Rogers 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

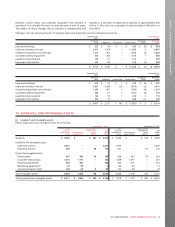

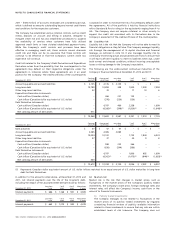

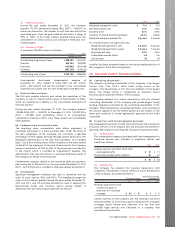

History of obligation and assets:

2012 2011 2010

Funded plan:

Benefit obligation $ 1,167 $ 817 $ 728

Fair value of plan assets 833 684 652

Deficit $ (334) $ (133) $ (76)

Unfunded plan:

Benefit obligation $45$39$36

Fair value of plan assets –––

Deficit $ (45) $ (39) $ (36)

22. SHAREHOLDERS’ EQUITY:

(a) Capital stock:

There are 400 million authorized preferred shares without par value,

issuable in series, with rights and terms of each series to be fixed by

the Board of Directors prior to the issue of such series. The preferred

shares have no rights to vote at any general meeting of the Company.

There are 112,474,388 authorized Class A voting shares without par

value. Each Class A voting share is entitled to 50 votes. The Class A

voting shares are convertible on a one-for-one basis into Class B Non-

Voting shares.

There are 1.4 billon authorized Class B Non-Voting shares without par

value.

The Articles of Continuance of the Company under the Company Act

(British Columbia) impose restrictions on the transfer, voting and issue

of the Class A Voting and Class B Non-Voting shares in order to

ensure that the Company remains qualified to hold or obtain licences

required to carry on certain of its business undertakings in Canada.

The Company is authorized to refuse to register transfers of any

shares of the Company to any person who is not a Canadian in order

to ensure that the Company remains qualified to hold the licences

referred to in the preceding paragraph.

(b) Dividends:

During 2012 and 2011, the Company declared and paid the following

dividends on each of its outstanding Class A Voting and Class B Non-

Voting shares:

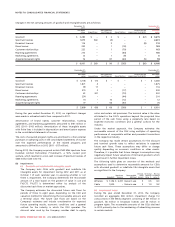

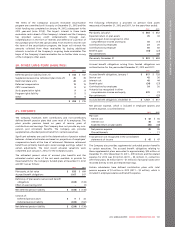

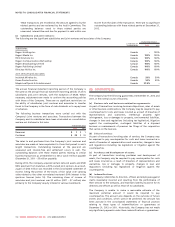

Date declared Date paid Dividend

per share

February 15, 2011 April 1, 2011 $ 0.355

April 27, 2011 July 4, 2011 0.355

August 17, 2011 October 3, 2011 0.355

October 26, 2011 January 4, 2012 0.355

$ 1.42

February 21, 2012 April 2, 2012 $ 0.395

April 25, 2012 July 3, 2012 0.395

August 15, 2012 October 3, 2012 0.395

October 24, 2012 January 2, 2013 0.395

$ 1.58

The holders of Class A shares are entitled to receive dividends at the

rate of up to five cents per share but only after dividends at the rate

of five cents per share have been paid or set aside on the Class B

shares. Thereafter, the Class A voting and Class B non-voting shares

participate equally as to dividends.

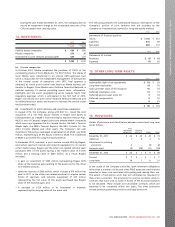

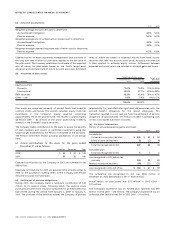

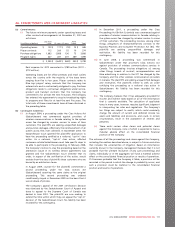

(c) Normal course issuer bid:

In February 2012, the Company renewed its prior normal course issuer

bid (“NCIB”). During the 12-month period commencing February 24,

2012 and ending February 23, 2013, the Company may purchase on

the TSX, the NYSE and/or alternative trading systems up to the lesser

of 36.8 million Class B Non-Voting shares, representing approximately

10% of the then issued and outstanding Class B Non-Voting shares,

and that number of Class B Non-Voting shares that can be purchased

under the NCIB for an aggregate purchase price of $1.0 billion. The

actual number of Class B Non-Voting shares purchased, if any, and the

timing of such purchases will be determined by the Company by

considering market conditions, share prices, its cash position, and

other factors.

In 2012, the Company purchased for cancellation 9,637,230 Class B

Non-Voting shares for a purchase price of $350 million, resulting in a

reduction to stated capital, share premium and retained earnings of

$10 million, $243 million and $97 million, respectively. All of the Class

B Non-Voting shares purchased for cancellation were purchased

directly under the NCIB.

In 2011, the Company purchased for cancellation 30,942,824 Class B

Non-Voting shares for a purchase price of $1,099 million, resulting in

a reduction to stated capital, share premium and retained earnings of

$30 million, $870 million and $199 million, respectively. Of the Class B

Non-Voting shares purchased for cancellation, 21,942,824 of these

shares were purchased for cancellation directly under the NCIB for

$814 million, and the remaining 9,000,000 shares were purchased for

cancellation pursuant to private agreements between the Company

and arm’s-length third-party sellers for $285 million. These purchases

were made under issuer bid exemption orders issued by the Ontario

Securities Commission and were included in calculating the number of

Class B Non-Voting shares that the Company purchased pursuant to

the NCIB.

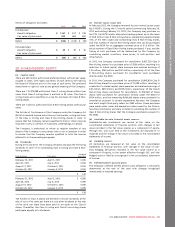

(d) Available-for-sale financial assets reserve:

Available-for-sale investments are carried at fair value on the

consolidated statements of financial position, with changes in fair

value recorded in the fair value reserve as a component of equity,

through OCI, until such time as the investments are disposed of or

impaired and the change in fair value is recorded in the consolidated

statements of income.

(e) Hedging reserve:

All derivatives are measured at fair value on the consolidated

statements of financial position, with changes in fair value of cash-

flow hedging derivatives recorded in the fair value reserve as a

component of equity, to the extent effective through OCI, until the

hedged asset or liability is recognized in the consolidated statements

of income.

(f) Defined benefit pension plans:

The Company’s defined benefit pension plan obligation is actuarially

determined at the end of the year with changes recognized

immediately in retained earnings.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 109