Rogers 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

We May Engage in Unsuccessful Acquisitions, Divestitures or

Investments

Acquiring complementary businesses and technologies, developing

strategic alliances and divesting portions of our business are part of

our overall business strategy. Services, technologies, key personnel or

businesses of acquired companies may not be effectively assimilated

into our business or service offerings, and our alliances may not be

successful. We may not be able to successfully complete any

divestitures on satisfactory terms, if at all. Divestitures may result in a

reduction in our total revenues and net income.

Our Businesses Are Complex

Our businesses, technologies, processes and systems are operationally

complex and increasingly interconnected. A failure to execute

properly may lead to negative customer experiences, resulting in

increased churn and loss of revenue.

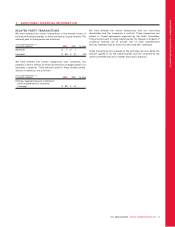

We Are Reliant on Third Party Service Providers through

Outsourcing Arrangements

Through outsourcing arrangements, third parties provide certain

essential components of our business operations to our employees

and customers, including payroll, certain facilities/property

management functions, call centre support, certain installation and

service technicians, certain information technology functions, and

invoice printing. Interruptions in these services can adversely affect

our ability to service our customers.

We Have Debt and Interest Payment Requirements That May

Restrict Our Future Operations and Impair Our Ability to Meet

Our Financial Obligations

Our debt may have important consequences, such as:

• Making it more difficult to satisfy our financial obligations;

• Requiring us to dedicate a substantial portion of any cash flow

from operations to the payment of interest and principal due

under our debt, which would reduce funds available for other

business purposes;

• Increasing our vulnerability to adverse economic and industry

conditions;

• Limiting our flexibility in planning for, or reacting to, changes in

our business and the industry in which we operate;

• Placing us at a competitive disadvantage compared to some of our

competitors that have less financial leverage; or

• Constraining our ability to obtain additional financing required to

fund working capital and capital expenditures and for other

general corporate purposes.

Our ability to satisfy our financial obligations depends on our future

operating performance and on economic, financial, competitive and

other factors, many of which are beyond our control. Our business

may not generate sufficient cash flow and future financings may not

be available to provide sufficient net proceeds to meet these

obligations or to successfully execute our business strategy.

Income and Indirect Tax Amounts May Materially Differ from the

Amounts Expected

We collect, pay and accrue significant amounts of income and indirect

taxes for and to various taxation authorities and believe that we have

adequately provided for such amounts. However, due to the

complexity of our business operations and the significant judgment

required in interpreting tax legislation and regulations, tax amounts

may be materially different than expected.

We have recorded significant amounts of deferred income tax

liabilities and income tax expense. These amounts have been

determined based upon substantively enacted future income tax rates

in effect at the time. A legislative change in these income tax rates

could have a material impact on the amounts recorded.

We have also recorded the benefit of income tax positions that are

more likely than not of being sustained upon examination and are

measured at the amount expected to be realized upon ultimate

settlement with the taxation authorities. Our tax filings are subject to

audits, the results of which could materially change the amount of

actual income tax expense, income taxes payable or receivable,

indirect taxes payable or receivable and deferred income tax assets or

liabilities and could, in certain circumstances, result in the assessment

of interest and penalties.

The Changing Competitive Landscape Requires Heightened Focus

on Organizational Structure and Talent

The telecommunications industry is generally competitive with respect

to attracting and retaining a skilled workforce. The loss of certain

employees or changes in morale as a result of events such as

restructuring could, in certain circumstances, impact our revenue and

profitability.

Copyright Tariff Increases Could Adversely Affect Results of

Operations

Copyright tariff pressures continue to affect our services. If fees were

to increase, they could negatively impact our results of operations.

We Are and Will Continue to Be Involved in Litigation

In August 2004, a proceeding under the Class Actions Act

(Saskatchewan) was commenced against providers of wireless

communications in Canada relating to the system access fee charged

by wireless carriers to some of their customers. The plaintiffs are

seeking unspecified damages and punitive damages, effectively the

reimbursement of the system access fees collected. In September

2007, the Saskatchewan Court granted the plaintiffs’ application to

have the proceeding certified as a national, “opt-in” class action. As a

national, “opt-in” class action, affected customers outside

Saskatchewan must take specific steps to participate in the

proceeding. In February 2008, our motion to stay the proceeding

based on the arbitration clause in our wireless service agreements was

granted and the Saskatchewan Court directed that its order, in

respect of the certification of the action, would exclude from the class

of plaintiffs those customers who are bound by an arbitration clause.

In August 2009, counsel for the plaintiffs commenced a second

proceeding under the Class Actions Act (Saskatchewan), asserting the

same claims as the original proceeding. This second proceeding was

ordered conditionally stayed in December 2009 on the basis that it

was an abuse of process.

The Company’s appeal of the 2007 certification decision was dismissed

by the Saskatchewan Court of Appeal and leave to appeal to the

Supreme Court of Canada was denied in June 2012. The plaintiffs are

presently seeking to extend the time within which they can appeal

the “opt-in” decision of the Saskatchewan Court. No liability has been

recorded for this contingency.

In December 2011, a proceeding under the Class Proceedings Act

(British Columbia) was commenced against providers of wireless

communications in Canada relating to the system access fee charged

by wireless carriers to some of their customers. The proceeding

involves, among other things, allegations of misrepresentations

contrary to the Business Practices and Consumer Protection Act

(British Columbia). The plaintiffs are seeking unquantified damages

and restitution. No liability has been recorded for this contingency.

2012 ANNUAL REPORT ROGERS COMMUNICATIONS INC. 65