Rogers 2012 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

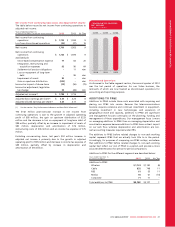

Finance Costs

The finance costs are as follows:

Years ended December 31,

(In millions of dollars) 2012 2011 % Chg

Interest on long-term debt $ (691) $ (668) 3

Loss on repayment of long-term debt –(99) n/m

Foreign exchange (loss) gain 9(6) n/m

Change in fair value of derivative

instruments (1) 14 n/m

Capitalized interest 28 29 (3)

Other (9) (8) 13

Total finance costs $ (664) $ (738) (10)

The $23 million increase in interest expense during 2012 reflects a

comparative increase in the principal amount of long-term debt

partially offset by the comparative decrease in the weighted average

interest rate on long-term debt compared to the previous year. The

change in principal and weighted-average interest rate primarily

reflects the refinancing activities completed in the second quarter of

2012. See the section below “Liquidity and Capital Resources”.

During 2011, we recorded a loss upon the early repayment of long-

term debt of $99 million, consisting of: (i) redemption premiums of

$76 million related to the redemption of two public debt issues; (ii) a

net loss on the termination of the related cross-currency interest rate

exchange agreements (“Debt Derivatives”) of $22 million; and (iii) a

write-off of deferred transaction costs of $2 million. This was partially

offset by a gain of $1 million relating to the non-cash write-down of

the fair value increment of long-term debt. (See the section below

“Debt Issuances and Redemptions”)

During 2012, the Canadian dollar strengthened by 2.2 cents versus the

U.S. dollar, resulting in a foreign exchange gain of $9 million,

primarily related to our US$350 million of Senior Notes due 2038 for

which the associated Debt Derivatives have not been designated as

hedges for accounting purposes. Much of this foreign exchange gain

is offset by the coincident change in the fair value of the associated

Debt Derivatives as discussed below. During 2011, the Canadian dollar

weakened by 2.2 cents versus the U.S. dollar, resulting in a foreign

exchange loss of $6 million, primarily related to our US$350 million of

Senior Notes due 2038 for which the associated Debt Derivatives have

not been designated as hedges for accounting purposes.

The expense for the change in the fair value of derivative instruments

during 2012 was primarily the result of (i) a non-cash gain on the

change in fair value of the Debt Derivatives hedging our US$350

million Senior Notes due 2038 that have not been designated as

hedges for accounting purposes combined with (ii) a non-cash loss

pertaining to an estimate of the relative hedge ineffectiveness of

Debt Derivatives that have been designated as hedges for accounting

purposes.

Other Income, Net

Other income of $15 million in 2012 was primarily associated with

investment income and expenses from certain investments, compared

to income of $1 million in 2011.

Share of the Income of Associates and Joint Ventures

During 2012, we acquired certain 2500 MHz spectrum from Inukshuk,

a 50% owned joint venture. As a result, we recorded a gain of $233

million, being the portion of the gain that related to the spectrum

licences sold to the non-related venturer. The remaining income of

$2 million was primarily due to our equity interest in various

investments, offset by the equity loss in MLSE.

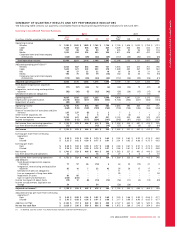

Income Tax Expense

Our effective income tax rate for 2012 and 2011 was 26.4% and

25.5%, respectively. The 2012 effective income tax rate did not differ

from the 2012 statutory income tax rate of 26.4%. This is primarily

due to several offsetting adjustments to our 2012 tax expense. The

most significant favourable adjustments resulted from the realization

of capital gains, only 50% of which are taxable, and the utilization of

losses that were not previously recognized. These amounts were

offset by a tax charge relating to the revaluation of our net deferred

tax liability to reflect an increase in tax rates and adjustments in

respect of non-deductible expenses.

The 2011 effective income tax rate was less than the 2011 statutory

income tax rate of 28.0%, primarily due to income tax recoveries of

$28 million and $31 million relating to tax rate changes.

In 2012, we paid $380 million in income taxes, up from $99 million in

the previous year. With respect to cash income tax payments as

opposed to accounting income tax expense, we utilized substantially

all of our remaining non-capital income tax loss carryforwards in

2012. This combined with legislative changes to eliminate the deferral

of partnership income led to the sizeable increase last year in our cash

income tax payment, a trend we estimate will continue during 2013

as detailed in the section “2013 Financial Outlook and Targets”. While

both of these items impact the timing of cash taxes, neither is

expected to have a material impact on our income tax expense for

accounting purposes.

Income tax expense varies from the amounts that would be computed

by applying the statutory income tax rate to income before income

taxes for the following reasons:

Years ended December 31,

(In millions of dollars, except tax rate) 2012 2011

Statutory income tax rate 26.4% 28.0%

Income before income taxes $ 2,352 $ 2,135

Computed income tax expense $ 621 $ 598

Increase (decrease) in income taxes resulting

from:

Recognition of previously unrecognized

deferred tax assets (22) (12)

Non-taxable portion of capital gains (61) –

Revaluation of deferred tax balances due

to legislative changes 54 (28)

Tax rate differential on origination and

reversal of temporary differences –(31)

Impairment on goodwill and intangible

assets 11 –

Stock-based compensation 94

Other items 814

Income tax expense $ 620 $ 545

Effective income tax rate 26.4% 25.5%

46 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT