Rogers 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

6. ACCOUNTING POLICIES

This MD&A has been prepared with reference to our 2012 Audited

Consolidated Financial Statements and Notes thereto, which have

been prepared in accordance with IFRS. The Audit Committee of the

Board reviews our accounting policies, reviews all quarterly and

annual filings, and recommends approval of our annual financial

statements to the Board. For a detailed discussion of our accounting

policies, see Note 2 to our 2012 Audited Consolidated Financial

Statements. In addition, a discussion of new accounting standards

adopted by us and critical accounting estimates are discussed in the

sections “New Accounting Standards” and “Critical Accounting

Estimates”, respectively.

CRITICAL ACCOUNTING ESTIMATES

The preparation of our financial statements requires management to

make estimates and assumptions that affect the reported amounts of

assets, liabilities, revenues and expenses and the related disclosure of

contingent assets and liabilities. These estimates are based on

management’s experience and various other assumptions that are

believed to be reasonable under the circumstances, the results of

which form the basis for making judgments about the reported

amounts of assets, liabilities, revenue and expenses that are not

readily apparent from other sources. Actual results could differ from

those estimates. We believe that the accounting estimates discussed

following are critical to our business operations and an

understanding of our results of operations or may involve additional

management judgment due to the sensitivity of the methods and

assumptions necessary in determining the related asset, liability,

revenue and expense amounts.

Allowance for Doubtful Accounts

A significant portion of our revenue is earned from selling on credit

to individual consumers and business customers. The allowance for

doubtful accounts is calculated by taking into account factors such as

our historical collection and write-off experience, the number of days

the customer is past due and the status of the customer’s account

with respect to whether or not the customer is continuing to receive

service. As a result, fluctuations in the aging of subscriber accounts

will directly impact the reported amount of bad debt expense. For

example, events or circumstances that result in a deterioration in the

aging of subscriber accounts will in turn increase the reported

amount of bad debt expense. Conversely, as circumstances improve

and customer accounts are adjusted and brought current, the

reported bad debt expense will decline.

Determining the Fair Values of Assets Acquired and Liabilities

Assumed

The determination of the fair values of the tangible and intangible

assets acquired and the liabilities assumed in an acquisition involves

considerable judgment. Among other things, the determination of

these fair values involves the use of discounted cash flow analyses,

estimated future margins, estimated future subscribers, estimated

future royalty rates and the use of information available in the

financial markets. Should actual rates, cash flows, costs and other

items differ from our estimates, this may necessitate revisions to the

carrying value of the related assets and liabilities acquired, including

revisions that may impact net income in future periods.

Useful Lives of Assets

We depreciate the cost of PP&E over their respective estimated useful

lives. These estimates of useful lives involve considerable judgment. In

determining the estimates of these useful lives, we take into account

industry trends and company-specific factors, including changing

technologies and expectations for the in-service period of certain

assets. On an annual basis, we reassess our existing estimates of useful

lives to ensure they match the anticipated life of the technology from

a revenue-producing perspective. If technological change happens

more quickly or in a different way than anticipated, we might have to

reduce the estimated life of PP&E, which could result in a higher

depreciation expense in future periods or an impairment charge to

write down the value of PP&E.

We amortize the cost of finite-lived intangible assets over their

estimated useful lives. These estimates of useful lives involve

considerable judgment. Our acquisitions have resulted in significant

increases to our intangible asset balances. Judgment is also involved

in determining that spectrum and broadcast licences have indefinite

lives and are therefore not amortized.

The determination of the estimated useful lives of brand names

involves historical experience, marketing considerations and the

nature of the industries in which we operate. The useful lives of

subscriber bases are based on the historical churn rates of the

underlying subscribers and judgments as to the applicability of these

rates going forward. The useful lives of roaming agreements are

based on estimates of the useful lives of the related network

equipment. The useful lives of wholesale agreements and dealer

networks are based on the underlying contractual lives. The useful life

of the marketing agreement is based on historical customer lives. The

determination of the estimated useful lives of intangible assets

impacts amortization expense in the current period as well as future

periods. The impact on net income on a full year basis of changing

the useful lives of the finite-lived intangible assets by one year is

shown in the following chart.

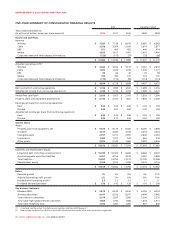

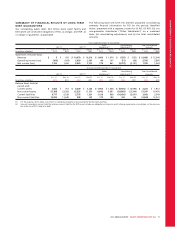

(In millions of dollars) Amortization

Period

Increase in

Net Income

if Life

Increased

by 1 year

Decrease in

Net Income

if Life

Decreased

by 1 year

Brand Names 7 – 20 years $ 1 $ (1)

Customer Relationships 3 – 5 years $ 12 $ (19)

Roaming Agreements 12 years $ 3 $ (4)

Marketing Agreements 3 years $ 1 $ (2)

Capitalization of Direct Labour, Overhead and Interest

Certain direct labour and indirect costs associated with the

acquisition, construction, development or betterment of our networks

are capitalized to PP&E. The capitalized amounts are calculated based

on estimated costs of projects that are capital in nature, and are

generally based on a rate per hour. In addition, interest costs are

capitalized during construction and development of certain PP&E.

Capitalized amounts increase the cost of the asset and result in a

higher amortization expense in future periods.

Impairment of Assets

Indefinite-lived intangible assets, including goodwill and spectrum/

broadcast licences, as well as definite life assets, including PP&E and

other intangible assets, are assessed for impairment on an annual

basis or more often if events or circumstances warrant. A cash

generating unit (“CGU”) is the smallest identifiable group of assets

that generates cash inflows that are largely independent of the cash

inflows from other assets or groups of assets. Goodwill and indefinite

life intangible assets are allocated to CGUs for the impairment testing

based on the level at which management monitors it, which is not

higher than an operating segment. These analyses involve estimates

of future cash flows, estimated periods of use and applicable discount

rates. If key estimates were to differ unfavourably in the future, we

could experience impairment charges that could decrease net income.

During 2012, we recorded an impairment charge of $80 million

related to certain of our assets, due to the challenging economic

68 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT