Rogers 2012 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Pre-tax Free Cash Flow

Largely as a result of the adjusted operating profit growth and

additions to PP&E results discussed above, we delivered consolidated

pre-tax free cash flow of $2.0 billion. This was within our 2012

guidance range and represented a 3% increase from 2011. This free

cash flow generation supported the $1,153 million of cash that we

returned to shareholders in the form of $803 million of dividends and

share buybacks totalling $350 million.

Cash Income Taxes

Cash income taxes were below the low end of our targeted 2012

range due to income tax planning and containment strategies. These

savings further contributed to consolidated free cash flow generation,

which totalled $1.6 billion on an after-tax basis.

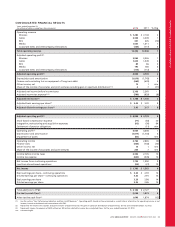

2013 FINANCIAL OUTLOOK AND TARGETS

The following table outlines guidance ranges and assumptions for

selected 2013 financial metrics, which takes into consideration our

strategic priorities and current outlook. This information is forward-

looking and should be read in conjunction with the section “Caution

Regarding Forward-Looking Statements, Risks and Assumptions” and

the related disclosures; various economic, competitive and regulatory

assumptions, factors and risks may cause actual future financial and

operating results to differ from those currently expected.

We provide annual guidance ranges on a consolidated full year basis

and are consistent with annual full year board-approved plans. In our

fourth quarter earnings release at the start of each year, we also

provide full year supplemental forecast details at the operating

segment level for both revenue and adjusted operating profit that is

not part of our formal 2013 guidance and is provided for information

purposes only. Any updates to our full year financial guidance over

the course of the year would be made only to the consolidated level

guidance ranges that appear below.

Full Year 2013 Guidance

(In millions of dollars) 2012

Actual 2013

Guidance

Consolidated Guidance

Adjusted operating profit(1)(4) $ 4,834 $ 4,865 to $ 5,050

Additions to PP&E(2) 2,142 2,150 to 2,250

Pre-tax free cash flow(3)(4) 2,029 2,030 to 2,090

Cash income taxes 380 650 to 700

(1) As defined. See the section “Key Performance Indicators and Non-GAAP

Measures”.

(2) Includes additions to Wireless, Cable, Media, RBS, and Corporate PP&E

expenditures.

(3) Pre-tax free cash flow is defined as adjusted operating profit less PP&E

expenditures and interest on long-term debt (net of capitalization), and is not a

defined term under IFRS.

(4) Assumes Mountain Cable and theScore close mid-year 2013.

As discussed in the section “Our Strategy”, we plan to meet our 2013

financial targets by executing the following six long-term strategic

objectives:

1. Deliver differentiated end-to-end customer experiences

Focus on evolving our cross-device integration to enable

seamless, reliable and easy-to-use customer experiences anytime,

anyplace and anywhere. Deliver a differentiated range of

devices and device-related services. Enable greater integration of

our media assets across screen types.

2. Maintain industry-leading networks

Expand our LTE network to a wider proportion of the Canadian

population. Continue to increase broadband Internet speeds and

migrate cable Internet subscribers to DOCSIS 3.0 technology.

Further enhance our TV platform with next generation features

and functionality.

3. Expand our services reach

Expand the reach of our networks and services through new

construction, by more widely deploying products such as the

Rogers One Number service, and by expanding the reach of key

media brands through our digital platforms.

4. Strengthen the customer experience

Widely deploy Rogers’ new retail store design and service

approach across our network of Rogers Plus stores. Continue to

improve our Rogers Concierge service and simplify our product

offerings.

5. Improve productivity and cost structure

Continue to focus on cost optimization initiatives aimed at

further improving organizational efficiency, by reducing

complexity, focusing on fewer, more impactful projects,

managing expenses and working closely with key suppliers.

6. Drive future growth opportunities

Continue to grow and nurture promising new growth areas of

our business, including M2M communications, mobile commerce,

local and digital media services, home automation and business

communications services.

3. FINANCIAL AND OPERATING RESULTS

For important accounting policies and estimates as they relate to the following discussion of our operating and financial results, please refer to

the sections in this MD&A “Accounting Policies”, “Critical Accounting Estimates” and “New Accounting Standards”, as well as the Notes to our

2012 Audited Consolidated Financial Statements.

We measure the success of our strategies in the ongoing management of our business using a number of key performance indicators, as

outlined in the section “Key Performance Indicators and Non-GAAP Measures”. Many of these key performance indicators are not

measurements in accordance with IFRS and should not be considered as alternative measures to net income or any other financial measure of

performance under IFRS. The non-GAAP measures presented in this MD&A include, among other measures, operating profit, free cash flow and

the “adjusted” amounts. We believe that the non-GAAP financial measures (which generally exclude: (i) stock-based compensation expense

(recovery); (ii) integration, restructuring and acquisition expenses; (iii) settlement of pension obligations; and (iv) in respect of net income and

earnings per share, loss on repayment of long-term debt, impairment of assets, gain on spectrum distribution and the related income tax

impacts of the preceding items and legislative change) provide for a more effective and actionable analysis of our operating performance.

32 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT