Rogers 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Adjusted Operating Profit, Adjusted Operating Profit Margin,

Adjusted Net Income, Adjusted Basic and Diluted Earnings per

Share, and Pre-tax Free Cash Flow

We define adjusted operating profit as operating profit excluding:

(i) stock-based compensation expense; (ii) integration, restructuring

and acquisition expenses; and (iii) settlement of pension obligations.

In addition, adjusted net income and adjusted earnings per share

excludes loss on repayment of long-term debt, impairment of assets,

gain on spectrum distribution, and the related income tax impacts of

the preceding items and the legislative tax change. We define pre-tax

free cash flow as adjusted operating profit less PP&E expenditures

and interest on long-term debt (net of capitalization).

Adjusted operating profit and adjusted operating profit margins,

which are reviewed regularly by management and our Board of

Directors, are also useful in assessing our performance and in making

decisions regarding the ongoing operations of the business and the

ability to generate cash flows.

These non-GAAP measures should be viewed as a supplement to, and

not a substitute for, our results of operations reported under IFRS. A

reconciliation of these non-GAAP financial measures to operating

profit, net income and earnings per share is included in this section

under “Adjusted Operating Profit, Net Income, Earnings Per Share

and Free Cash Flow Calculations”.

We calculate adjusted operating profit margin by dividing adjusted

operating profit by total revenue, except in the case of Wireless. For

Wireless, adjusted operating profit margin is calculated by dividing

adjusted operating profit by network revenue. Network revenue is

used in the calculation instead of total revenue because network

revenue better reflects Wireless’ core business activity of providing

wireless services. The following table illustrates the adjusted

operating profit margin calculations for Wireless, Cable, RBS and

Media.

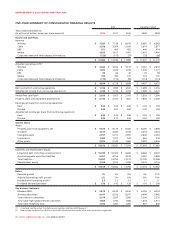

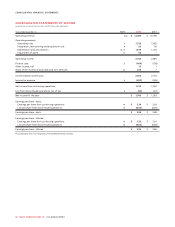

Adjusted Operating Profit Margin Calculations

Years ended December 31,

(In millions of dollars, except for margins) 2012 2011

RCI:

Adjusted operating profit $ 4,834 $ 4,739

Divided by total revenue 12,486 12,346

RCI adjusted operating profit margin 38.7% 38.4%

WIRELESS:

Adjusted operating profit $ 3,063 $ 3,036

Divided by network revenue 6,719 6,601

Wireless adjusted operating profit

margin 45.6% 46.0%

CABLE:

Adjusted operating profit $ 1,605 $ 1,549

Divided by revenue 3,358 3,309

Cable adjusted operating profit margin 47.8% 46.8%

ROGERS BUSINESS SOLUTIONS:

Adjusted operating profit $89$86

Divided by revenue 351 405

Rogers Business Solutions adjusted

operating profit margin 25.4% 21.2%

MEDIA:

Adjusted operating profit $ 190 $ 180

Divided by revenue 1,620 1,611

Media adjusted operating profit margin 11.7% 11.2%

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 75