Rogers 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

MEDIA

Media Industry Trends

> Increased Competition

The Canadian media industry is highly-competitive, with a small

number of competitors having significant scale and financial

resources. In recent years, there has been increased consolidation of

traditional media assets across the Canadian media landscape. The

majority of players have become more vertically integrated to better

enable the acquisition and monetization of premium content.

Consumers have also been shifting their media consumption towards

digital media, mobile device usage and on-demand content. This has

caused new business models to emerge and advertisers to shift

portions of their spending to digital platforms.

Media’s ongoing success depends, among other things, on its ability

to secure popular broadcasting programs and content at favourable

prices; to maintain its high distribution level within the publishing

industry; to leverage its premium content, brands and capabilities

across multiple platforms; to adapt to and participate in the shift

towards digital advertising; and to leverage its leadership in sports

broadcasting.

The Canadian retail industry is inherently cyclical and subject to

recessionary pressures. Media’s televised shopping network faces

direct competition with traditional retail stores, catalogue retailers,

Internet retailers, direct marketing retailers, mail order companies

and other discount retailers. There is also a rapidly growing consumer

trend towards online shopping, which has been a historic strength of

Media’s televised shopping network. A rising number of traditional

retailers now offer online shopping options, further intensifying

competition in the sector.

The success of the Sports Entertainment business depends heavily on

team performance and fan-based loyalty. Media competes with other

professional league teams for fan-base and audience.

Media Operating and Financial Results

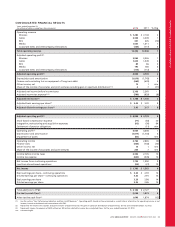

Summarized Media Financial Results

The following table summarizes Media’s financial results in the years

ended December 31, 2012 and 2011.

Years ended December 31,

(In millions of dollars, except margin) 2012 2011 % Chg

Operating revenue $ 1,620 $ 1,611 1

Operating expenses (1,430) (1,431) –

Adjusted operating profit(1) $ 190 $ 180 6

Adjusted operating profit margin(1) 11.7% 11.2%

Additions to PP&E $55$ 61 (10)

(1) As defined. See the section “Key Performance Indicators and Non-GAAP

Measures”.

Media Operating Highlights for 2012

• Media launched the City Saskatchewan television station following

the acquisition of Saskatchewan Communications Network,

marking another step in City’s geographic expansion towards a

national footprint. Media also announced that City and Jim

Pattison Broadcast Group signed long-term affiliate agreements

that will deliver City programming to audiences on all three of

Pattison’s television stations in western Canada.

• On February 4, 2013, Media closed the agreement to acquire Metro

14 Montreal and the station was relaunched as City Montreal,

which will enable the further expansion of the City broadcast TV

network into the largest portion of the Quebec market. With the

acquisitions and agreements put in place during 2012, City’s reach

has increased by more than 20% to over 80% of Canadian

households.

• Media closed the acquisition of theScore Television Network and

related television assets into a trust pending final approval from

the CRTC. theScore is a national specialty TV service that provides

sports news, information, highlights and live event programming.

It is Canada’s third-largest specialty sports channel with 6.6 million

television subscribers. The acquisition builds on Rogers’ rich history

in sports broadcasting and reinforces our commitment to delivering

premium sports content to audiences on their platform of choice.

Subject to final regulatory approval from the CRTC, which is

anticipated early in the first half of 2013, the television network

will be rebranded under the Sportsnet umbrella.

• Media advanced Rogers’ strategy of delivering highly sought-after

sports content anywhere, anytime, on any platform by

strengthening the value of its sports brand, Sportsnet, which is

further enhanced by Rogers’ 37.5% investment in MLSE.

• The Toronto Blue Jays made several off-season all-star calibre

player acquisitions and other moves that significantly boost the

team’s depth.

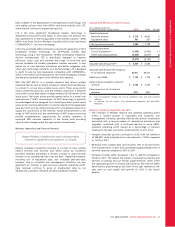

Media Revenue

Media’s revenue mainly consists of: (i) advertising revenue;

(ii) circulation revenue; (iii) subscription revenue; (iv) retail product

sales; and (v) ticket sales, receipts of MLB revenue sharing and

concession sales associated with Rogers Sports Entertainment.

Media’s revenue increased modestly from 2011, primarily driven by

revenue growth in our sports properties. Subscription revenue

increased by 10% due to the strength of the Sportsnet franchise and

overall distribution growth on our other specialty channels. In

addition, revenue in Sports Entertainment grew 17% as a result of

increased revenue related to the Toronto Blue Jays and successful

events at the Rogers Centre. These increases were partially offset by a

continued slow-growing advertising market across most industry

sectors in the face of economic softness and global uncertainty that

created ongoing volatility in advertising spending, as well as

advertising declines in the later part of the year associated with the

recently concluded NHL player lockout.

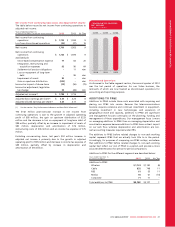

(In millions of dollars)

MEDIA REVENUE

$1,461 $1,611 $1,620

2010 2011 2012

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 43