Rogers 2012 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

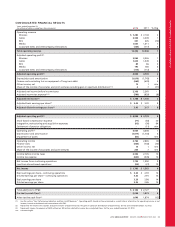

MANAGEMENT’S DISCUSSION AND ANALYSIS

RBS Operating and Financial Results

Summarized RBS Financial Results

RBS’ total operating revenue declined due to the continued planned

exit of the legacy business. However, operating expenses were

reduced for the same reason, as well as a result of our strategic cost

management and productivity improvement initiatives; which

enabled RBS to deliver a year-over-year increase in adjusted operating

profit.

Years ended December 31,

(In millions of dollars, except margin) 2012 2011(1) % Chg

Operating revenue

Next generation $ 162 $ 128 27

Legacy 183 271 (32)

Service revenue 345 399 (14)

Equipment sales 66–

Total operating revenue 351 405 (13)

Operating expenses (262) (319) (18)

Adjusted operating profit(2) $89$86 3

Adjusted operating profit margin(2) 25.4% 21.2%

Additions to PP&E $61$55 11

(1) The operating results of Atria Networks LP are included in the RBS results of

operations from the date of its acquisition on January 4, 2011.

(2) As defined. See the section “Key Performance Indicators and Non-GAAP

Measures”.

RBS Operating Highlights for 2012

RBS continues to focus on achieving our strategic objectives as

discussed earlier and noted the following operating highlights for the

year ended December 31, 2012:

• Underlying the 13% year-over-year overall decline in RBS revenues

was a strong 27% growth of revenue associated with the on-net

and next generation IP-based services portions of the business. This

shift to higher margin on-net services enabled RBS to generate 3%

growth in adjusted operating profit while expanding adjusted

operating profit margins by 420 basis points year-over-year.

• RBS announced the availability of SIP Trunking, a new IP-based

voice solution for enterprises designed to complement its fibre-

based Internet and WAN connectivity services. By merging voice

services with a business data network, SIP Trunking solutions

dynamically allocate bandwidth as needed to support voice and/or

data needs depending upon capacity requirements during peak

hours and also provide a platform for next generation IP-based

video, mobile and productivity applications and services.

RBS Revenue

RBS’ revenues are generated from telephony, data networking and

access services used by enterprise and government customers, and the

sale of services on a wholesale basis to other telecommunications

carriers.

The year-over-year decrease in RBS’ revenue for the year ended

December 31, 2012 largely reflects the planned decline in certain

categories of the lower margin off-net legacy business, offset by

continued strong growth in the next generation IP and other on-net

services. RBS’ focus is primarily on IP-based services and increasingly

on leveraging higher margin on-net and near-net revenue

opportunities utilizing its own and Cable’s network facilities to

expand offerings to the medium and large-sized enterprise, public

sector and carrier markets. The lower margin off-net legacy business,

which includes long distance, local and certain legacy data services,

continues to decline as expected and was down 32% year-over-year.

In comparison, the higher margin next generation business was up

27% year-over-year.

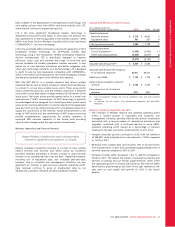

Next Generation Legacy

271183

128162

20122011

(In millions of dollars)

RBS SERVICE

REVENUE MIX

RBS Operating Expenses

RBS’ operating expenses consist of: (i) telecom and data networking

equipment costs; and (ii) all other expenses incurred to operate the

business on a day-to-day basis, service existing customer relationships

and attract new subscribers.

Operating expenses decreased last year as a result of a planned

decrease in the legacy service-related costs (e.g., lower leased facility

costs), lower volumes and customer support-related spending levels,

and strategic initiatives to improve RBS’ cost structure and

productivity. RBS continues to implement permanent cost

management and efficiency improvement initiatives to control its

overall cost structure.

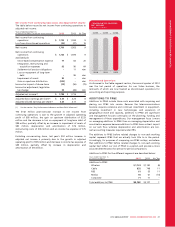

RBS Adjusted Operating Profit

The year-over-year growth in adjusted operating profit reflects RBS’

focus on growing its on-net next generation data revenue. This

strategic shift has more than offset the planned declines in the lower

margin legacy voice and data services. Cost reductions and efficiency

initiatives across various functions have also contributed to higher

operating profit margins.

(In millions of dollars)

RBS ADJUSTED OPERATING

PROFIT

$40 $86 $89

2010 2011 2012

42 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT