Rogers 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

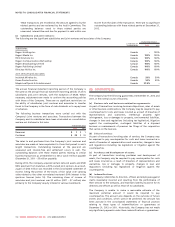

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

2011 – $478 million) of accounts receivable are considered past due,

which is defined as amounts outstanding beyond normal credit terms

and conditions for the respective customers.

The Company has established various internal controls, such as credit

checks, deposits on account and billing in advance, designed to

mitigate credit risk and has also established procedures to suspend

the availability of services when customers have fully utilized

approved credit limits or have violated established payment terms.

While the Company’s credit controls and processes have been

effective in managing credit risk, these controls cannot eliminate

credit risk and there can be no assurance that these controls will

continue to be effective or that the Company’s current credit loss

experience will continue.

Credit risk related to the Company’s Debt Derivatives and Expenditure

Derivatives arises from the possibility that the counterparties to the

agreements may default on their respective obligations under the

agreements in instances where these agreements are in an asset

position for the Company. The creditworthiness of the counterparties

is assessed in order to minimize the risk of counterparty default under

the agreements. All of the portfolio is held by financial institutions

with a Standard & Poor’s rating (or the equivalent) ranging from A- to

AA-. The Company does not require collateral or other security to

support the credit risk associated with its Derivatives due to the

Company’s assessment of the creditworthiness of the counterparties.

(b) Liquidity risk:

Liquidity risk is the risk that the Company will not be able to meet its

financial obligations as they fall due. The Company manages liquidity

risk through the management of its capital structure and financial

leverage, as outlined in note 18. It also manages liquidity risk by

continually monitoring actual and projected cash flows to ensure that

it will have sufficient liquidity to meet its liabilities when due, under

both normal and stressed conditions, without incurring unacceptable

losses or risking damage to the Company’s reputation.

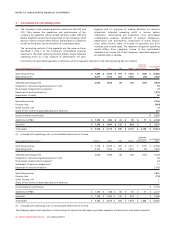

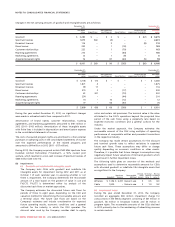

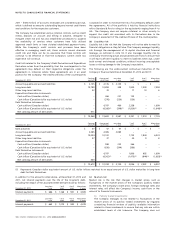

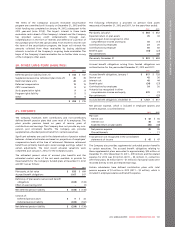

The following are the undiscounted contractual maturities of the

Company’s financial liabilities at December 31, 2012 and 2011:

December 31, 2012 Carrying

amount Contractual

cash flows Less than

1 year 1to3

years 4to5

years More than

5 years

Accounts payable and accrued liabilities $ 2,135 $ 2,135 $ 2,135 $ – $ – $ –

Long-term debt 10,789 10,858 348 1,920 1,500 7,090

Other long-term liabilities 33 33 – 17 10 6

Expenditure Derivative instruments:

Cash outflow (Canadian dollar) – 366 231 135 – –

Cash inflow (Canadian dollar equivalent of U.S. dollar) – (378) (239) (139) – –

Debt Derivative instruments:

Cash outflow (Canadian dollar) – 4,797 460 2,338 – 1,999

Cash inflow (Canadian dollar equivalent of U.S. dollar) – (4,208)(1) (348)(1) (1,920)(1) – (1,940)(1)

Net carrying amount of derivatives 511

$ 13,468 $ 13,603 $ 2,587 $ 2,351 $ 1,510 $ 7,155

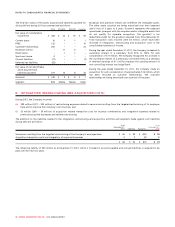

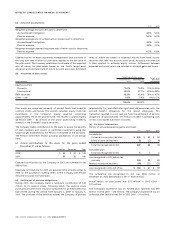

December 31, 2011 Carrying

amount Contractual

cash flows Less than

1 year 1to3

years 4to5

years More than

5 years

Bank advances $ 57 $ 57 $ 57 $ – $ – $ –

Accounts payable and accrued liabilities 2,085 2,085 2,085 – – –

Long-term debt 10,034 10,102 – 1,725 1,844 6,533

Other long-term liabilities 37 37 – 20 9 8

Expenditure Derivative instruments:

Cash outflow (Canadian dollar) – 598 232 366 – –

Cash inflow (Canadian dollar equivalent of U.S. dollar) – (630) (244) (386) – –

Debt Derivative instruments:

Cash outflow (Canadian dollar) – 4,797 – 1,806 992 1,999

Cash inflow (Canadian dollar equivalent of U.S. dollar) – (4,302)(1) – (1,475)(1) (844)(1) (1,983)(1)

Net carrying amount of derivatives 460

$ 12,673 $ 12,744 $ 2,130 $ 2,056 $ 2,001 $ 6,557

(1) Represents Canadian dollar equivalent amount of U.S. dollar inflows matched to an equal amount of U.S. dollar maturities in long-term

debt for Debt Derivatives.

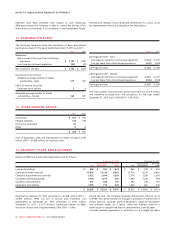

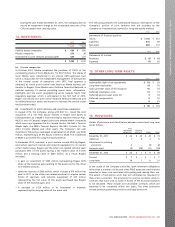

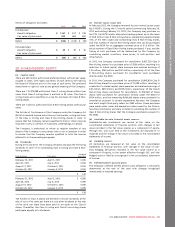

In addition to the amounts noted above, at December 31, 2012 and

2011, net interest payments over the life of the long-term debt,

including the impact of the associated Debt Derivatives are as follows:

December 31, 2012 Less than

1 year 1to3

years 4to5

years More than

5 years

Interest payments $ 686 $ 1,168 $ 901 $ 3,929

December 31, 2011 Less than

1 year 1to3

years 4to5

years More than

5 years

Interest payments $ 663 $ 1,219 $ 920 $ 4,229

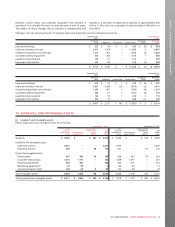

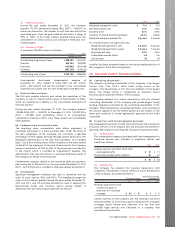

(c) Market risk:

Market risk is the risk that changes in market prices, such as

fluctuations in the market prices of the Company’s publicly traded

investments, the Company’s share price, foreign exchange rates and

interest rates, will affect the Company’s income, cash flows or the

value of its financial instruments.

(i) Publicly traded investments:

The Company manages its risk related to fluctuations in the

market prices of its publicly traded investments by regularly

conducting financial reviews of publicly available information

related to these investments to ensure that any risks are within

established levels of risk tolerance. The Company does not

104 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT