Rogers 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

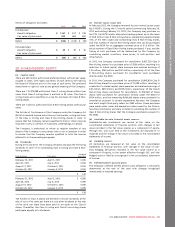

27. SUBSEQUENT EVENTS:

(a) On January 14, 2013 the Company announced a multipart

strategic transaction with Shaw Communications (“Shaw”) to

acquire Shaw’s cable system in Hamilton, Ontario and secure an

option to purchase Shaw’s Advanced Wireless Services (“AWS”)

spectrum holdings in 2014. The Company is also to sell Rogers’

one-third interest in specialty channel TVtropolis to Shaw and

enters into negotiations with Shaw for the provision of certain

services in Western Canada. Rogers’ net cash investment is

expected to total approximately $700 million if all aspects of the

transactions are approved.

(b) In February 2013, the Company filed a notice with the TSX of its

intention to renew its prior NCIB for a further one-year period.

Subject to acceptance by the TSX, the TSX notice provides that

the Company may, during the twelve-month period commencing

February 25, 2013 and ending February 24, 2014, purchase on

the TSX, the NYSE and/or alternate trading systems up to the

lesser of 35.8 million Class B Non-Voting shares, representing

approximately 10% of the issued and outstanding Class B Non-

Voting shares, and that number of Class B Non-Voting shares

that can be purchased under the NCIB for an aggregate

purchase price of $500 million. The actual number of Class B

Non-Voting shares purchased, if any, and the timing of such

purchases will be determined by the Company considering

market conditions, share prices, its cash position, and other

factors.

(c) In February 2013, the Company’s Board increased the annualized

dividend rate from $1.58 to $1.74 per Class A Voting and Class B

Non-Voting share effective immediately to be paid in quarterly

amounts of $0.435 per share. Such quarterly dividends are

payable only as and when declared by the Board and there is no

entitlement to any dividends prior thereto.

In addition, on February 14, 2013, the Board declared a quarterly

dividend totalling $0.435 per share on each of its outstanding

Class A Voting and Class B Non-Voting shares, such dividend to

be paid on April 2, 2013, to shareholders of record on March 15,

2013, and is the first quarterly dividend to reflect the newly

increased $1.74 per share annual dividend level.

(d) On January 14, 2013 the Company received initial funding on

the accounts receivable securitization program of $400 million

(note 19(f)).

114 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT