Rogers 2012 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Media Operating Expenses

Media’s operating expenses mainly consist of: (i) the cost of retail

products sold by The Shopping Channel and Sports Entertainment;

(ii) broadcast content costs; (iii) Blue Jays player payroll; and (iv) other

expenses incurred to operate the business on a day-to-day basis.

Media’s operating costs decreased modestly from 2011. This was due

to lower publishing costs, lower sports programming costs and

significant cost efficiencies achieved across most of Media’s divisions.

The lower sports programming costs were primarily related to the

NHL player lockout, as no NHL games were produced or aired during

the first half of the 2012-2013 season. The decreased costs were

partially offset by planned increases in conventional television

programming, as Media continues to secure rights to premium and

exclusive content on its broadcast and digital platforms to improve

audience ratings in key demographics. Excluding the impact of the

NHL player lockout, operating expenses would have increased by

approximately 3% year-over-year.

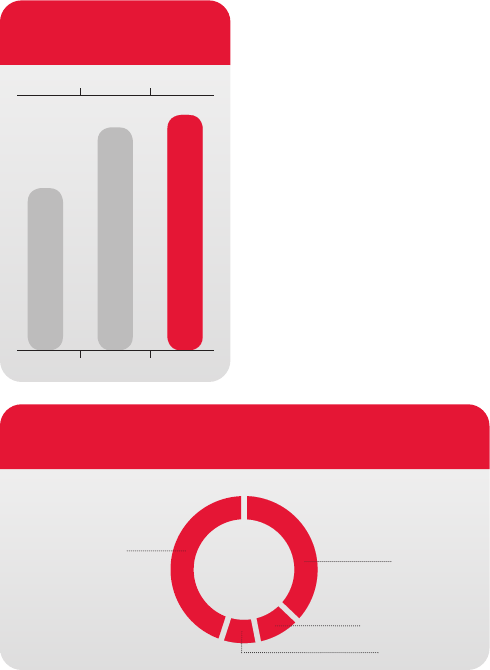

Media Adjusted Operating Profit

The increase in Media’s adjusted operating profit for 2012, compared

to 2011, primarily reflects the revenue and expense changes discussed

in the preceding sections, including an estimated $30 million of net

positive impact of the NHL player lockout.

(In millions of dollars)

MEDIA ADJUSTED

OPERATING PROFIT

$131 $180 $190

2010 2011 2012

(%)

2012 MEDIA ADJUSTED OPERATING PROFIT MIX

TELEVISION 43%

RADIO 35%

$0.19

BILLION

PUBLISHING 13%

CHANNEL 9%

THE SHOPPING

Media Acquisitions

In October 2012, Media completed the purchase of 100% of the

outstanding shares of Score Media Inc. for $167 million. The shares of

Score Media were transferred to an interim CRTC-approved trust

which is responsible for the independent management of the business

in the normal course of operations until CRTC final approval is

obtained, at which point control over theScore Media business will

transfer to Rogers. Score Media owns theScore Television Network, a

national specialty TV service providing sports news, information,

highlights and live event programming across Canada. Upon final

regulatory approval, which is anticipated in the first half of 2013,

Rogers will wholly own and control theScore Television Network and

its related television assets, and expects to rebrand it under the

Sportsnet brand.

On February 4, 2013, Media closed the agreement to acquire Metro14

Montreal for approximately $10 million.

Other Media Developments

The Toronto Blue Jays made several off-season all-star calibre player

acquisitions and other moves that will significantly boost the team’s

depth. The 2012 season demonstrated a renewed appetite for

baseball in the city of Toronto, with increased ticket sales,

merchandise sales and viewership. The growing revenue helped

enable the off-season investments, which are consistent with Rogers

Media’s sports-focused strategy to significantly improve game

attendance, merchandising and Sportsnet ratings.

VIDEO

As of June 2012, Rogers’ retail stores no longer rent or sell DVDs and

games and now focus exclusively on sales and service relating to

Rogers’ wireless and cable products. The second quarter of 2012 was

the last period for operations of the Video sub-segment of the Cable

segment, with the remnants of that business now treated as

discontinued operations for accounting and reporting purposes.

CORPORATE

Acquisitions and New Initiatives

In an ongoing effort to maximize subscribers, operating profit and

return on invested capital as part of our strategy to be Canada’s

leading diversified communications and media company, Rogers

initiated or completed the following acquisitions and initiatives

during 2012:

> Investment in Maple Leaf Sports & Entertainment

On August 22, 2012, along with BCE Inc., we closed the joint

acquisition of a net 75% equity interest in MLSE from the Ontario

Teachers’ Pension Plan. MLSE is one of Canada’s largest sports and

entertainment companies which owns and operates the Air Canada

Centre, the NHL’s Toronto Maple Leafs, the NBA’s Toronto Raptors,

the MLS’ Toronto FC, the AHL’s Toronto Marlies and other real estate

and entertainment assets. Rogers’ net cash investment was $540

million, representing a 37.5% equity interest in MLSE.

> Banking Licence

In 2011, we applied for a banking licence as required under the

federal Bank Act to enable Rogers to engage in credit card and other

mobile payment services. During 2012, key management with

extensive experience in credit card operations joined the company

and third party vendors were selected to support the operations. We

expect to receive our licence from the Office of the Superintendent of

Financial Institutions (OSFI) in mid-2013.

> Rogers Smart Home Monitoring

Rogers Smart Home Monitoring is an advanced real-time home

monitoring, automation and security service. It allows for remote

access, monitoring and control from Internet-connected computers

and smartphones, as well as real-time alerts and remote viewing.

Rogers is in the early stage of developing and deploying this product.

The product is generally marketed and installed by Cable.

44 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT