Rogers 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

> OutRank

We announced the exclusive availability of OutRank in Canada, a

new, best-in-class online marketing solution for small businesses

currently without a web presence. With OutRank, local businesses can

easily get a website, paid search marketing, search engine

optimization and a performance dashboard, all for an affordable

price. The service helps small businesses generate inbound phone calls

and e-mails by marketing them online where consumers are searching

for their services. OutRank was selected by Google to join the

AdWords Premier SMB Partner Program, the first Canadian-owned

and operated company in the program.

CONSOLIDATED ANALYSIS

We review the results of the following items below adjusted

operating profit on a consolidated basis.

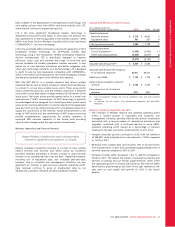

Years ended December 31,

(In millions of dollars) 2012 2011 % Chg

Adjusted operating profit(1) $ 4,834 $ 4,739 2

Stock-based compensation expense (77) (64) 20

Integration, restructuring and

acquisition expenses (92) (56) 64

Settlement of pension obligations –(11) n/m

Operating profit(1) 4,665 4,608 1

Depreciation and amortization (1,819) (1,743) 4

Impairment of assets (80) – n/m

Operating income 2,766 2,865 (3)

Finance costs (664) (738) (10)

Other income, net 15 1 n/m

Share of the income of associates

and joint ventures 235 7 n/m

Income before income taxes 2,352 2,135 10

Income tax expense (620) (545) 14

Net income from continuing

operations 1,732 1,590 9

Loss from discontinued operations (32) (27) 19

Net income $ 1,700 $ 1,563 9

(1) As defined. See the section “Key Performance Indicators and Non-GAAP

Measures”.

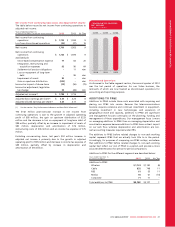

Adjusted Operating Profit

As discussed above, the adjusted operating profit in Wireless, Cable,

RBS and Media increased for 2012 compared to 2011. For discussions

of the results of operations of each of these segments, refer to the

respective segment discussions.

Consolidated adjusted operating profit climbed to $4,834 million,

from $4,739 million in the prior year. These amounts for 2012 and

2011, respectively, exclude: (i) stock-based compensation expense of

$77 million and $64 million; (ii) integration, restructuring and

acquisition expenses of $92 million and $56 million; and

(iii) settlement of pension obligations of $nil and $11 million.

Stock-Based Compensation

The year-over-year increase in our stock-based compensation is

primarily attributable to the rise in the RCI.b stock price on the

Toronto Stock Exchange (“TSX”), which is used in determining the fair

value of our stock-based compensation liability at year-end.

Stock-based compensation expense increased to $77 million, from $64

million in 2011, mainly related to the stock price increase of $5.91

during 2012. The expense in a given period is generally determined

by the vested options and units valued at the current market price.

Approximately $47 million of the expense was related to the change

in market value of RCI stock compared to December 31, 2011.

At December 31, 2012, we had a liability of $195 million (2011 – $194

million) related to stock-based compensation recorded at its fair

value, including stock options, restricted share units and deferred

share units. During 2012, $76 million (2011 – $45 million) was paid to

holders of stock options, restricted share units and deferred share

units upon exercise. All of the stock option exercises were executed at

the election of the option holders through the exercise of the

optional share appreciation right (“SAR”) feature. We may use

derivative instruments from time to time to manage our exposure to

market-based fluctuations in our stock-based compensation expense.

Integration, Restructuring and Acquisition Expenses

During 2012, we incurred $92 million of integration, restructuring

and acquisition expenses associated with initiatives aimed at

improving our cost structure related to: (i) severance costs associated

with the targeted restructuring of our employee base ($89 million);

and (ii) acquisition transaction costs incurred and the integration costs

of acquired businesses ($3 million).

During 2011, we incurred $56 million of integration, restructuring

and acquisition expenses associated with initiatives to improve our

cost structure related to: (i) severance costs associated with the

targeted restructuring of our employee base ($42 million);

(ii) acquisition transaction costs incurred and the integration of

acquired businesses ($4 million); and (iii) the closure of certain retail

stores and lease exit costs ($10 million).

Settlement of Pension Obligations

During 2011, we incurred a non-cash loss from the settlement of

pension obligations of approximately $11 million resulting from a

lump-sum contribution of approximately $18 million to our pension

plans, following which the pension plans purchased approximately

$68 million of annuities from insurance companies for all employees

who had retired between January 1, 2009 and January 1, 2011. See

the section below “Pension Plans Purchase of Annuities”.

Depreciation and Amortization Expense

The year-over-year increase in depreciation and amortization reflects

an increase in depreciation on PP&E that is largely related to the

acceleration of depreciation on certain network transmission assets

and the timing of readiness of certain network and system initiatives,

including the launch of our LTE network in various municipalities. This

was mostly offset by a decrease in depreciation expense of $90 million

due to an increase in the estimated useful life made in July 2012 of

certain network and information technology assets.

Impairment of Assets

Late in 2012, we recorded an $80 million impairment charge in the

Media segment, consisting of $67 million in goodwill, $8 million in

broadcast licences and $5 million in program rights, using a

combination of value in use and fair value less costs to sell

methodologies with pre-tax discount rates of approximately 10%. The

recoverable amounts of the cash generating units declined in 2012

primarily due to the weakening of advertising revenue in certain

markets. There was no impairment of assets during 2011.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 45