Rogers 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(ii) Performance RSUs:

During the year ended December 31, 2012, the Company

granted 172,779 performance-based RSUs (2011 – 189,571) to

certain key executives. The number of units that vest and will be

paid three years from the grant date will be within a range of

50% to 150% of the initial number granted based upon the

achievement of certain annual and cumulative three-year non-

market targets.

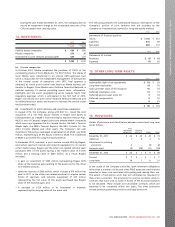

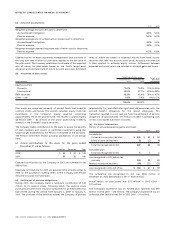

(iii) Summary of RSUs:

A summary of the RSU plans is as follows:

2012 2011

Number of units

Outstanding, beginning of year 1,988,955 1,616,370

Granted 893,784 928,544

Exercised (159,843) (416,146)

Forfeited (467,738) (139,813)

Outstanding, end of year 2,255,158 1,988,955

Unrecognized stock-based compensation expense at

December 31, 2012, related to these RSUs was $37 million

(2011 – $32 million) and will be recorded in the consolidated

statements of income over the next three years as the RSUs vest.

(c) Deferred share unit plan:

The DSU plan enables directors and certain key executives of the

Company to elect to receive certain types of remuneration in DSUs,

which are classified as a liability on the consolidated statements of

financial position.

During the year ended December 31, 2012, the Company granted

115,964 DSUs (2011 – 154,937). At December 31, 2012, 741,423 DSUs

(2011 – 751,903) were outstanding. There is no unrecognized

compensation related to DSUs, since these awards vest immediately

when granted.

(d) Employee share accumulation plan:

The employee share accumulation plan allows employees to

voluntarily participate in a share purchase plan. Under the terms of

the plan, employees of the Company can contribute a specified

percentage of their regular earnings through payroll deductions. The

designated administrator of the plan then purchases, on a monthly

basis, Class B Non-Voting shares of the Company on the open market

on behalf of the employee. At the end of each month, the Company

makes a contribution of 25% to 50% of the employee’s contribution

in the month, which is recorded as compensation expense. The

administrator then uses this amount to purchase additional shares of

the Company on behalf of the employee.

Compensation expense related to the employee share accumulation

plan amounted to $26 million for the year ended December 31, 2012

(2011 – $23 million) and is included in employee salaries and benefits.

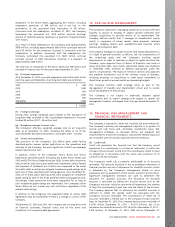

(e) Assumptions:

Significant management estimates are used to determine the fair

value of stock options, RSUs and DSUs. The weighted-average fair

value of stock options granted during the years ended December 31,

2012 and 2011, and the principal assumptions used in applying the

Black-Scholes model and trinomial option pricing models to

determine their fair value at grant date were as follows:

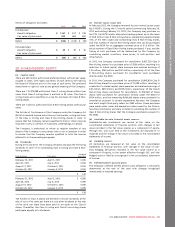

2012 2011

Weighted average fair value $ 7.51 $ 7.25

Risk-free interest rate 1.6% 2.8%

Dividend yield 4.0% 4.0%

Volatility of Class B Non-Voting shares 28.1% 29.0%

Weighted average expected life 5.4 years 5.4 years

For Trinomial option pricing model only:

Weighted average time to vest 2.4 years 2.4 years

Weighted average time to expiry 6.9 years 7.0 years

Employee exit rate 3.9% 3.6%

Suboptimal exercise factor 2.6 2.6

Lattice steps 50 50

Volatility has been estimated based on the actual trading statistics of

the Company’s Class B Non-Voting shares.

24. RELATED PARTY TRANSACTIONS:

(a) Controlling shareholder:

The ultimate controlling shareholder of the Company is the Rogers

Control Trust (“the Trust”) which holds voting control of the

Company. The beneficiaries of the Trust are members of the Rogers

family. The Rogers family is represented as Directors, Senior

Executives and Corporate Officers of the Company.

The Company entered into certain transactions with the ultimate

controlling shareholder of the Company and private Rogers’ family

holding companies controlled by the controlling shareholder of the

Company. These transactions, as summarized below, were recorded at

the amount agreed to by the related parties and are subject to the

terms and conditions of formal agreements approved by the Audit

Committee.

(b) Transactions with key management personnel:

Key management personnel include the Directors and the most Senior

Corporate Officers of the Company who are primarily responsible for

planning, directing and controlling the Company’s business activities.

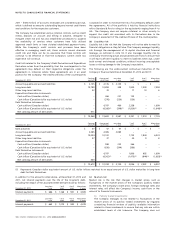

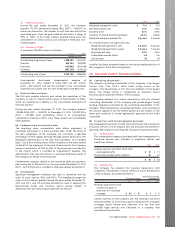

(i) Compensation:

The compensation expense associated with key management for

employee services was included in employee salaries and

benefits as follows:

2012 2011

Salaries, pension and other short-term

employee benefits $10 $11

Stock-based compensation expense 35 27

$45 $38

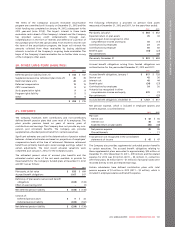

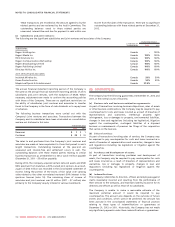

(ii) Transactions:

The Company has entered into business transactions with

companies, the partners or senior officers of which are Directors

of the Company, as summarized below:

Transaction value Balance outstanding,

December 31,

2012 2011 2012 2011

Printing, legal services and

commission paid on

premiums for insurance

coverage $43 $41 $1 $3

Certain directors of the Company are: the Chairman and Chief

Executive Officer of a firm that is paid commissions for insurance

coverage; Senior Partner and Chairman of a law firm that

provides legal services; and Chairman of a company that

provides printing services.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 111