Rogers 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

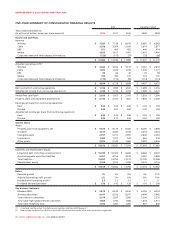

Average Revenue per User Calculations – Wireless

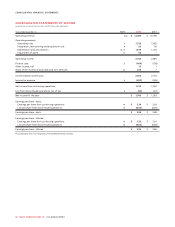

Years ended December 31,

(In millions of dollars, subscribers in thousands, except

ARPU figures) 2012 2011

Postpaid ARPU (monthly)

Postpaid (voice and data) revenue $ 6,402 $ 6,275

Divided by: average postpaid wireless

voice and data subscribers 7,698 7,443

Divided by: twelve months for the year 12 12

$ 69.30 $ 70.26

Prepaid ARPU (monthly)

Prepaid (voice and data) revenue $ 317 $ 326

Divided by: average prepaid subscribers 1,667 1,695

Divided by: twelve months for the year 12 12

$ 15.84 $ 16.02

Blended ARPU (monthly)

Voice and data revenue $ 6,719 $ 6,601

Divided by: average wireless voice and

data subscribers 9,365 9,138

Divided by: twelve months for the year 12 12

$ 59.79 $ 60.20

Operating Expenses

Operating expenses are segregated into two categories for assessing

business performance:

• Cost of equipment sales; and

• Other operating expenses.

In the Wireless and Cable industries in Canada, the demand for

services continues to grow, and the variable costs, such as

commissions paid for subscriber activations, as well as the fixed costs

of acquiring new subscribers, are significant. Fluctuations in the

number of activations of new subscribers from period-to-period and

the seasonal nature of both wireless and cable subscriber additions

result in fluctuations in sales- and marketing-related expenses and

accordingly, in the overall level of operating expenses. In our Media

business, sales and marketing related expenses may be significant to

promote publishing, radio and television properties, which in turn

attract advertisers, viewers, listeners and readers.

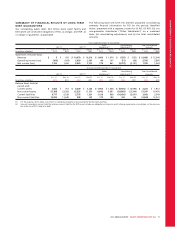

Capital Intensity

Capital intensity provides a comparative basis on the level of PP&E

additions within the industry. It is computed as the total additions to

PP&E divided by the total operating revenue. In case of Wireless,

capital intensity represents the total additions to PP&E divided by the

total network revenue.

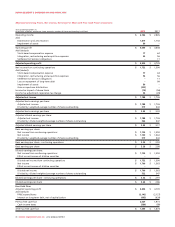

Non-GAAP Measures

We have included certain non-GAAP financial measures that we

believe provide useful information to management and readers of

this MD&A in measuring our financial performance. These measures,

which include operating profit, operating profit margin, adjusted

operating profit, adjusted operating profit margin, adjusted net

income, adjusted basic and diluted earnings per share and free cash

flow, do not have a standardized meaning under GAAP and,

therefore, may not be comparable to similarly titled measures

presented by other publicly traded companies, nor should they be

construed as an alternative to other financial measures determined in

accordance with GAAP.

We believe that these non-GAAP financial measures may provide for a

more effective analysis of our operating performance. These measures

are also used by investors and lending institutions as an indicator of

our operating performance, our ability to incur and service debt, and

as a valuation metric. In addition, the items mentioned in the

preceding paragraph could potentially distort the analysis of trends

due to the fact that they are volatile and can vary widely from

company to company, thereby impairing comparability. The exclusion

of these items does not mean that they are unusual, infrequent or

non-recurring.

We use these non-GAAP measures internally to make strategic

decisions, forecast future results and evaluate our performance from

period to period and compare to forecasts on a consistent basis. We

believe that these measures present trends that are useful in

managing our business and in allowing investors and analysts to

assess the underlying changes in our business over time.

Operating Profit and Operating Profit Margin

We define operating profit as net income from continuing operations

before depreciation and amortization, income taxes and non-

operating items, which include finance costs (such as interest on long-

term debt, loss on repayment of long-term debt, foreign exchange

gains (losses), change in fair value of derivative instruments,

capitalized interest and amortization of deferred transaction costs),

impairment of assets, share of income in associates and joint ventures

and other income. Operating profit is a standard measure used in the

communications industry to assist in understanding and comparing

operating results and is often referred to by our peers and

competitors as EBITDA (earnings before interest, taxes, depreciation

and amortization) or OIBDA (operating income before depreciation

and amortization). We believe this is an important measure, as it

allows us to assess our ongoing businesses without the impact of

depreciation or amortization expenses as well as non-operating

factors. It is intended to indicate our ability to incur or service debt

and invest in PP&E and allows us to compare the Company to our

peers and competitors who may have different capital or

organizational structures. This measure is not a defined term under

IFRS.

74 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT