Rogers 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

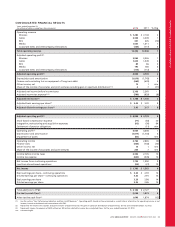

MANAGEMENT’S DISCUSSION AND ANALYSIS

Home Phone Revenue

Home Phone revenue includes revenues from residential and small

business local telephony service, calling features such as voicemail and

call waiting, and long-distance.

Home Phone revenue for 2012 was flat. An increase in our Home

Phone subscriber base and pricing changes were offset by the impact

of the divestiture of our legacy circuit switched telephony base and

operations, which occurred during 2011.

Cable telephony lines in service grew 2% last year, and by year-end

represented 49% of Television subscribers and 28% of the homes

passed by our cable networks, compared to 46% and 28%,

respectively, at the end of 2011.

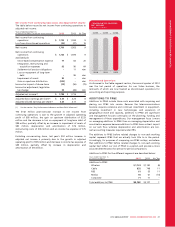

(In thousands)

CABLE TELEPHONY SUBSCRIBERS

AND PENETRATION

OF HOMES PASSED

1,003 1,052 1,074

2010 2011 2012

27% 28% 28%

Cable Equipment Sales

Equipment sales include revenues generated from the sale of digital

cable set-top terminals and Internet modems.

The year-over-year decrease in equipment revenue for 2012 reflects

the mix of sales versus rentals, as well as fewer digital cable gross

additions.

Cable Operating Expenses

Cable’s operating expenses are segregated into the following

categories for management’s assessment of business performance:

(i) cost of equipment sales, namely cable digital set-top box and

Internet modem equipment costs; (ii) programming costs; and (iii) all

other expenses incurred to operate the business on a day-to-day basis,

service existing subscriber relationships and attract new subscribers.

Cable’s operating expenses for 2012 were flat compared to 2011,

helped by strategic initiatives to improve our cost structure and

productivity and lower new subscriber additions, partially offset by

incremental retention costs and costs associated with the analog to

digital conversion. Cable continues to focus on implementing a

program of permanent cost reduction and efficiency improvement

initiatives to control the overall growth in operating expenses.

Cable Adjusted Operating Profit

The year-over-year growth in adjusted operating profit was driven by

the revenue increases, resulting in expanded adjusted operating

profit margins of 47.8% in 2012, compared to 46.8% in 2011.

RBS

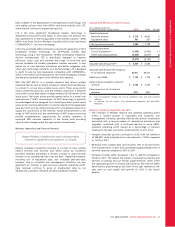

RBS Industry Trends

> Growth of Internet Protocol-Based Services

In the enterprise market, there is a continuing shift to IP-based based

services and a growing adoption of VoIP and cable telephony services

from time-division multiplexing (“TDM”) based protocols. Similarly,

there is a shift from asynchronous transfer mode (“ATM”) and frame

relay services to Ethernet IP-based services.

> Investment in Improved Networks and Expanded Service

Offerings

Over the past several years, carriers of all sizes have begun to lean

towards dismantling or significantly consolidating their TDM legacy

networks in favour of more reliable and scalable IP Next Generation

network platforms. Carriers are investing in networks to enable

service convergence of voice, data and video solutions all onto one

distribution and access network platform.

Traditionally, services that were separated across monolithic platforms

have been converging to IP and Ethernet and examples of such

applications have been proliferating across the industry. RBS launched

several such applications, including SIP voice services along with a

Virtual Call Centre service that allows end users to virtualize and

consolidate services over a single Ethernet and IP platform.

> Proliferation of Big Data

With the increased speed and reliability afforded by fibre-based

access services, in conjunction with cost effective and powerful on-

demand cloud computing resources, organizations are better

equipped than ever before to assemble and analyze incredibly large

volumes of data captured from a seemingly endless number of inputs.

This enables organizations to dramatically enhance the quality and

effectiveness of their business intelligence. This allows businesses to

analyze strategies and drive tactical decision making in real-time

throughout the organization, be it, for example, focusing sales and

resources to support micro-market strategies or improving customer

service and loyalty. The increased volume and detail of information

captured by organizations, and the rise of multimedia, social media,

and the Internet-based applications will drive exponential growth in

data demand for the foreseeable future.

> Data Centre Consolidation and Virtualization

The rapid change in data centre technologies, particularly regarding

power density, virtualization and security, has led to a changing

dynamic in the colocation market. Large enterprises and all levels of

government are undergoing dramatic transformations to consolidate

infrastructure to gain better efficiencies and scale in order to save

costs, simplify management and improve security and performance.

Recent data centre acquisitions in the carrier space have enabled far

greater breadth and depth of service offerings. Similarly, enterprise

solution requirements are moving into the physical and virtual realm

of data storage and hosting for advanced service offerings like IaaS,

SaaS, and Software Defined Networking (“SDN”).

The increasing acceptance in organizations to embrace and model

virtualization through the proliferation of cloud services will continue

to drive more advanced network functionality and require carriers to

develop robust, scalable services and supportive dynamic network

infrastructures.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 41