Rogers 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

conditions, weakening industry expectations and a decline in

advertising revenues.

Financial Instruments

The fair values of our Derivatives are recorded using an estimated

credit-adjusted mark-to-market valuation. In the case of Derivatives in

an asset position (i.e., the counterparty owes Rogers) the credit

spread for the bank counterparty is added to the risk-free discount

rate to determine the estimated credit-adjusted value. In the case of

Derivatives in a liability position (i.e., Rogers owes the counterparty),

our credit spread is added to the risk-free discount rate. The

estimated credit-adjusted values of Derivatives are subject to changes

in credit spreads of Rogers and its counterparties. If these estimates

differ materially from management expectations, fair value changes

could impact net income or hedging reserves.

Income Tax Estimates

We provide for income taxes based on currently available information

in each of the jurisdictions in which we operate. The calculation of

income taxes in many cases, however, requires significant judgment in

interpreting tax rules and regulations. Our tax filings are subject to

audits, which could materially change the amount of current and

deferred income tax assets and liabilities, and could, in certain

circumstances, result in the assessment of interest and penalties.

Additionally, estimation of the income provisions includes evaluating

the recoverability of deferred tax assets based on our assessment of

the ability to use the underlying future tax deductions before they

expire against future taxable income. Our assessment is based upon

existing tax laws, estimates of future profitability and tax planning

strategies. Deferred tax assets are recognized to the extent that it is

more likely than not that taxable profit will be available against

which the deferred tax assets can be utilized.

Accrued Liabilities

Provisions are recorded if we believe a loss is probable and can be

reasonably estimated. Provisions are measured at the estimated

expenditure required to settle the present obligation, based on the

most reliable evidence available at the reporting date, including the

risks and uncertainties associated with the present obligation.

Provisions are determined by discounting the expected future cash

flows at a pre-tax rate that reflects current market assessments of the

time value of money and the risks specific to the liability.

Decommissioning and restoration costs are calculated on the basis of

the identified costs for the current financial year, extrapolated into

the future based on management’s best estimates of future trends in

prices, inflation and other factors, and are discounted to present

value. Forecasts are revised in light of future changes in business

conditions or technological requirements.

If estimates differ from management’s expectations, there could be a

material over or understatement in liabilities.

Pension Plans

When accounting for defined benefit pension plans, assumptions are

made in determining the valuation of benefit obligations and the

future performance of plan assets. The primary assumptions and

estimates include the discount rate, the expected return on plan

assets and the rate of compensation increase. Changes to these

primary assumptions and estimates would impact pension expense,

pension asset and liability, and other comprehensive income. The

current economic conditions may also have an impact on our pension

plan because there is no assurance that the plan will be able to earn

the assumed rate of return. As well, market-driven changes may result

in changes in the discount rates and other variables that would result

in us being required to make contributions in the future that differ

significantly from the current contributions and assumptions

incorporated into the actuarial valuation process.

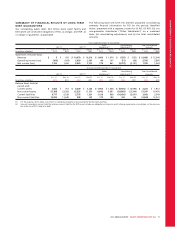

The following table illustrates the increase (decrease) in the accrued

benefit obligation and pension expense for changes in these primary

assumptions and estimates:

(In millions of dollars)

Accrued Benefit

Obligation at End

of Fiscal 2012 Pension Expense

Fiscal 2012

Discount rate 4.50% 5.50%

Impact of: 1% increase $ (188) $ (12)

1% decrease 223 12

Rate of compensation increase 3.00% 3.00%

Impact of: 0.25% increase $ 17 $ 6

0.25% decrease (17) (5)

Expected rate of return on assets N/A 6.75%

Impact of: 1% increase N/A $ 7

1% decrease N/A (7)

Stock-Based Compensation

Our employee stock option plans attach cash-settled share

appreciation rights (“SARs”) to all new and previously granted

options. The SAR feature allows the option holder to elect to receive

in cash an amount equal to the intrinsic value, instead of exercising

the option and acquiring Class B Non-Voting shares. All outstanding

stock options are classified as liabilities and are carried at their fair

value, measured using option pricing models. The liability is marked-

to-market in each period and is amortized to expense using a graded

vesting approach over the period in which the related employee

services are rendered or, as applicable, over the period to the date an

employee is eligible to retire, whichever is shorter.

The liability for stock-based compensation expense is recorded based

on the fair value of the options, as described in the preceding

paragraph. The expense in each period is impacted by the change in

the price of RCI’s Class B Non-Voting shares during the life of the

option.

NEW ACCOUNTING STANDARDS

IFRS 7, Financial Instruments: Disclosures

In October 2010, the IASB amended IFRS 7, Financial Instruments:

Disclosures (“IFRS 7”). This amendment enhances disclosure

requirements to aid financial statement users in evaluating the nature

of, and risks associated with an entity’s continuing involvement in

derecognized financial assets. This amendment was effective for our

interim and annual consolidated financial statements commencing

January 1, 2012, and was applied prospectively. There was no impact

to the consolidated financial statements upon adoption.

IAS 12, Deferred Tax: Recovery of Underlying Assets

In December 2010, the IASB amended IAS 12, Deferred Tax: Recovery

of Underlying Assets (“IAS 12”). IAS 12 includes a rebuttal

presumption which determines that the deferred tax on the

depreciable component of an investment property measured using

the fair value model from IAS 40, Investment Property should be

based on its carrying amount being recovered through a sale. The

standard has also been amended to include the requirement that

deferred tax on non-depreciable assets measured using the

revaluation model in IAS 16, Property, Plant and Equipment should be

measured on the sale basis. This new standard was effective for our

interim and annual consolidated financial statements commencing

January 1, 2012, and was applied prospectively. There was no impact

to the consolidated financial statements upon adoption.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 69