Rogers 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Rogers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

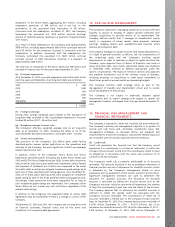

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

These transactions are recorded at the amount agreed to by the

related parties and are reviewed by the Audit Committee. The

outstanding balances owed to these related parties are

unsecured, interest-free and due for payment in cash within one

month from the date of the transaction. There are no significant

outstanding balances with these related parties at December 31,

2012.

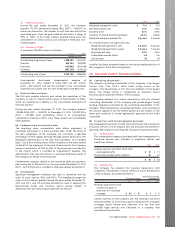

(c) Subsidiaries and joint ventures:

The following are the significant subsidiaries and joint ventures and associates of the Company:

Jurisdiction of

incorporation

Ownership interest

2012 2011

Subsidiaries:

Rogers Holdings Inc. Canada –100%

Rogers Media Inc. Canada 100% 100%

FIDO Solutions Inc. Canada 100% 100%

Rogers Communications Partnership Canada 100% 100%

Rogers Broadcasting Limited Canada 100% 100%

Rogers Publishing Limited Canada 100% 100%

Blue Jays Holdco Inc. Canada 100% 100%

Joint ventures and associates:

Inukshuk Wireless Inc. Canada 50% 50%

Dome Productions Inc. Canada 50% 50%

Maple Leaf Sports & Entertainment Canada 37.5% –

The annual financial statement reporting period of the Company is

the same as the annual financial statement reporting periods of all its

subsidiaries and joint ventures, with the exception of MLSE. When

necessary, adjustments are made to conform the accounting policies

with those of the Company. There are no significant restrictions on

the ability of subsidiaries, joint ventures and associates to transfer

funds to the Company in the form of cash dividends or to repay loans

or advances.

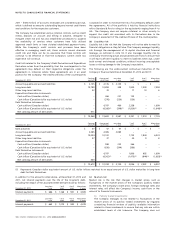

The following business transactions were carried out with the

Company’s joint ventures and associates. Transactions between the

Company and its subsidiaries have been eliminated on consolidation

and are not disclosed in this note.

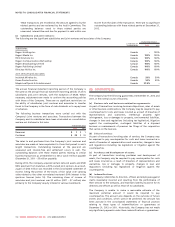

Transaction value

2012 2011

Revenues $1$1

Purchases $38 $51

The sales to and purchases from the Company’s joint ventures and

associates are made at terms equivalent to those that prevail in arm’s

length transactions. Outstanding balances at the year-end are

unsecured and interest-free and settlement occurs in cash. The

outstanding balances with these related parties relating to similar

business transactions as at December 31, 2012, was $1 million payable

(December 31, 2011 – $5 million payable).

During 2012, the Company acquired certain network assets and 2500

MHz spectrum from Inukshuk, a 50% owned joint venture. As a result,

a gain of $233 million was recorded in the consolidated statement of

income, being the portion of the excess of fair value over carrying

value related to the other non-related venturer’s 50% interest in the

spectrum licences (note 14). The remaining share of income of

associates and joint ventures was $2 million (2011 – $7 million) due

primarily to the Company’s equity interest in various investments.

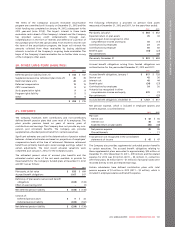

25. GUARANTEES:

The Company has the following guarantees at December 31, 2012 and

2011, in the normal course of business:

(a) Business sale and business combination agreements:

As part of transactions involving business dispositions, sales of assets

or other business combinations, the Company may be required to pay

counterparties for costs and losses incurred as a result of breaches of

representations and warranties, intellectual property right

infringement, loss or damages to property, environmental liabilities,

changes in laws and regulations (including tax legislation), litigation

against the counterparties, contingent liabilities of a disposed

business or reassessments of previous tax filings of the corporation

that carries on the business.

(b) Sales of services:

As part of transactions involving sales of services, the Company may

be required to pay counterparties for costs and losses incurred as a

result of breaches of representations and warranties, changes in laws

and regulations (including tax legislation) or litigation against the

counterparties.

(c) Purchases and development of assets:

As part of transactions involving purchases and development of

assets, the Company may be required to pay counterparties for costs

and losses incurred as a result of breaches of representations and

warranties, loss or damages to property, changes in laws and

regulations (including tax legislation) or litigation against the

counterparties.

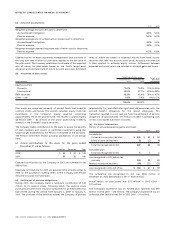

(d) Indemnifications:

The Company indemnifies its directors, officers and employees against

claims reasonably incurred and resulting from the performance of

their services to the Company, and maintains liability insurance for its

directors and officers as well as those of its subsidiaries.

The Company is unable to make a reasonable estimate of the

maximum potential amount it would be required to pay

counterparties. The amount also depends on the outcome of future

events and conditions, which cannot be predicted. No amount has

been accrued in the consolidated statements of financial position

relating to these types of indemnifications or guarantees at

December 31, 2012 or 2011. Historically, the Company has not made

any significant payments under these indemnifications or guarantees.

112 ROGERS COMMUNICATIONS INC. 2012 ANNUAL REPORT