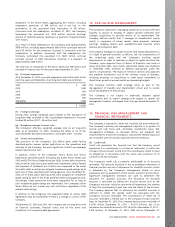

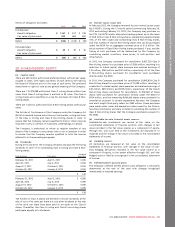

Fair value measurements at reporting date

Carrying value Level 1(1) Level 2(2)

Dec. 31, Dec. 31, Dec. 31,

2012 2011 2012 2011 2012 2011

Financial assets

Available-for-sale, measured at fair value:

Investments in publicly traded companies $ 624 $ 850 $ 624 $ 850 $–$–

Held-for-trading:

Debt Derivatives not accounted for as hedges 32––32

Expenditure Derivatives accounted for as cash flow hedges 13 39 ––13 39

$ 640 $ 891 $ 624 $ 850 $16$41

Financial liabilities

Held-for-trading:

Debt Derivatives accounted for as cash flow hedges $ 527 $ 501 $–$–$ 527 $ 501

(1) Level 1 classification comprises of financial assets and financial liabilities that are carried at fair value determined by quoted market prices.

(2) Level 2 classification comprises of financial assets and financial liabilities that are carried at fair value determined by valuation technique

using observable market inputs.

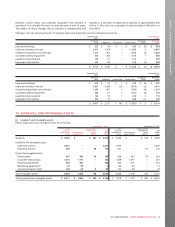

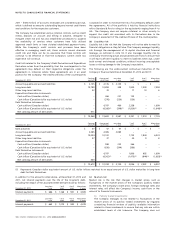

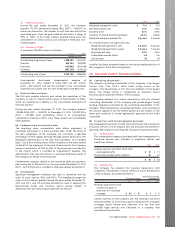

The Company’s long-term debt is initially measured at fair value and

then subsequently measured at amortized cost using the effective

interest method, as follows:

2012 2011

Carrying

amount Fair

value Carrying

amount Fair

value

Long-term debt $ 10,441 $ 12,603 $ 10,034 $ 11,471

The Company did not have any non-derivative held-to-maturity

financial assets during the years ended December 31, 2012 and 2011.

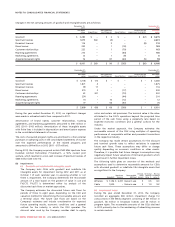

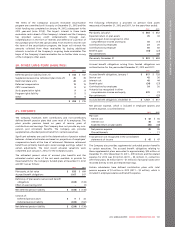

(f) Accounts receivable securitization:

On December 31, 2012 the Company entered into an accounts

receivable securitization program with a Canadian financial

institution which will enable it to sell certain trade receivables into

the program with the proceeds recorded in current liabilities as

revolving floating rate loans of up to $900 million, secured by those

trade receivables. The Company will continue to service these

accounts receivable and they will continue to be recorded in current

assets on the consolidated statement of financial position.

106 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT