Rogers 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

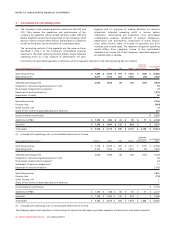

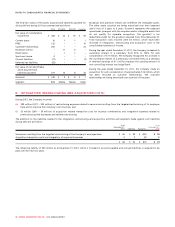

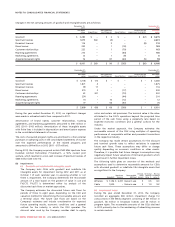

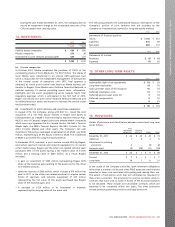

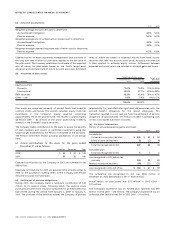

Changes in the net carrying amounts of goodwill and intangible assets are as follows:

December 31,

2011 December 31,

2012

Net book

value Acquisitions Net Additions

and Disposals Amortization Current period

impairment loss (b)(ii) Net book

value

Goodwill $ 3,280 $ – $ 2 $ – $ (67) $ 3,215

Spectrum licences 1,875 360 (4) – – 2,231

Broadcast licences 116 – 2 – (8) 110

Brand names 200 – 1 (18) – 183

Customer relationships 232 – 1 (70) – 163

Roaming agreements 210 – – (44) – 166

Marketing agreements 12 – 1 (9) – 4

Acquired program rights 76 – 87 (64) (5) 94

$ 6,001 $ 360 $ 90 $ (205) $ (80) $ 6,166

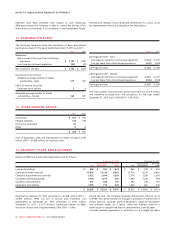

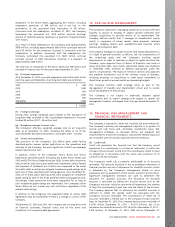

December 31,

2010 December 31,

2011

Net book

value Acquisitions Net Additions

and Disposals Amortization Current period

impairment loss (b)(ii) Net book

value

Goodwill $ 3,108 $ 172 $ – $ – $ – $ 3,280

Spectrum licences 1,871 4 – – – 1,875

Broadcast licences 99 17 – – – 116

Brand names 215 2 – (17) – 200

Customer relationships 61 241 – (70) – 232

Roaming agreements 254 – – (44) – 210

Marketing agreements 14 – 10 (12) – 12

Acquired program rights 77 – 56 (57) – 76

$ 5,699 $ 436 $ 66 $ (200) $ – $ 6,001

During the year ended December 31, 2012, no significant changes

were made in estimated useful lives compared to 2011.

Amortization of brand names, customer relationships, roaming

agreements, and marketing agreements amounted to $141 million in

2012 (2011 – $143 million). Amortization of these intangible assets

with finite lives is included in depreciation and amortization expense

in the consolidated statements of income.

The costs of acquired program rights are amortized to other external

purchases in operating costs in the consolidated statements of income

over the expected performances of the related programs and

amounted to $64 million in 2012 (2011 – $57 million).

During 2012, the Company acquired certain 2500 MHz spectrum from

Inukshuk Limited Partnership (“Inukshuk”), a 50% owned joint

venture, which resulted in a non-cash increase of Spectrum licenses of

$360 million (see note 14).

(b) Impairment:

(i) Goodwill and indefinite life intangible assets:

The Company tests CGUs with goodwill and indefinite life

intangible assets for impairment during 2012 and 2011 as at

October 1 of each calendar year. In assessing whether or not

there is impairment, the Company determines the recoverable

amount of a CGU based on the greater of value in use and

FVLCTS. FVLCTS is determined either by analysis of the

discounted cash flows or market approaches.

The Company estimates the discounted future cash flows for

periods of three to eight years, depending on the CGU and

valuation method for determining the recoverable amount, and

a terminal value. The future cash flows are based on the

Company’s estimates and include consideration for expected

future operating results, economic conditions and a general

outlook for the industry in which the CGU operates. The

discount rates used by the Company consider debt to equity

ratios and certain risk premiums. The terminal value is the value

attributed to the CGU’s operations beyond the projected time

period of the cash flows using a perpetuity rate based on

expected economic conditions and a general outlook for the

industry.

Under the market approach, the Company estimates the

recoverable amount of the CGU using multiples of operating

performance of comparable entities and precedent transactions

in the respective industry.

The Company has made certain assumptions for the discount

and terminal growth rates to reflect variations in expected

future cash flows. These assumptions may differ or change

quickly depending on economic conditions or other events.

Therefore, it is possible that future changes in assumptions may

negatively impact future valuations of CGUs and goodwill, which

would result in further impairment losses.

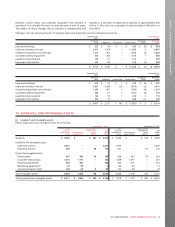

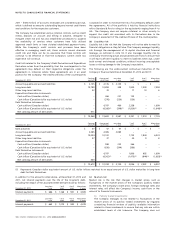

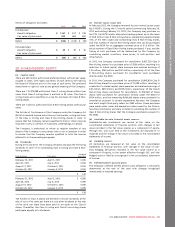

The following table gives an overview of the methods and

assumptions used to determine recoverable amounts for CGUs

with allocated goodwill or indefinite life intangible assets that

are significant to the Company:

Goodwill Spectrum

licences Recoverable

Method

Periods

used

(years)

Terminal

growth

rates %

Pre-tax

Discount

rates %

Wireless $ 1,146 $ 2,231 Value in use 5 0.5 8.3

Cable 1,000 – Value in use 5 1.0 9.2

(ii) Impairment losses:

During the year ended December 31, 2012, the Company

recorded an aggregate $80 million impairment charge for

various CGUs in the Media segment, consisting of $67 million in

goodwill, $8 million in broadcast licences and $5 million in

program rights. The recoverable amounts of the CGUs declined

in 2012 primarily due to the weakening of advertising revenue

in certain markets.

100 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT