Rogers 2012 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

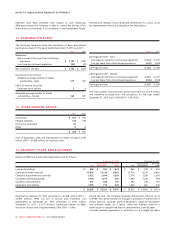

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

liabilities have been provided with respect to such temporary

differences where the Company is able to control the timing of the

reversal and such reversal is not probable in the foreseeable future.

Furthermore, reversal of such temporary differences, if it occurs, could

be implemented without any significant tax implications.

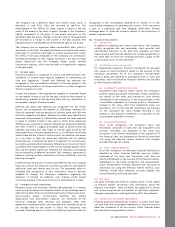

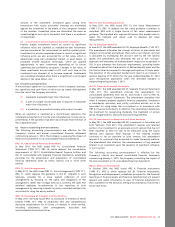

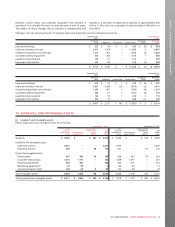

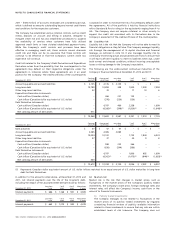

10. EARNINGS PER SHARE:

The following table sets forth the calculation of basic and diluted

earnings per share for the years ended December 31, 2012 and 2011:

2012 2011

Numerator:

Net income for the year from continuing

operations $ 1,732 $ 1,590

Loss from discontinued operations (32) (27)

Net income for the year $ 1,700 $ 1,563

Denominator (in millions):

Weighted average number of shares

outstanding – basic 519 543

Effect of dilutive securities:

Employee stock options 34

Weighted average number of shares

outstanding – diluted 522 547

2012 2011

Earnings per share – basic:

Earnings per share from continuing operations $ 3.34 $ 2.93

Loss per share from discontinued operations (0.06) (0.05)

Earnings per share $ 3.28 $ 2.88

Earnings per share – diluted:

Earnings per share from continuing operations $ 3.32 $ 2.91

Loss per share from discontinued operations (0.06) (0.05)

Earnings per share $ 3.26 $ 2.86

The total number of anti-dilutive options that were out of the money

and therefore excluded from the calculation for the year ended

December 31, 2012 was 17,240 (2011 – 1,570,760).

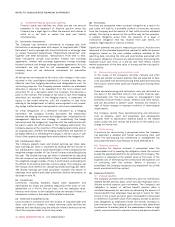

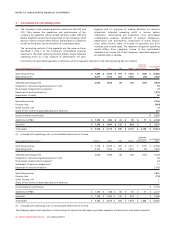

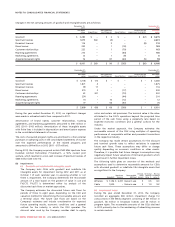

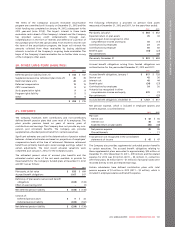

11. OTHER CURRENT ASSETS:

2012 2011

Inventories $ 293 $ 206

Prepaid expenses 126 108

Income tax receivable 39 –

Other 68

$ 464 $ 322

Cost of equipment sales and merchandise for resale includes $1,778

million (2011 – $1,625 million) of inventory costs.

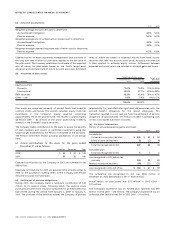

12. PROPERTY, PLANT AND EQUIPMENT

Details of PP&E and accumulated depreciation are as follows:

December 31, 2012 December 31, 2011

Cost Accumulated

depreciation Net book

value Cost Accumulated

depreciation Net book

value

Land and buildings $ 894 $ 260 $ 634 $ 865 $ 230 $ 635

Cable and wireless network 16,805 10,138 6,667 15,776 9,375 6,401

Computer equipment and software 3,972 2,644 1,328 3,574 2,358 1,216

Customer premise equipment 1,764 1,319 445 1,592 1,228 364

Leasehold improvements 407 248 159 392 239 153

Equipment and vehicles 1,055 712 343 1,006 661 345

$ 24,897 $ 15,321 $ 9,576 $ 23,205 $ 14,091 $ 9,114

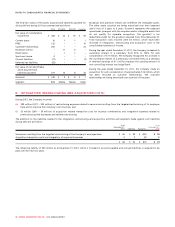

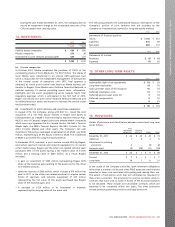

Depreciation expense for 2012 amounted to $1,678 million (2011 –

$1,595 million). PP&E not yet in service and, therefore, not

depreciated at December 31, 2012 amounted to $917 million

(December 31, 2011 – $1,371 million). Capitalized interest on PP&E

was at an interest rate of approximately 5.8% (2011 – 5.9%).

During the year, the Company reviewed depreciation rates for all of

its PP&E. This review resulted in changes in estimates of useful lives of

certain network, customer premise equipment, computer equipment

and software assets. As a result, cable and wireless network is

amortized on a straight-line basis at rates between 3 and 30 years,

customer premise equipment is amortized on a straight-line basis

98 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT