Rogers 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

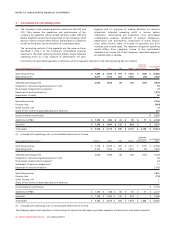

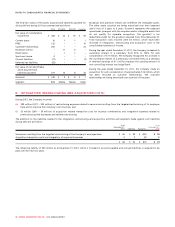

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

During the year ended December 31, 2011, the Company did not

record an impairment charge as the recoverable amounts of the

CGUs exceeded their carrying value.

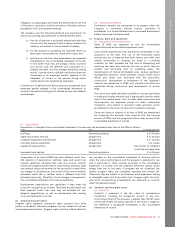

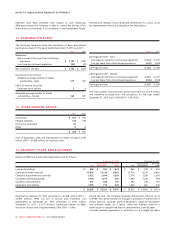

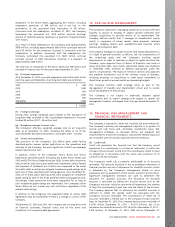

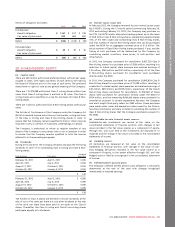

14. INVESTMENTS:

2012 2011

Carrying

value Carrying

value

Publicly traded companies $ 624 $ 850

Private companies 231 36

Investments in joint ventures and associates 629 221

$ 1,484 $ 1,107

(a) Private companies:

In October 2012, Media completed the purchase of 100% of the

outstanding shares of Score Media Inc. for $167 million. The shares of

Score Media were transferred to an interim CRTC-approved trust

which is responsible for the independent management of the business

in the normal course of operations until CRTC final approval is

obtained, at which point control over theScore Media business will

transfer to Rogers. Score Media owns theScore Television Network, a

national specialty TV service providing sports news, information,

highlights and live event programming across Canada. Upon final

regulatory approval, which is anticipated in the first half of 2013,

Rogers will wholly own and control theScore Television Network and

its related television assets and expects to rebrand the service under

the Sportsnet brand.

(b) Investments in joint ventures and associates companies:

In August 2012, the Company, along with BCE Inc., closed the joint

acquisition of a net 75% equity interest in Maple Leaf Sports &

Entertainment Ltd. (“MLSE”) from the Ontario Teachers’ Pension Plan.

MLSE is one of Canada’s largest sports and entertainment companies

which owns and operates the Air Canada Centre, the NHL’s Toronto

Maple Leafs, the NBA’s Toronto Raptors, the MLS’ Toronto FC, the

AHL’s Toronto Marlies and other assets. The Company’s net cash

investment, following a leveraged recapitalization of MLSE, was $540

million, representing a 37.5% equity interest in MLSE. The investment

in MLSE is accounted for using the equity method.

In December 2012, Inukshuk, a joint venture owned 50% by Rogers,

sold certain spectrum licenses and network equipment to its owners

at fair market value. Rogers and the other non-related venturer each

purchased 50% of the assets having a fair market value of $1,181

million and a carrying value of $250 million. As a result, Rogers

recorded:

• A gain on investment of $233 million representing Rogers 50%

share of the Inukshuk gain relating to the assets sold to the other

non-related venturer;

• Spectrum licences of $360 million, which includes a $15 million fee

paid in 2011 to the other non-related venturer to acquire certain

blocks of spectrum, and network equipment of $13 million

representing the fair value of the assets purchased less Rogers

share of the Inukshuk gain; and

• A decrease of $125 million in its investment in Inukshuk

representing the carrying value of the assets sold.

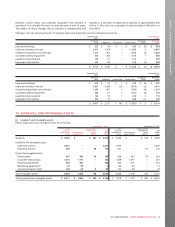

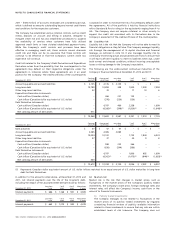

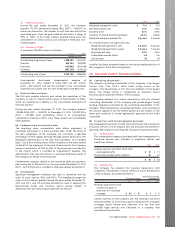

The following presents the summarized financial information of the

Company’s portion of joint ventures that are recorded by the

Company as investments accounted for using the equity method:

2012 2011

Statements of financial position:

Assets $ 1,100 $ 231

Liabilities 616 59

Net assets 484 172

2012 2011

Statements of income:

Revenues $85 $68

Expenses 81 62

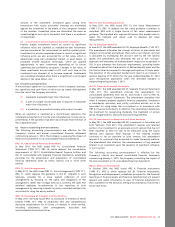

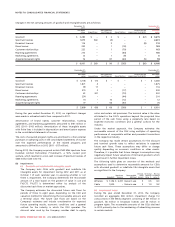

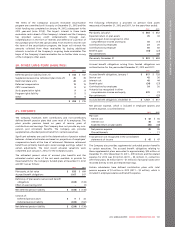

15. OTHER LONG-TERM ASSETS:

2012 2011

Indefeasible right of use agreements $24 $25

Long-term receivables 19 16

Cash surrender value of life insurance 16 15

Deferred installation costs 13 12

Deferred pension asset (note 21) 933

Deferred compensation 910

Other 823

$98 $ 134

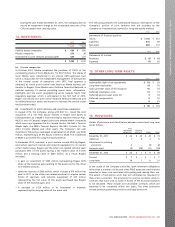

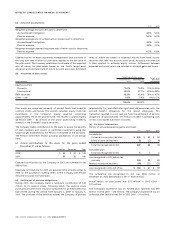

16. PROVISIONS:

Details of provisions and classification between current and long-term

are as follows:

Asset

retirement

obligations Onerous

contracts Other Total

December 31, 2011 $ 26 $ 24 $ 23 $ 73

Additions 1 5 3 9

Adjustment to existing

provisions 2 – (4) (2)

Amounts used (3) (28) (11) (42)

December 31, 2012 $ 26 $ 1 $ 11 $ 38

Current $ 7 $ – $ – $ 7

Long-term 19 1 11 31

In the course of the Company’s activities, asset retirement obligations

arise when a number of sites and other PP&E assets are used that are

expected to have costs associated with exiting and ceasing their use.

The extent of restoration work that will ultimately be required for

these sites is uncertain. The provisions for onerous contracts relate to

contracts that have costs to fulfill in excess of the economic benefits

to be obtained. These include non-cancellable contracts, which are

expected to be completed within two years. The other provisions

include product guarantee provisions and legal provisions.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 101