Rogers 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

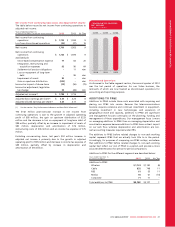

Consolidated Hedged Debt Position

(In millions of dollars, except percentages) December 31, 2012 December 31, 2011

U.S. dollar-denominated long-term debt U.S. $ 4,230 U.S. $ 4,230

Hedged with Debt Derivatives U.S. $ 4,230 U.S. $ 4,230

Hedged exchange rate 1.1340 1.1340

Percent hedged(1) 100.0% 100.0%

Amount of long-term debt at fixed rates:(2)

Total long-term debt Cdn $ 11,447 Cdn $ 10,597

Total long-term debt at fixed rates Cdn $ 11,447 Cdn $ 10,347

Percent of long-term debt fixed 100.0% 97.6%

Weighted average interest rate on long-term debt 6.06% 6.22%

(1) Pursuant to the requirements for hedge accounting under IAS 39, Financial Instruments: Recognition and Measurement, on December 31, 2012, and December 31, 2011, RCI

accounted for 91.7% of its Debt Derivatives as hedges against designated U.S. dollar-denominated debt. As a result, on December 31, 2012, 91.7% of U.S. dollar-

denominated debt is hedged for accounting purposes compared to 100% on an economic basis.

(2) Long-term debt includes the effect of the Debt Derivatives.

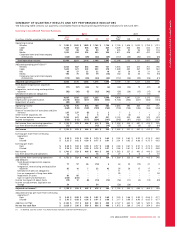

Mark-to-Market Value of Derivatives

In accordance with IFRS, we have recorded our Derivatives using an

estimated credit-adjusted mark-to-market valuation using treasury-

related discount rates together with an estimated bond spread for

the relevant term and counterparty for each Derivative. The

estimated credit-adjusted values of the Derivatives are subject to

changes in credit spreads of Rogers and its counterparties. At

December 31, 2012, details of the derivative instruments net liability

are as follows:

(In millions of dollars) U.S. $

notional Exchange

rate Cdn $

notional Fair

value

Debt Derivatives accounted for as cash flow hedges:

As assets $ 1,600 1.0252 $ 1,640 $ 34

As liabilities 2,280 1.2270 2,798 (561)

Debt Derivatives not accounted for as hedges:

As assets 350 1.0258 359 3

Net mark-to-market liability Debt Derivatives (524)

Expenditure Derivatives accounted for as cash flow hedges:

As assets 380 0.9643 366 13

Total (511)

Less net current liability portion (136)

Net long-term liability portion $ (375)

Long-Term Debt Plus Net Debt Derivative Liabilities

The aggregate of our long-term debt plus net Debt Derivative

liabilities at the estimated credit-adjusted mark-to-market valuation is

calculated as follows:

(In millions of dollars) December 31, 2012 December 31, 2011

Long-term debt(1) $ 10,858 $ 10,102

Net derivative liabilities

for Debt Derivatives(2) $ 524 $ 499

Total $ 11,382 $ 10,601

(1) Before deducting fair value decrement arising from purchase accounting and

deferred transaction costs.

(2) Includes current and long-term portions.

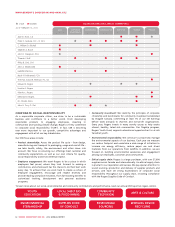

OUTSTANDING COMMON SHARE DATA

Set out below is our outstanding common share data at fiscal year-

end for 2012 and 2011. In 2012, we purchased an aggregate 9,637,230

Class B Non-Voting shares for cancellation pursuant to our NCIB for

approximately $350 million. For additional information, refer to

Note 21 to our 2012 Audited Consolidated Financial Statements.

Weighted average number of shares outstanding is used for the

purpose of the earnings per share calculation; refer to the section

“Key Performance Indicators and Non-GAAP Measures”.

December 31, 2012 December 31, 2011

Common shares(1)

Class A Voting 112,462,014 112,462,014

Class B Non-Voting 402,788,156 412,395,406

Total common shares 515,250,170 524,857,420

Options to purchase

Class B Non-Voting

shares

Outstanding options 8,734,028 10,689,099

Outstanding options

exercisable 4,638,496 5,716,945

(1) Holders of RCI’s Class B Non-Voting shares are entitled to receive notice of and to

attend meetings of our shareholders but, except as required by law or as

stipulated by stock exchanges, are not entitled to vote at such meetings. If an

offer is made to purchase outstanding Class A Voting shares, there is no

requirement under applicable law or RCI’s constating documents that an offer be

made for the outstanding Class B Non-Voting shares and there is no other

protection available to shareholders under RCI’s constating documents. If an

offer is made to purchase both Class A Voting shares and Class B Non-Voting

shares, the offer for the Class A Voting shares may be made on different terms

than the offer to the holders of Class B Non-Voting shares.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 55